Run like Hoka

work in progress

- Run. 10 things about running, by Scott Belsky. The Joggo app is running up and to the right. When will Motion Trials start sprinting go to market? A couple of pods for inspiration - how Hoka ran away from competition (Deckers bought it for $1.1M in 2012, and now 2023 revenue = $1.41 billion!). Also, how On Running went from 0 to IPO, w/David Allemann.

- Creator economy - some learnings, such as power law play and graduation from tools. Did Qoorio miss due to timing or perhaps go to market? Power users can swing massively. Gajus continue building Contra. How is Contribee doing these days?

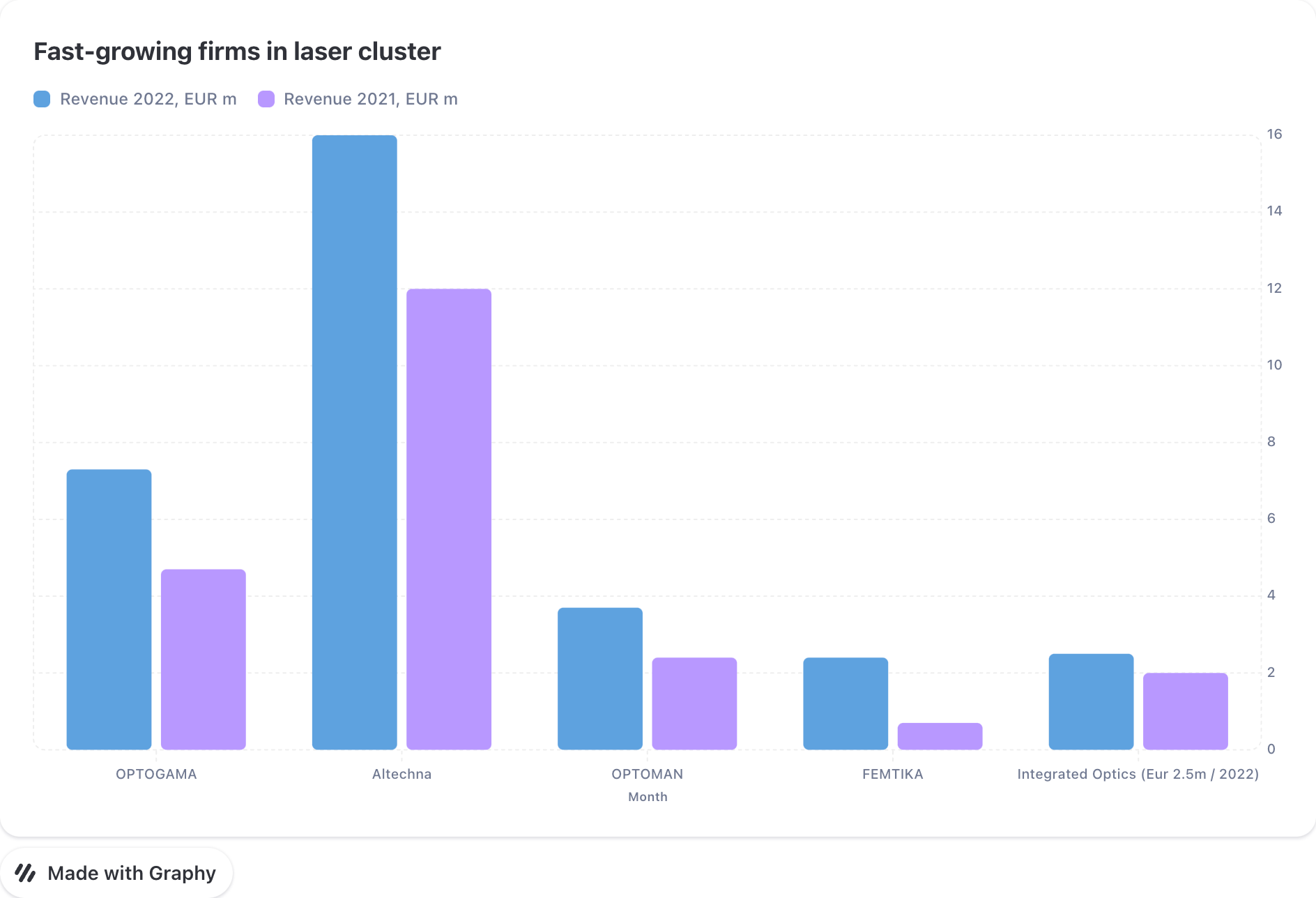

- Laser firms. Starting with niche research products, the laser industry is shifting. It took too long for the LT laser cluster to break out and spread these skills into fast-growth domains/markets, finally happening to some extent. Here are a few to keep track of - Altechna, Optogama, Optoman, Integrated Optics, Femtika. Anything missing?

