Ways to scale

work in progress

- Hobbies turn into industries - but not always as we expect them to do. 3D printing has become a mature industry, with machines at work in dentistry, making hearing aids and aircraft parts (but no machine in every home, printing that extra cutlery piece - as we imagined!). We've got 3D printing ventures for full house construction (Strato 3D Print), kidneys and other bioprinting (Vital 3D), electronics (CyberPod), supplying raisins (Amera Labs), 3D printing marketplace (Vulkaza), and of course, building 3D models (CGTrader).

- Stories of scale. 600 team members, very profitable and bootstrapped - the amazing story of Bored Panda. New story in the making - Vinted Go platform is live, which is 58 routes linking 14 countries and 220 000+ pick-up points.

- People. Karolina joins Plug and Play in SV. Another senior hire for Amlyze. Auguste leaving Imaguru Startup Hub. Jonas considering Product Manager roles.

Something to share or take note? Submit here, anonymously if you'd like.

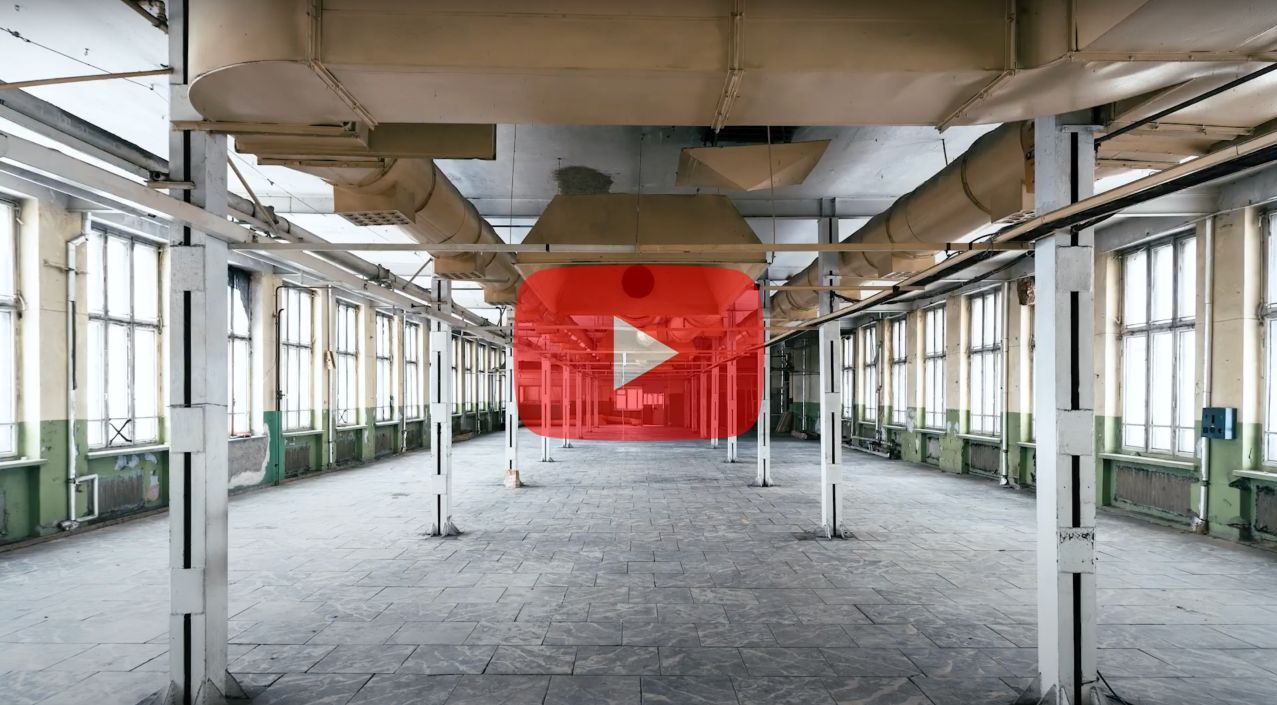

…and in 2024 it will grow into the biggest technology hub in Europe which will be filled with startups and other creative businesses.

rounds and capital

- Heavy Finance closes a nice EUR 3m seed round from Practica Capital

- After successful work together, Tesonet invested in Flanco, an office app & property management platform.

- Rebranding ME Investicija family office into Willgrow, so that it grows more. Sheds a little more light on venture exposure - few direct deals, but investor in Koshla Ventures, Left Lane, and others. Is Dig - the new Rytis Vitkauskas fund? Then the logo is different.

