Possibly majestic

Lithuania Tech Weekly — #100!

Big thanks to all supporters who subscribe, read, respond and share. And a very special thank you to all paid TP members, as well as our generous sponsors. You are awesome.

work in progress

- Space. 5300 teams took part at NASA Space Apps 2022, and among just a few global winners - Lithuanian tAMing particles! They end the project description with tags - #mars #3Dprinting #tools #lifeonmars #topologyoptimisiation #SlavaUkraini. More spacetech: Astrolight founder Laurynas on a podcast, and Blackswan Space releasing ACE, an end-to-end autonomy platform dedicated for satellite mission integrators and operators. Aurora Propulsion (Practica portfolio) is working to enable sustainable space.

- Fintech. This could be easily just a fintech newsletter - always something is happening. Such as discussing whether Bank of Lithunia gave up on taking any risk anymore (in LT). Or lists like Accel's Fintech 100 EMEA, which obviously carries kevin. logo, too. FIRSTPICK serves Fintech Baltics fundraising summary, 2022. Who is building new? Audrius Softloans, Ricardas Hive5, Justinas PSPcircle. On related news, EBRD supported HeavyFinance, and Paysera is expanding into Kosovo.

- Lockers. Vinted Go lifts Portuguese startup Bloq.it, by partnering on a smart locker technology. More sharing - specifically item sharing P2P - was the winning hardware solution at the recent Bridgio tech hackathon.

rounds and capital

- Baltic Sandbox Ventures officially announced. "Team wants to accelerate up to 60 teams (with an acceleration ticket of EUR 25.5k). It also aims to invest in 23 teams at the pre-seed level (with tickets of up to EUR 100k) and complete 18 follow-on investments at seed (EUR 200k - 400k)". Wishing to outperform Angular Ventures - here is a recent good podcast episode.

- Transporeon, a transport logistics platform operating a part of its R&D in Estonia, was acquired for almost $2B. There is plenty of history behind it, including the famous Palleter post, when they admitted that startup is not working and decided not to take EUR 1m investment.

- Finland's Nosto, after acquiring SearchNode last year (maintains team in LT, interview with Antanas after acquisition), now buys Findologic.

- Orion Ventures joined LatBAN.

- Speedinvest (kevin. in portfolio) has new EUR 500m, and on a mission to make seed investing scalable.

AWS announced Cloudvisor as the winner of the Rising Star Partner of the Year - EMEA award. Chosen among thousands of AWS partners in the EMEA region proves Cloudvisor is one of the leading AWS partners empowering startups to scale. Book a free consultation today. AWS + Startups = Cloudvisor 🖤

roleplay

Openli - Privacy Success Manager

Direct Machining Control - Software Engineer (watch them)

Eneba - Data Engineer

LCC University - Director of Cyber Technology Center (CTC)

Drop a link to your job posting here, and select to show one or two weeks. Free for early-stage teams.

founder guide

- McKinsey survey is actually pretty good to spot what is key in scaling. When capital dries (rather critical) double down on product expansions VS geographical expansion (podcast)

- Fundraising hacks - calendar density, connect with venture-backed founders

- Careers. For BigCo to Startup - how to assess and make a better decision

insights

- Investing into YC startups - winning strategy or not? "After a couple of years of survival, a YC company is nearly as likely to end up exited as failed in any given year"

- Possibly - the most successful venture fund ever (in Europe)