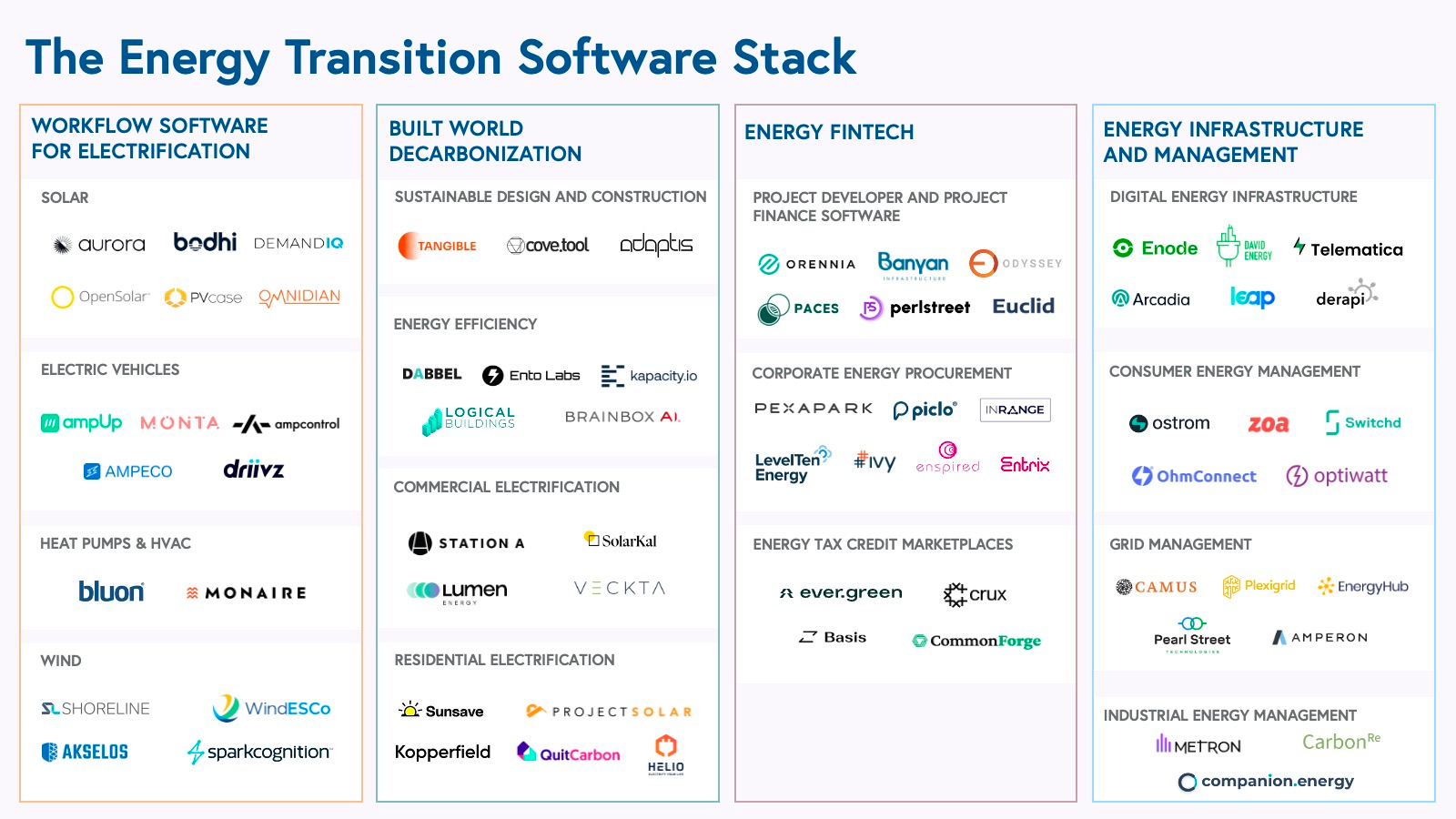

- Sun. Installations growing much more rapidly than policymakers expected, thus bright days not only for PVcase. Energia Futura (Business Angel Fund), grew to EUR 6.6m revenue (all local market it seems?), Inion Software’s sales grew 300% in the first half of the year. Here are European energy startups with the fastest growing teams, and this Bessemer chart will only get expanded:

- Food. Mikas co-founded Billoka - a personal dietitian in a mobile app, Oh My Food project is in need of a co-founder (both AI danger/opportunity zones). Prie Pat will help farmers sell their veggies.

- IPOs are back? S-1s from Instacart and Klaviyo, Omnisend competitor. Made a big mistake downplaying them in the previous issue and picking the wrong data source for revenue. Klaviyo actually has built a machine with all these venture dollars — $585m ARR, 57% growth, 119% NRR. Also, the founder still owns 38% of the company!

