Run, bank

Lithuania Tech Weekly #112

Subscribe at philomaths.tech, also LinkedIn

Partner with us - see options

Big one or not so? SVB collapse is being contained quickly. Now we got the news - US depositors bailed out, UK SVB is being acquired by HSBC.

Smart people have made some important remarks on the situation - unusual SVB risk profile (undiversified depositor base and reliance on long-term bonds), the vast majority of uninsured money (above 250k), and suddenly the bank getting trapped in monetary policy change. More by Politano, or much quoted Matt Levine:

And so if you were the Bank of Startups, just like if you were the Bank of Crypto, it turned out that you had made a huge concentrated bet on interest rates. Your customers were flush with cash, so they gave you all that cash, but they didn’t need loans so you invested all that cash in longer-dated fixed-income securities, which lost value when rates went up. But also, when rates went up, your customers all got smoked, because it turned out that they were creatures of low interest rates, and in a higher-interest-rate environment they didn’t have money anymore. So they withdrew their deposits, so you had to sell those securities at a loss to pay them back. Now you have lost money and look financially shaky, so customers get spooked and withdraw more money, so you sell more securities, so you book more losses, oops oops oops

Also - we have become really good in bank runs, which happen like a flash (SVB run was $1m per second, 10 hours straight) - time for some preventive systems? LT startups affected - not really unless some that have done banking/debt with SVB in UK. SVB happens to be of investors in TransferGo.

work in progress

- Energy. Lots of energy in energy, although we continue to move too slowly in climate transition. Vytautas and Andrius launched Luna to unlock the full potential of solar roof by maximising self-consumption. Viezo turns vibration into energy, and is currently focused on helping train operators save costs. Stuart Energy is building EV charge point operator platform. Overall, cleantech firms have raised above EUR 700m in the last 6 years. Janulevicius hints there should be a battery manufacturing project from Taiwan.

- Get social. Early adopters can try Joiner App, which is about meeting new people and exploring new places. Love to follow Lithuanian social & consumer space, because we like things that barely exist...

- Data for good. Tomas (Oxylabs) explains the power of public web data, and how this is getting enhanced with AI/ML. In a new partnership, Oxylabs committed to helping Environmental Protection Department to identify wrongdoings.

- Newsletters. Get to know how Viktorija Trimbel is getting started at CoInvest Capital, and her new substack (in LT). Their evergreen fund has 15m+ ready to be deployed.

Human-centred. With movement and healthy diet in mind

Sustainability. Multiple reuse elements across the campus

Community. A large and vibrant, 5000 people

rounds and capital

- It's mid-March and we have 3 rounds publicly closed. We don't want to show this sad graph.

- Mitch Yang talks about Taiwania Capital's strategy - as they step into the region scarce for deeptech growth rounds.

But there are also solid business reasons for the fund’s interest in Lithuania, rather than the more dynamic start-up ecosystem of Estonia, for example. “After visiting Lithuania, we found that it is a better match for Taiwanese companies and industry,” said Yang. “The number-one attraction is being able to use Lithuania’s femtosecond lasers in our electronics applications. It’s likely that this technology will play a role in the next generation of semiconductor development.”

roleplay

Greenifs - CMO

Bolt - Country Manager, Latvia

FittyAI - Partnerships Manager

Breezit - Sales Assistant

Tidio - Agency Partnerships Manager

Amlyze - Business Analyst

The Knotty Ones - Digital Growth Manager

NFQ - Senior UX Designer

Teachers Lead Tech - Comms Role (part time)

Save between 10% and 40% on your AWS bill. How? By doing a Well-Architected Framework Review with Cloudvisor. Looking for proof? This is how TableAir benefited. AWS + Startups = Cloudvisor 🖤

