Programs startups go

Lithuania Tech Weekly #144

Subscribe - philomaths.tech

X and LinkedIn for fractional updates

Supported by:

Subscribe - philomaths.tech

X and LinkedIn for fractional updates

Supported by:

work in progress

- Play. Nordcurrent is investing in Croatian studio Misfit Village and will release their horror game Go Home Annie! Here is an earlier talk with Simonas, CMO of Nordcurrent and what he has to say about state support:

We are not in favour of excessive funding for a specific industry, because this investment does not necessarily pay off for the state, especially if it distorts the developers’ goals when they develop for the mere sake of justifying funding rather than to create a game that millions of people want to play. The game development industry in Lithuania would benefit most from investment in education, children’s creativity and artistic potential.

- Programs – and capital. Mastercard Lighthouse Baltic batch is pretty much all Lithuanian - Fideum Group, DappRadar, Torus, Spenfi, and Fundvest. Cargo Stream joined Connected Places Catapult program. Spike Technologies is part of Plug and Play Tech Center Insurtech Accelerator. Palmo has secured grants in Germany with RIED Berlin. Fiestos joined Founder.university, run by Jason Calacanis. List of latest pre-accelerator batch at FIRSTPICK - all AI-powered, too.

- Entrepreneurs, repeat? Nanoavioncs founder and CEO, Vytenis Buzas, is stepping down from his role. A truly inspiring story of starting from scratch, building an iconic satellite company, and successfully exiting to Kongsgberg. Will the next gig fly, too?

After building Fullreach, a rollercoaster journey and finally a successful merge with Pinnacle Realty Advisors, Tadas and the founding team are stepping down - and starting something new. Of course, this is AI-powered venture, called InfiniteReps - a virtual sales rep provider. (We immediately added these founders to the repeat founder list).

Repeat Founders - the list

Why serial entrepreneurship is so important? Interestingly, in many ways, it becomes harder to start again. Just like NVIDIA’s CEO just said - “no, I would not start again if I knew what it would take”. For repeat founders, naivete is gone - they all know how hard it is

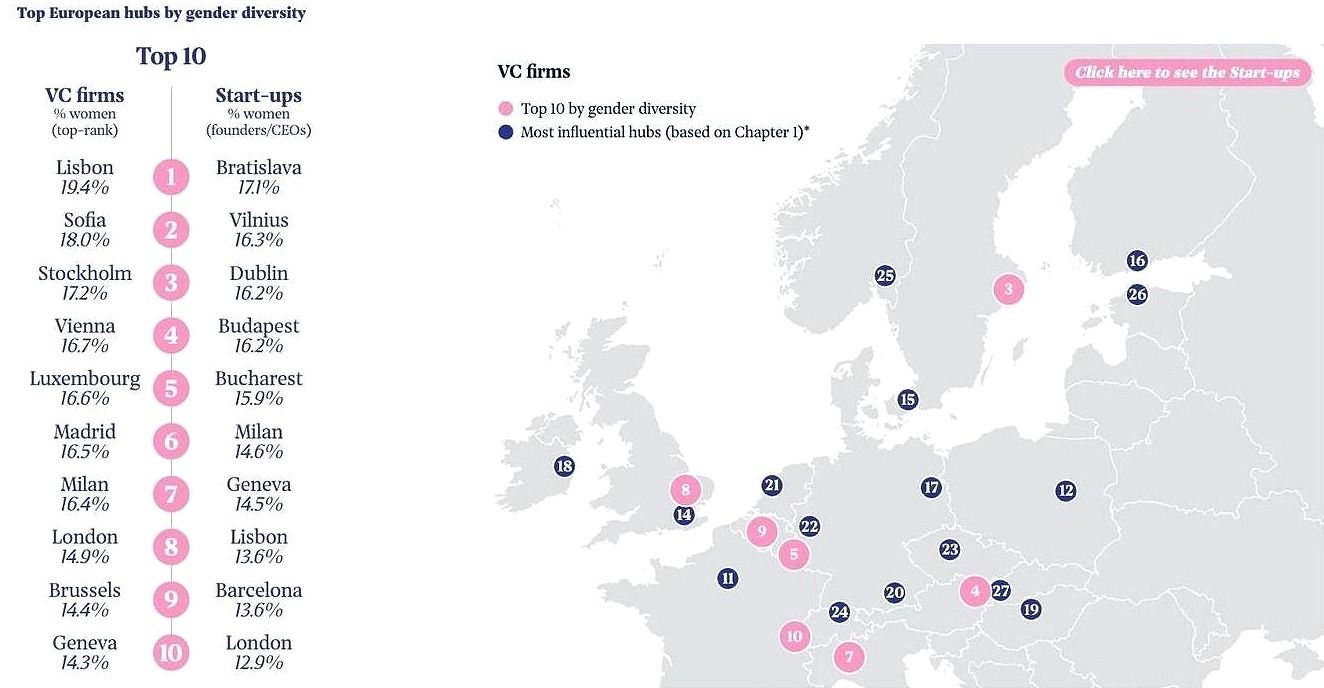

- Diversity. Invest Europe report highlights that LT has many female startup founders (second after Bratislava!) - and features Dalia Lasaite, CEO and co-founder of CGTrader.

rounds and capital

- Vinted is weighing a secondary share sale that could be worth more than EUR 200m - the company hired Morgan Stanley to investigate options before a potential IPO.