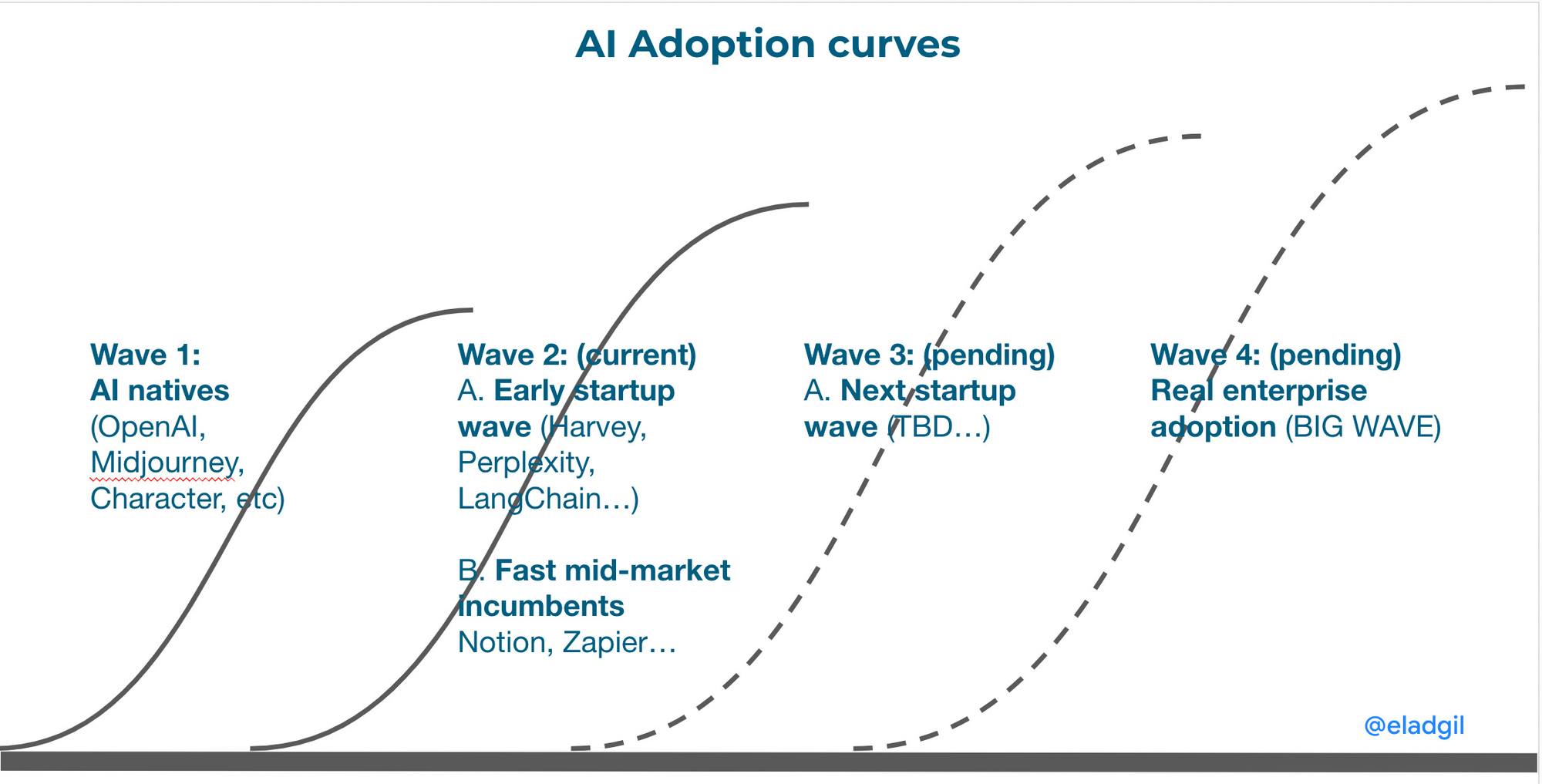

- AI. Early days of AI (and AI Hype Cycle) by Elad Gill. We are just hitting the second wave in this framework. Also, LLMs will unlock the next wave of innovation in B2B SaaS - including previously difficult industries to tackle. Meanwhile, Oxus seem to have shifted to language learning, Mentum AI is now e-commerce listing automation solution. During Adobe Express Beta stage more than 10,000 designs were analyzed with Attention Insight Add-On.

rounds and capital

- Not entirely announcement but looks like Sign on Tab raised EUR 610K from Business Angels Fund, Depo Ventures, and BADideas.Fund in June 2023.

- Viezo, autonomous IOT for the railways, raises a round from Coinvest Capital and multiple LitBAN Angels. Monitoring railways from Norway to Australia.

- Fiedler is in search of Baltic pre-seed and early-seed deals, get in touch.

- Siena Secondary Fund pulled off a deal to acquire a stake in Finnish scaleup Oura Ring.

- A recent study shows that LT banks reject 32% of loan applications from SMEs, while the EU average is 7%. Conservative banks or crazy entrepreneurs?.. Anyways, EIF and SME Finance have signed a guarantee agreement under the InvestEU programme to facilitate more than €40 million in new loans and leases.

roleplay

Robotikos Akademija - Head of Marketing

Open Circle Capital - Analyst

Sun Investment Group - Head of Legal

EmPlastrum - CTO

NFQ - Sales Manager

Comundo - Decarbonisation Lead

Elinta Charge - Sales Manager

Printify - General Manager Business Expansion (remote within EMEA)

Open Circle Capital - Analyst

Sun Investment Group - Head of Legal

EmPlastrum - CTO

NFQ - Sales Manager

Comundo - Decarbonisation Lead

Elinta Charge - Sales Manager

