Dress for success

Subscribe - philomaths.tech

X and LinkedIn for fractional updates

Supported by:

work in progress

- Fashion. Expect startups to go after niches Vinted leaves behind - as fashion+sustainability are taking off, Rex Woodbury points out:

There’s a big business to be built here. In a market approaching $200B in size, most of the dedicated players are still sub-$1B in revenue. The biggest winners remain the Ebays, Craiglists, and Facebook Marketplaces of the world—antiquated products that haven’t evolved in years. This creates the opening for a new player. Generational tailwinds are there (sustainable fashion, off-price commerce), alongside a technology unlock (AI). Tying together purchase → resale is the key.

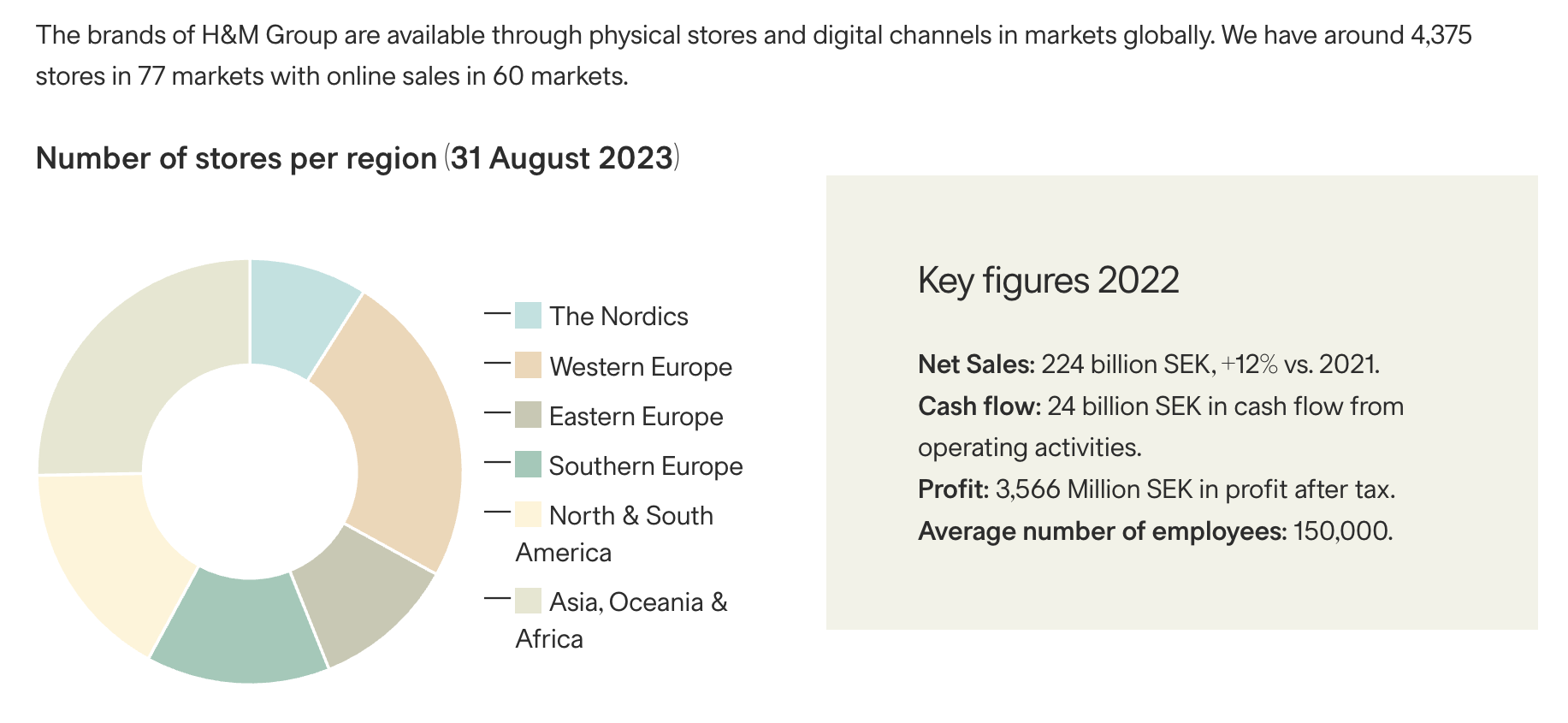

Vinted, I believe, will surprise us not by the next big round or even an IPO - but by growing way, way bigger, as a true superlinear return asset. What if today is still very early days for them? Think of companies that are almost "category of one", such as Spotify or AirBnB. Alternatively, let's look at incumbents. More than 23 years ago H&M opened their first US store on Fifth Avenue, New York. Now they have 4300+ stores, 150,000 employees, and around EUR 20B in revenues.

To play in this fashion transition, Ieva, Karina and Daniel are kickstarting a dedicated fund - called &beyond. Indre has an idea for Tiings – a zero-effort fashion repairs marketplace for busy people & brands. Estonian Yaga raised EUR 2.2M last year for a second-hand fashion marketplace in Asia and Africa. Also Estonian, KIUD is transforming discarded textiles into packaging material. Friendly Textiles (LT) believes wool can come from brushed-out dog undercoat. And The Knotty Ones are growing further, now available on Revolve (and also featured by the Guardian).

- Web3. Founderheads had an active Q3, adding Linas Kuzma as venture partner. Monika talks to Gintare, founder and CEO of micapass - a decentralized on-chain compliance tool. monitok is the next-gen hybrid crypto exchange. Also OPNX, another crypto exchange, has obtained VASP licence in LT.