- Plural (Sten and Taavet) adds another partner / operator to the fund

roleplay

Letry (edtech) - Egle is in search of a co-founder

ConnectPay - Business Development Executive

RSI Europe - Supply Chain Manager

10 Speed - Product Owner

Paylar - CEO

Algori - Senior Sales Representative

IPXO - Sales Manager

walk15 - Sales Manager for Germany

further insights

- Unexpected and lacking a coherent explanation, Techstars stops its acceleration program in Sweden. They are also likely to apply for Lithuanian tender. Sobering read from Dragos on the typical accelerator business model.

- Germany struggles to attract qualified talent

Germany radiates a lot of bureaucracy and precious little welcoming culture

- Seeking markets, which are (a) Enormous, (b) Largely undisrupted and -(c) Dominated by technologically inept incumbents, with low customer NPS? They are called regulated markets.

- This week on AI - a long list - but you can learn about the potential economic impact and opportunities, and learn how to boost your writing. Also, everyone is talking about OpenAI history and Musk leaving as Sam Altman stepped up.

- World's largest trial on four-day week, and 92% of firms plan to keep it, citing multiple benefits. Startup operators, please skip this section.

founder's guide

- Ten traits of highly successful founders

- Founder's guide to compensation

- Preventing burnout - from Agne, in LT. Also, sleep? -

Getting sleep is important if you want to act like a decent human being. When people don’t sleep enough they become less likely to help other people the next day.

— Ethan Mollick (@emollick) March 20, 2023

This it true at the individual level, among people, & even at the level of entire societies. https://t.co/hIiONQjqLY pic.twitter.com/2RT82yS2mQ

- Pricing. When .99 works best? Show the original price next. Also, Substack finds that using .99 instead of a round number, has reduced free to paid conversion.

- How to master Enterprise Sales? Also, podcast episode with Karolis Zemaits on how PVcase books meetings.

- It goes long way if you know how to reduce team decently and with respect. Pleo building a Pleo Alumni site is one simple smart thing to do.

- Every B2B SaaS company now has a podcast? No, 26% of them.

three questions

Milda Jasaite, Senior Director of Corporate Development, Vinted

What should founders do to make sure they are better prepared to be acquired, if that comes along unexpectedly?

I think it's crucial to have good fundamentals (not easy!). While there are certain tactics related to the acquisition process that can be useful, I believe they are minor in comparison to the points below:

- Developing a unique company and valuable assets that are hard to find or replicate: whether it's cutting-edge technology, a strong presence in a particular market, a team with specialized expertise, valuable datasets, or innovative products... this is key

- Sound financials and runway management allows being strong in unexpected situations

- Making sure that your vision for the company is aligned with your Board of directors and key shareholders. Depending on the lifecycle of the investor’s fund or their strategy - some could be more short-term oriented, some more long-term. It's helpful to be able to come as a united front when faced with an exit opportunity.

What are the distinct features of Vinted M&A strategy - and what have you accomplished so far?

One of the key distinctions is that we think about the integration as soon as we jump on the first call with the founder, and we want this to be a joint exercise. Are we aligned on the vision, do we see culture fit, how exactly are we integrating the teams, technology and operations? How can we preserve the key elements that made the acquired team successful and also benefit from the best practices at Vinted? These are some of the questions we think about very early on.

Our most recent highlight is joining forces with Rebelle, a premium fashion marketplace -through a public-to-private transaction - as they were listed on Nasdaq First North Growth Market Exchange. Previously we have successfully acquired platforms running similar types of businesses in Spain and Netherlands, and also added a few new capabilities through acquihires.

You spent time with Earlybird in Berlin - what change do you want to see in tech ecosystem in Lithuania and Baltics?

It's crucial to develop solutions that break out of the limitations of the local market. When the market size is only around 300M EUR, it can be challenging to make a compelling case for VC investment, so it's important to position your solution in a broader context.

To attract capital and build a strong team, it's crucial to create a compelling narrative. You need to be able to explain how your product will scale, what sets you apart from the competition, and what milestones you've already met that increase your chances of success. If you can tell a convincing story about your company, it will be easier for external parties to grasp its potential.

Furthermore, there has already been significant progress in our ecosystem with the rise of successful tech scaleups and increased investment from global funds. This progress reflects that we are moving forward, and it's important to keep pushing ahead!

Three advantages of ice hockey against other sports.

Speed!

Speed!

Speed!

It's the fastest team sport in the world ;)

Member discussion