Printify - General Manager Business Expansion (remote within EMEA)

Simple, tactical advice - your startup job search

Pick a startup - find a job

Inspired by the reader’s comment below, a practical framework for how to think, research and find the best jobs in the tech market. A draft -help improve this by sending your suggestions. The early options that matter have already matured and there are just not enough high-growth early stage startu…

founder's guide

- 13 Things That Say “Don’t Fund Me” To VCs

- Practical AI. Get your idea crushed by this AI VC, before meeting a real one. Another resource - flow to request missing invoices and automatically converse with vendors using ChatGPT, Airtable & Gmail.

- Nine sources of advantage, which ones are yours?

- How to hire your first growth team

- When VCs are slow to setup a meeting - a simple framework why.

First off, we are reviewing hundreds of opportunities every month. Vast majority of them (Class C) are just not interesting. A tiny tiny minority (Class A) is clearly interesting, and we typically drop everything to meet them immediately and move those deals forward if necessary.

— Gil Dibner (@gdibner) August 20, 2023

- "Would be great to have something like Y Combinator, but for Bootstrappers"

- Forget growth-first, new model of "raise less, build more" is emerging. LT scale-up founders could start cohort-based courses just on that.

- Started putting resources together on startup ideas - let us know if you've seen something good on the topic [open for paid members now]

Your startup idea [draft]

Startup scene in Lithuania - weekly newsletter

further insights

- A reason large firms conduct R&D at the same rate as small ones, despite (apparently) lower R&D productivity = more process innovation.

