Hard investments

Subscribe - philomaths.tech

X and LinkedIn for fractional updates

Supported by: edON

work in progress

- Defence and dual-use. Will Europe get serious soon enough? FT writes that "in 2022, European VCs contributed a meagre $2bn in defence tech, which would be just enough to cover American autonomy startup Anduril Industries’s $1.5bn latest Series E raise". NATO's Defence Accelerator, DIANA, selected two LT startups for their first batch - Astrolight and VistaReader, building in visual cognition and decision space. New North Ventures is coming around LT to source more hard startups. Good – Lithuania is now a repair hub for Ukraine's tanks, while Estonian Milrem Robotics keep growing.

Markus Villig, founder and CEO of Bolt, brings on-point piece on why Estonia (and other Baltic countries) need to bolster defence investment - and what "Putin tax" we are all paying.

By postponing these investments, we're risking not only Estonia's security but also higher capital costs in the future. Because the continued worsening of the security situation would amount to a much bigger risk premium than 1 percentage point.

- Transport. The benefits of lightweight materials, by Dancer bus founder. The benefits of V10: Rhino RR01 combines Porsche looks with an Audi V10:

- Two Elinta companies – Motors and Charge – are successfully charging ahead with revenue growth. Stuart Energy is building charging infra at LT airports. Also, expect noise to grow in importance, too - in Vilnius roughly 232,000 people endure constant exposure to noise levels exceeding 55 dBA - electric buses can make a difference. Drones play a role in health, too - a pilot in Sweden shows that they allow deploying defibrillators about 3 minutes earlier than ambulance arrives.

- Community grows as more partnerships get started – Bored Panda will deliver media support package for RatePunk – expect them to grow rapidly and cool initiative from Pandas.

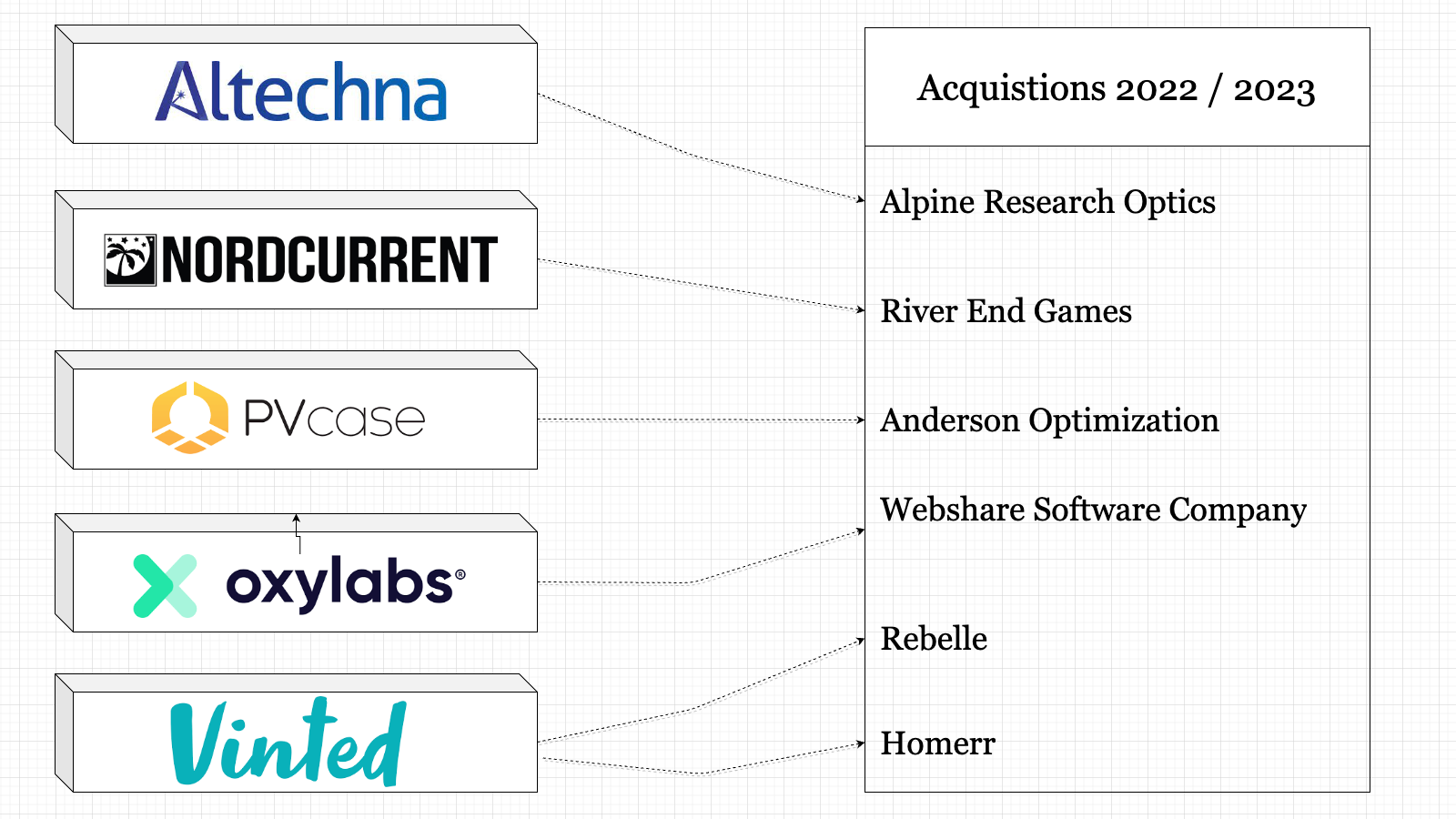

- Vinted is now 15 years old and we need to update the LT tech acquisition chart to reflect the big moves their M&A team has been making. You may also enjoy their annual report since Vinted Limited is UK-based. The year 2022 was €370m in revenue and only €27m loss.