- Mobility. A pretty geeky (therefore interesting) interview with Trafi CEO Damian Brown, who also says Trafi became profitable this year. What, besides MaaS app, helps public transport the most? Increase in quality, and think less about reducing prices - that is the learning from Tallinn's "free transit" experiment. Interestingly, new research suggests that cyclists care more about society and the common good than drivers do. For that reason, we hope Cyber City will run out of these Parkis bike lifts soon - and will ask to add more. For friends thinking about cities and quality of life, here is an older post about the urban experience in Vilnius - I like most of these ideas, such as "less architecture, more city"

- Drones. Industry is flying again, since drones have revolutionized modern warfare, and today there is no lack of demand. Latvians know a thing or two about drones, and recently Andris (Change Ventures) did an angel investment in Origin Robotics. Another cool product - SUBmerge Baltics - is an underwater drone. As you know, even Aerones started with a drone. FIXAR is a full-stack developer of autonomous VTOL drones. After a merger, UAV Factory in Latvia became EDGE Autonomy (which supplied drones to Ukraine and recently caught on fire..). Another Latvian firm - Atlas Dynamics - also are actively helping out Ukraine in the war. In LT, Thrust is working in the aerial inspection field. We will be hearing more from Unmanned Defense Systems. EDM4S Skywiper system is developed by NT Service.

- Building in AI space (or trying to keep up with OpenAI releases). There are a few VC newsletters we try not to miss weekly, one of them is from Angular Ventures. In the last issue, Gil Dibner looks at 3 distinct AI startup types they receive pitches: 1) thin and ephemeral 2) big and weak and 3) small and strong.

These startups are often “strong,” in my view because they tend to have a pretty robust layer of application functionality built on top of the data and AI layer that underlies them. They sometimes generate their own proprietary data. They have enough domain expertise, for example, to be able to create barriers to entry around LLM inputs and outputs in ways that less experienced teams would not be able to devise. Their strategic depth often extends into their go-to-market operations.

This is something JB and evergrowth team is aiming at, cloning their looong years of experience into powerful sales ICP mapping, searching - and even outbound email drafts and objection handling. Becoming full-suite sales solution, but 100x the speed. Demo here - new RevTech startup rises?