- Repsense, secures another round - EUR 800k - from existing investors Coinvest Capital, Iron Wolf Capital and Baltic Sandbox Ventures (as well as business angels led by Povilas Dapkevičius in the first round, and Darius Antanaitis in the current round). Repsense is AI-powered platform for global online reputation.

- Orion is helping Sun Investment Group with a new bond issue, which targets to raise EUR 5m (13% interest).

- SOLIDU (impact/cosmetics) is running an equity fundraising campaign, towards EUR 150k goal.

- Justinas Pasys & Gytenis Galkis have formed a new angel syndicate of Latvian and Lithuanian investors looking to invest EUR 200k-500 K in an early-stage startup (apply by Nov 10)

founder's guide

- How to create an investor CRM

- How RatePunk uses Pinterest for millions of views

- How to grow your SaaS by building free tools

- The fallacy of freemium in SaaS

- Simple yet effective on building network - or friendships - Strike When The Iron Is Hot

- AI & Sales - JB is bringing back Sales Tech Day, this one is Nov 9 book if not sold out yet.

What Cloud Solution Is Best for Your Startup? A guide comparing different cloud solutions – AWS, Google Cloud, and Microsoft Azure.

further insights

- On writing online: Lenny Ratchisky produces great content for anyone in building mode, and here he reveals how to build a 500,000-reader newsletter.

- China's Age of Malaise (The New Yorker)

- Hardware renaissance and a new era of contextual computing

- Superlinear Returns - new essay from Paul Graham

Are there general rules for finding situations with superlinear returns? The most obvious one is to seek work that compounds.

There are two ways work can compound. It can compound directly, in the sense that doing well in one cycle causes you to do better in the next. That happens for example when you're building infrastructure, or growing an audience or brand. Or work can compound by teaching you, since learning compounds. This second case is an interesting one because you may feel you're doing badly as it's happening. You may be failing to achieve your immediate goal. But if you're learning a lot, then you're getting exponential growth nonetheless.

ecosystem

- France wants to follow UK lead in incentivizing angel investment - will provide up to EUR 50k tax break if you invest in a startup.

- There is something very special about economic performance in Scandinavia. For example, Nordics have delivered +4.0% Total Return to Shareholders vs. Europe over the past 20 years (and +2.2% vs Global average). What is the key driver behind this? Strong company performance is fully explained by a higher degree of differentiation in local and global niche markets, leading to higher margins and economic profit. So that's an interesting insight from McKinsey.

- Less spot-on is when they dive into startups and scale-ups, where things are a bit more dynamic and data is much less clean to work with. With this report, they tried to make a point about which countries are better in scaling their startups. This created a lot of debates online (why Netherlands so much behind Sweden?) but in reality this graph suffers from poor selection of metrics. The scaling is narrowly defined as "firms founded between 2010-2015 that have moved from pre-series D to series D+ or IPO". This clearly leaves a ton of companies out that had other paths (such as profitable growth without external financing or successful acquisition). Combining the startup success with general business creation (most of these are just SMEs for the local economy) is also not helpful.

roleplay

Poklet - Co-Founders with expertise - Tech/Product Ownership, Growth/Marketing, and Business Development

Spike Technologies - Senior AI-tech Sales Executive

Cloudvisor - Partnerships Manager

BaltCap - ESG Manager

#walk15 - Sales Manager Germany

Syntropy - Product Designer

Spike Technologies - Senior AI-tech Sales Executive

Cloudvisor - Partnerships Manager

BaltCap - ESG Manager

#walk15 - Sales Manager Germany

Syntropy - Product Designer

One way to get interviews - make a slide deck

Pick a startup - find a job

Inspired by the reader’s comment below, a practical framework for how to think, research and find the best jobs in the tech market. A draft -help improve this by sending your suggestions. The early options that matter have already matured and there are just not enough high-growth early stage startu…

other messengers

Newsletters

Swedish Tech Weekly, On Norwegian Tech, Northstack (Iceland), Nordic EdTech, mondayfriday (Nordics)

Podcasts

The Pursuit of Scrappiness, Superproduktas

Swedish Tech Weekly, On Norwegian Tech, Northstack (Iceland), Nordic EdTech, mondayfriday (Nordics)

Podcasts

The Pursuit of Scrappiness, Superproduktas

three questions, previously

- Sten Tamkivi, Partner, Plural and Partner, Taavet+Sten

- Rytis Lauris, Co-founder and CEO, Omnisend

- Andreas Helbig, Partner, Atomico

- Domas Janickas, Co-founder at edON

- Milda Jasaite, Senior Director of Corporate Development, Vinted

- Darius Zakaitis, Founder & CEO, Tech Zity

- Roman Novacek, Partner, Presto Ventures

- Lina Zakarauskaite, Principal, Stride.VC

- Justinas Pasys, Managing Director, LitBAN

- Magnus Hambleton, Investor, byFounders

- Povilas Poderskis, Development Director, Darnu Group, ex-COO Nord Security

- Gytenis Galkis, Venture Partner, Superhero Capital

- Daniel Kratkovski and Dominykas Milašius, co-founders, Delta Biosciences

- Kasparas Aleknavicius - Co-Founder and CPO, Loctax

- Andrius Milinavičius, General Partner, Baltic Sandbox Ventures

- Laura Korsakova, Founder and CEO, Psylink

- Paulius Uziela, Investment Manager, Coinvest Capital

Member discussion