Empower your team with AI & no-code skills: transform career development with edON Academy!

Boost team performance, acquire new skills, and knowledge and get equipped to drive growth and innovation.

The courses include AI Tools and strategy, no-code, Cybersecurity, Quality Assurance, Affiliate marketing, and a Mini MBA covering all the key areas for decision-makers.

Our lecturers have gained expertise while building solutions for large enterprises as well as contributing to the successes of local scale-ups. Many of our courses are eligible for EU incentives, offering you the opportunity to significantly reduce or even eliminate costs and the cohort-based training sessions are tailored to fit busy schedules.

Discover more about our upskilling / reskilling programmes or schedule a free demo call.

rounds and capital

- Sentante, a teleoperated robotic system developer for endovascular intervention, closed of a €6 m seed round led by Practica Capital with participation of EIC fund. Here is a recent interview with Edvardas Satkauskas, CEO, about their journey.

- Revo Capital, early investors in TransferGo, are in the process of raising a third fund – targeting $100 million, with goal to close the Series A+ funding gap across six verticals, all of which also have an AI/ML/Big Data component.

- SOLIDU, an ethical and waterless solid cosmetics producer, raised €134k on Crowdcube at €2.7m pre-money.

three questions

Emmet King, Founding Partner, J12 Ventures

Help us understand J12 in terms of investment stages, themes, and geography.

We invest across Europe at pre-seed and seed stage, in companies that are either enablers of AI (typically data infrastructure, developer tools, MLOpps) or vertical applications of AI (recent investments have e.g. included solutions specific to industrial maintenance, retail, and legal services). Our team is based in Stockholm, Paris, and London.

You seem to be heavily focused on AI now. What's your thesis related to the startups in Nordics/Baltics, and what are you trying to achieve with NEXUS?

Just as we have seen previous winners built in the region across B2B/enterprise software and consumer offerings, we believe that founders across the Nordics/Baltics are well-placed to build category-leading companies that have AI at the core of the product offering. When it comes to applications, it's about deep understanding of specific workflows and user behaviours, and being able to build and distribute product that solves a real problem in relation to those - and Nordic/Baltic founders have a great history of doing that, particularly within areas such as fintech, industry, retail, energy, and healthcare. When it comes to AI enablers, we know that data scientists, developers, and ML engineers operating within the previous big tech successes across the region are working on challenges at the forefront, and thus are well-positioned to be the founders of new companies setting out to solve those challenges for all.

With NEXUS, we are looking to support Europe's AI leadership by gathering the most ambitious founders in the space over a series of invite-only events in Stockholm and London, starting in January. Given the fast-moving landscape, rate of technological development, and different perspectives to take on board, we believe there is real value in connecting founders operating in the different layers of the AI stack, and across different stages, in order for all to learn and move faster.

Is Size, Risk, Go still the framework for investment decisions? Or has it evolved since?

Ohh that article is a bit of a blast from the past! But yes the fundamentals still hold true. We need to invest in large enough opportunities and understand the different risks we are happy to be taking when doing so. We like to build conviction around markets and their dynamics, and back teams that are doing genuinely difficult things - and that often relates to taking on a higher degree of product/technical risk. The founding team and ability to execute will always be the most important though, so at the pre-seed stage that framework could be reduced simply to "Go, Go, Go".

founder's guide

- If you think you can raise at a pitching event, Yrjo says they are the same as dunking competitions — fun, but far from the real thing

- For creatives out there - build online like Frank Zappa

“It's a game, you have a piece of time and you get to decorate it.”

- Reflecting on Figma's failed acquisition by Adobe, Byrne writes about "Economics of Companies Acquiring What They Could Make In-House". Figma seems to be worth 11B-12B now. And here is pod on how he writes 50k reader newsletter called the Diff.

- Your guide to outbound automation

roleplay

Whatagraph - Senior Product Designer

Teltonika - Head of R&D, Energy

Plug & Play - Accelerator Director

Cybercare - Employer Brand & Communications Lead

Product Management job went from working by the pool in 2022, to the one where most want to quit as we reach the end of 2023

further insights

- Power Law works in popular media, similar to venture returns

- Every year, we check what Benedict Evans have to say

- Why Europe fails to generate wealth (to be fair, there are other types of wealth created in Europe, not only monetary)

- Podcast with Elad Gil - many interesting insights on AI.

- Already in Yearly Life Review? This is a comprehensive tool if you need one - Use Strategic Thinking to Create the Life You Want

three questions, previously

- Sten Tamkivi, Partner, Plural and Partner, Taavet+Sten

- Rytis Lauris, Co-founder and CEO, Omnisend

- Andreas Helbig, Partner, Atomico

- Domas Janickas, Co-founder at edON

- Milda Jasaite, Senior Director of Corporate Development, Vinted

- Darius Zakaitis, Founder & CEO, Tech Zity

- Roman Novacek, Partner, Presto Ventures

- Lina Zakarauskaite, Principal, Stride.VC

- Justinas Pasys, Managing Director, LitBAN

- Magnus Hambleton, Investor, byFounders

Member discussion