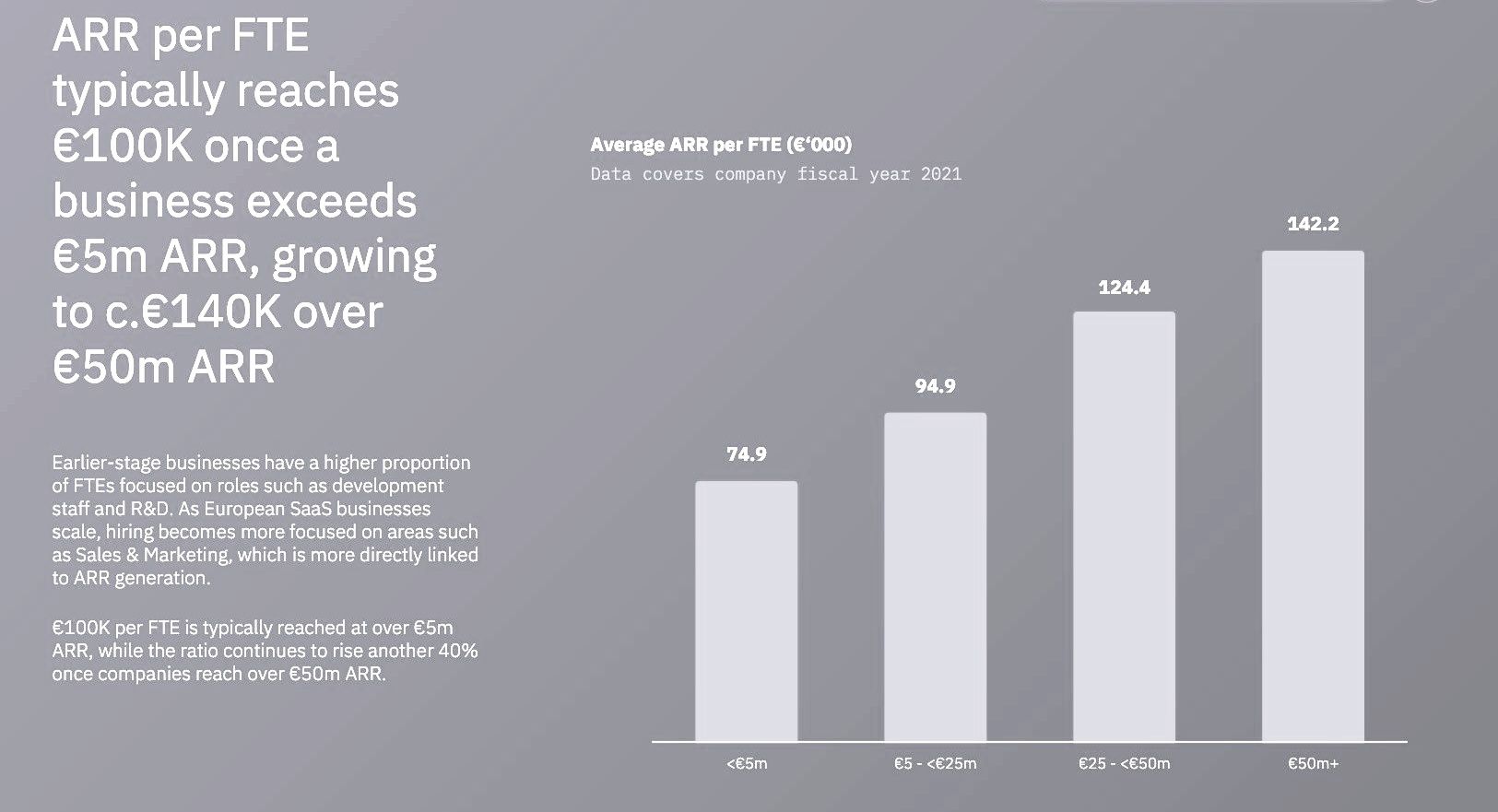

- GP Bullhound releases new European SaaS report, with interesting graphs for some great LinkedIn thought leadership

things planetary

- C.I.A stands for Cycling Innovation Accelerator

- Night trains in Europe, updated map

- Four ways to accelerate deeptech and hardware climate startups in Europe

- Scale of what needs to be done is absolutely massive. The Ezra Klein podcast - the single best guide to decarbonization I’ve heard

[For wind farms] The most cost effective of our net-zero scenarios spans an area that is equal to Illinois, Indiana, Ohio, Kentucky and Tennessee put together. And the solar farms are an area the size of Connecticut, Rhode Island and Massachusetts.

three questions

Magnus Hambleton, Investor, byFounders

What is your role and focus within byFounders?

Everyone on the investment team does similar work at a high level: scouting for founders, evaluating whether or not to make an investment and helping the founders of our portfolio companies.

Personally I am focusing on meeting as many founders as I can, to develop an idea of what "good" looks like. To know when someone is in the top 1%, you need to have met at least 100 founders! I have met around 200 founders in my first 3 months (I went through my calendar and counted!), and have reviewed maybe ~3x that many decks and materials, but I am still very much learning and don't expect I will ever feel like I have fully learned how to do this job.

We don't have a sector focus, so everyone on the team is keen to meet founders in all kinds of companies, but given my background I have a particular keen interest in health, AI and deeply technical problems.

Given your Healthtech and ML/AI background, where do see new opportunities for founders? We seem to have new AI hype for sure.

In 2020, with the launch of GPT-3, a very large set of potential companies went from being impossible to being possible. I think we will spend the next decade working out what these new companies are.

The first of this new wave of companies will be ones that operate on data that was previously too "fluffy" to work well with code. E.g. understanding, summarising and transforming text and images. I think the best way to think of it is not "what human tasks can we automate?" but more "how would you change your workflow if you had access to infinite amounts of slightly below human-quality labour?"

Within Health, we now have almost a decade worth of continuous health data from wearables (e.g. the Apple Watch). Data collection will continue expanding with more devices and tests, but the real benefits will come when we have enough data to start recognising patterns in long term trends and health conditions. Apple has only just started this via their heart monitoring apps — I think we will see many more useful things in the future.

What is your view on the Lithuanian ecosystem and how can you help entrepreneurs?

I think the Lithuanian ecosystem is super impressive! It's still early and relatively small, but it has a lot going for it. The early success stories such as Vinted and Nord Security have provided examples of what success looks like and have trained a lot of high quality tech talent. A relatively small population forces founders to think globally very early. I've met a lot of strong AI talent around Vilnius which is going to be an important space going forward.

Our focus is on building a community around the founders we invest in. We involve our Collective, consisting of the founders of the big successes in the region, to be available as thought partners and support. We are also of course very active when it comes to helping the founders in our portfolio fundraise for future rounds.

Member discussion