- People. Roberta is stepping down from Startup Lithuania. Rimante, ex-Omnisend, joins Ellex as COO. Elina steps up as Interim CEO of Auga Group. Algimantas Markauskas joins Altechna Board - watch as they are working on acquisition deals, too. Fred Destin (Stride.VC) stopped raising the third fund, team reduced, and Lina Zakarauskaite will be taking on new adventures (more about Lina in a previous letter)

- Please carry the flag. Almost everyone has roots in Lithuania, just need to go back in history long enough... Vlad Loktev, former AirBnB executive joined Index Ventures (left LT as a kid). It is also the land of ancestors for Noah Smith. But the most interesting one is how we print a shiny new passport for Jonas Andrulis, founder and CEO of Aleph Alpha, German AI startup which just closed $500m series B round?

What Are AWS Credits for Startups and How to Get Them? Exploring how early-stage firms can secure up to $100,000 in free AWS credits.

rounds and capital

- CAST.AI bags $35m for their series B, just nine months after $20m series A - time is perfect for growth (CAST.AI reduces expenses by automating cloud infrastructure optimization). Round led by Vintage Investment Partners and existing investors Creandum and Uncorrelated Ventures. Of course, hiring a few colleagues now.

- AppsFlyer has acquired DevtoDev, a comprehensive data analytics solution tailored for game and app developers. Dmytro moved to Vilnius years ago with Game Insight, which is just one great example of how important talent attraction is.

- Friends from Finland launched Kvanted, the first Nordic industrial tech VC (EUR 70m). How should get in touch? Perhaps DMC, ColibrisODM, Sprana, Femtika, Litilit - and a few others.