- Be strategic: Messi has walked more than any player at the World Cup.

Pep Guardiola described his walking, especially in the early stages of a game, as a form of cartography—an exercise in scanning and surveying, taking the measure of the defense, noticing where the vulnerabilities lie, and calculating when and how opportunities might be seized. “After five, ten minutes, he’ll have a map in his eyes and in his brain”

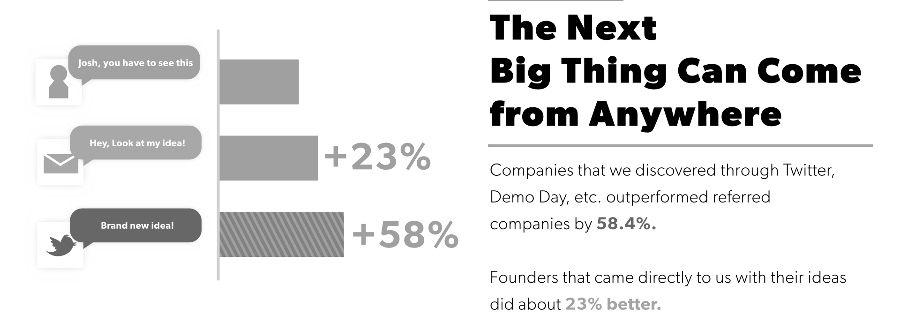

- First Round 10-year review, important takeaways. First - do not rely on referrals as filtering strategy:

Startups with a female founder performed 63% better than their investments with all-male founding teams.

Teams with an average age under 25 (when invested) perform nearly 30% above average.

First Round companies with at least one founder who attended an Ivy performed 220% better than other teams.

Teams with at least one founder coming out of Amazon, Apple, Facebook, Google, Microsoft or Twitter, performed 160% better than other companies.

Repeat founders’ initial valuations tended to be over 50% higher.

Technical co-founders are critical to enterprise, not so much for consumer

First Round companies founded outside New York and the Bay Area are performing just as well as their peers based in those epicenters

Teams with an average age under 25 (when invested) perform nearly 30% above average.

First Round companies with at least one founder who attended an Ivy performed 220% better than other teams.

Teams with at least one founder coming out of Amazon, Apple, Facebook, Google, Microsoft or Twitter, performed 160% better than other companies.

Repeat founders’ initial valuations tended to be over 50% higher.

Technical co-founders are critical to enterprise, not so much for consumer

First Round companies founded outside New York and the Bay Area are performing just as well as their peers based in those epicenters

ecosystem

- Taking ‘bold’ bets: new UK agency prepares to fund breakthrough technologies

- Venture funds, CEE style: €426m funding hole brings Poland's early-stage VC market to a standstill

The Polish ministry responsible for allocating the EU funds has the money, but hasn’t yet transferred it to PFR Ventures.

The ministry tells Sifted that the funds should arrive this year — but don't explain why the process is taking so long.

Partner with Tech Philomaths

Read by founders and tech executives, angel investors and VCs

three questions, previously

- Rytis Lauris, Co-founder and CEO, Omnisend

- Andreas Helbig, Partner, Atomico

- Domas Janickas, Co-founder at edON

- Milda Jasaite, Senior Director of Corporate Development, Vinted

- Darius Zakaitis, Founder & CEO, Tech Zity

- Roman Novacek, Partner, Presto Ventures

- Lina Zakarauskaite, Principal, Stride.VC

- Justinas Pasys, Managing Director, LitBAN

- Magnus Hambleton, Investor, byFounders

- Povilas Poderskis, Development Director, Darnu Group, ex-COO Nord Security

- Gytenis Galkis, Venture Partner, Superhero Capital

- Daniel Kratkovski and Dominykas Milašius, co-founders, Delta Biosciences

- Kasparas Aleknavicius - Co-Founder and CPO, Loctax

- Andrius Milinavičius, General Partner, Baltic Sandbox Ventures

- Laura Korsakova, Founder and CEO, Psylink

- Paulius Uziela, Investment Manager, Coinvest Capital

Member discussion