founder's guide

- 8 AI-Powered Tools for Sales

- Running your engineering onboarding program

- Generative AI tools for everyday, from A16Z

- Saving during uni for the 1-year Thai runway, bootstrapping on steroids

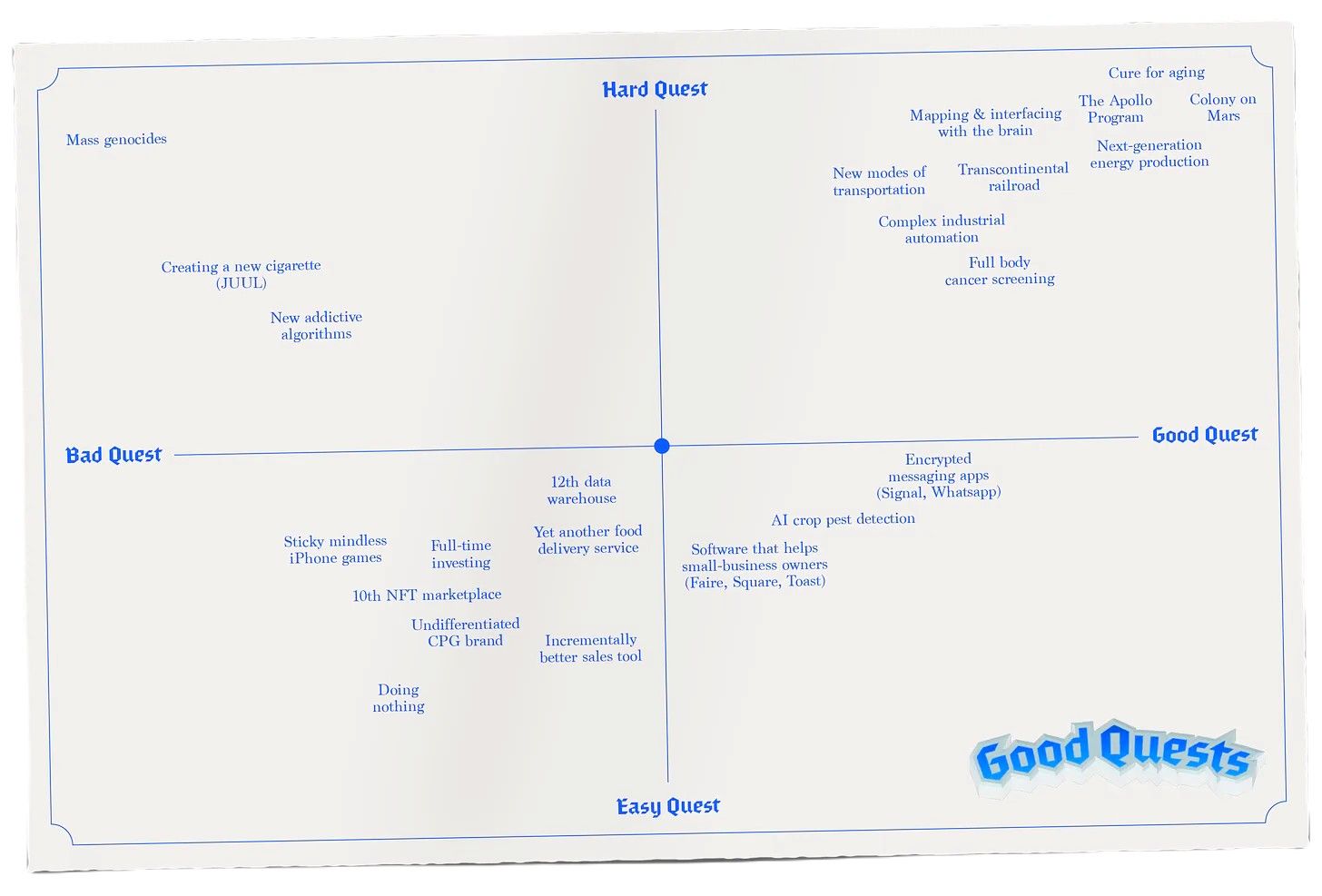

- Choose Good Quests:

If you are an experienced founder with lots of money or social capital, leave the next food delivery startup to the Level 1 neuromancer, and ask yourself: what would the world look like if our best players took on good quests?

- In this spirit, Sam Altman (OpenAI) pours all his liquid net worth ($555m) into two startups - Retro (human longevity) and Helion Energy (fusion power).

further insight

- The Tail End (When you look at that reality, you realize that despite not being at the end of your life, you may very well be nearing the end of your time with some of the most important people in your life.)

- Does more money correlate with greater happiness? There was this study that showed happiness plateau after $75k mark. Now it's been revisited and apparently, this is limited to a small group - the majority enjoy raising incomes without any limit.

ecosystem

- Connectivity. There is this evidence about flights and connectivity between the cities, that tells you that the benefits are huge - in terms of business creation, investment, innovation, and growth of exports. Vilnius is still quite a bit of a mess, so when the current CEO of LT airports tells that the situation is "kind of fine", education comes around for free.

three questions, previously

- Darius Zakaitis, Founder & CEO, Tech Zity

- Roman Novacek, Partner, Presto Ventures

- Lina Zakarauskaite, Principal, Stride.VC

- Justinas Pasys, Managing Director, LitBAN

- Magnus Hambleton, Investor, byFounders

- Povilas Poderskis, Development Director, Darnu Group, ex-COO Nord Security

- Gytenis Galkis, Venture Partner, Superhero Capital

- Daniel Kratkovski and Dominykas Milašius, co-founders, Delta Biosciences

- Kasparas Aleknavicius - Co-Founder and CPO, Loctax

- Andrius Milinavičius, General Partner, Baltic Sandbox Ventures

- Laura Korsakova, Founder and CEO, Psylink

- Paulius Uziela, Investment Manager, Coinvest Capital

Member discussion