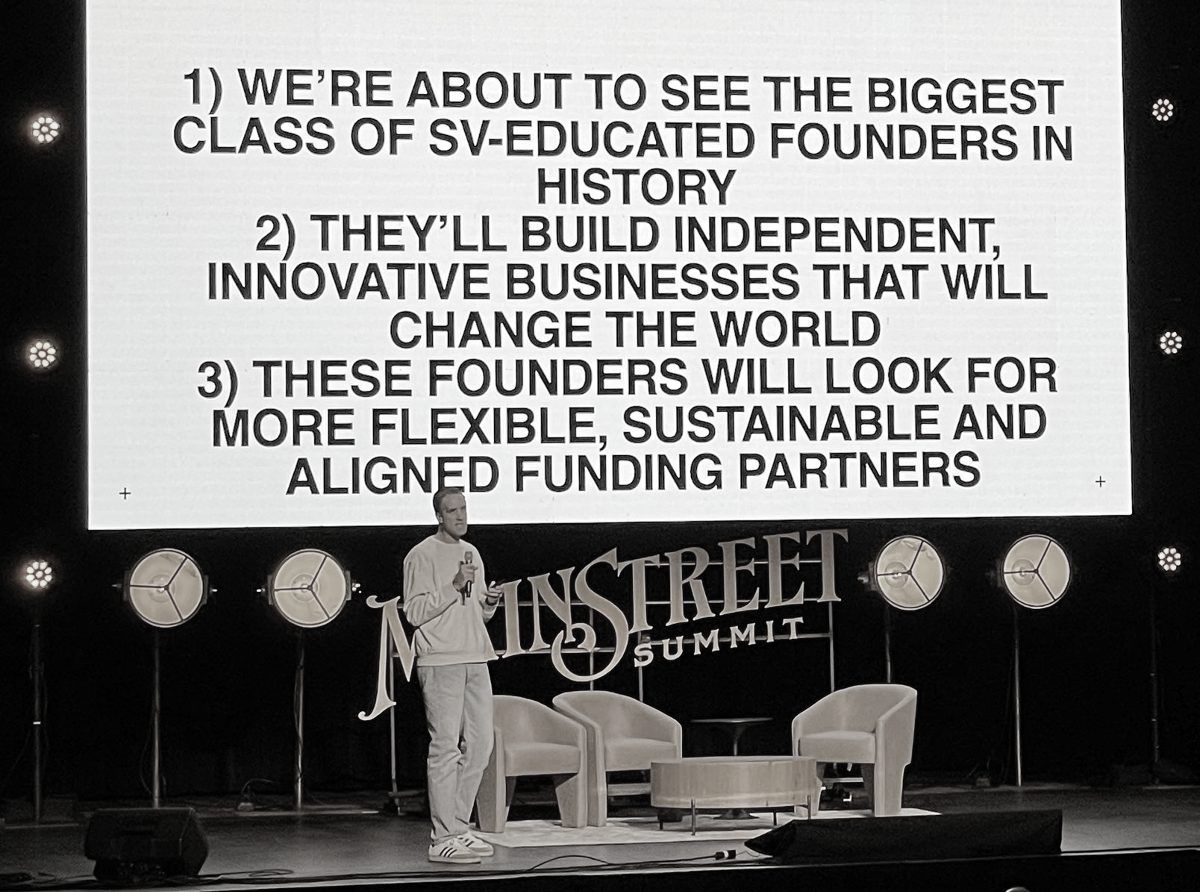

- We did not see this massive VC capital wave (and crash afterwards) as much as it happened in the US. We are still the bootstrapped and scrappy startup land. But across the Atlantic, the sentiment of "all things indie" is very much back. New indie backers (here, here) are trying to land grab technology firms either stuck on VC path (distressed assets or not able to raise), or simply when founders choose not to go that route. Even Bryce Roberts is giving it a shot, again.

founder's guide

- Venture: new compensation survey, 775 respondents across VCs in US+Europe.

- Having visitors? A local’s guide to Vilnius

roleplay

RSI Europe - Sales Director

Aerones - Sales Director

Signicat - Strategy and M&A Analyst

Evergrowth - Senior Manager Sales Operations (Latvia)

Ovoko - BDM

Nucleate Baltics - Director of Communications (part time)

Planner 5D - HR Manager

Whatagraph - Head of Revenue Ops

Mindletic - Sales Team Lead

PVcase - Head of Accounting

further insights

- Interview with Jason Matheny, now CEO of RAND, on how to predict the future:

Over a 20-year period, Tetlock evaluated the accuracy of forecasts from a bunch of different participants about world events and found that the accuracy wasn't substantially better than random chance, in many cases. The decisions that humans make can be extraordinarily costly. The wars in Iraq and Afghanistan were multi-trillion dollar decisions. If you can improve the accuracy of forecasting individual strategies by just a percentage point, that would be worth tens of billions of dollars.

Yet society does not invest tens of billions of dollars in figuring out how to improve the accuracy of human judgment. That seems really odd. You really can substantially improve human judgment through a few interventions that are pretty robust, over different cohorts of people, over different periods of time, over different kinds of analytic questions.

- Social media trap - "On average, users would need to be paid $59 to deactivate TikTok and $47 to deactivate Instagram"

- You got to be very bullish on technology - in a broad sense. Fun write-up by Packy, where he argues that Every Market Will Look More Like Software - and will grow MUCH bigger.

As the costs of energy, intelligence, and dexterity approach zero, the cost and speed of manipulating and distributing atoms will approach the cost and speed of manipulating and distributing bits.

I said approach, not match, because the laws of physics stand in the way. Bits can move at the speed of light; atoms cannot. Bits can cost practically zero; atoms cannot. The cost and speed of physical things will asymptote somewhere above zero, but they’ll get much cheaper and faster than they are today.

productivity

Business productivity software is turning more process-based, argues Cal Newport, who wrote probably the most popular books on this school of thought.

I have started using Sunsama - a digital daily planner - just recently and really like how it is structured around deep work - to an extent I've got the first-ever affiliate link here.

other messengers

Swedish Tech Weekly, On Norwegian Tech, Northstack (Iceland), Nordic EdTech, mondayfriday (Nordics)

Podcasts

The Pursuit of Scrappiness, Superproduktas

three questions, previously

- Sten Tamkivi, Partner, Plural and Partner, Taavet+Sten

- Rytis Lauris, Co-founder and CEO, Omnisend

- Andreas Helbig, Partner, Atomico

- Domas Janickas, Co-founder at edON

- Milda Jasaite, Senior Director of Corporate Development, Vinted

- Darius Zakaitis, Founder & CEO, Tech Zity

- Roman Novacek, Partner, Presto Ventures

- Lina Zakarauskaite, Principal, Stride.VC

- Justinas Pasys, Managing Director, LitBAN

- Magnus Hambleton, Investor, byFounders

Member discussion