Stay calm

Follow on X and LinkedIn

Job board - early-stage Baltic startups - here

Newsletter is invitation-only (1 invite for 2024)

Many invites for subscribers and sponsors

philomaths.tech

work in progress

- Comply. If Americans build 1000 variations of lead gen/sales tools, Europeans are as busy with compliance solutions. I'm not here to judge - as long as they automate away some pain points, there is certainly a market to pay for it. Worth following closer – Loctax, Esgrid, CyberUpgrade, Complok, FoodDocs, and just emerging Axcenna (privacy/marketing), kloosive (accessibility).

- Cybersecurity grows in importance - a recent pharmacy hack in Estonia took 400,000 emails, 60,000 home addresses and around 30,000 phone numbers.

- Plug&Play accelerator launched in Vilnius. If you are a Latvian or Estonian startup just getting started, book tickets to LT (note that the train only reaches Riga..). Talk to FIRSTPICK, Baltic Sandbox, Plug & Play, CoInvest Capital, LitBAN and NGL, Scalewolf (defence tech), and Tim from Change Ventures is often around. You can also go Kilo Health or Tesonet route if related domains. No excuse for the lack of progress – early-stage capital is very much available.

- People moves. Karolina Urbonaite is the new Head of Startup Lithuania – welcome! After impressive growth with Knygos.lt and other projects, Dovydas is up for adventures. Pija Ona left Vilnius GO and joined Omnisend as Brand Manager – guess we can't blame her for the lousy Vilnius promo video now. Zane is now an investment associate at Change Ventures. After B2B SaaS, Juste joins Persy Booths - with LT roots. Mangirdas joins Go Vilnius. Martynas joins Axiology. Roberta joins OBDeleven as Head of HR. Arune left GovTech Lab, after building it from scratch five years ago (thank you!). Aurimas moved to Bangkok for 3 months – building mode (btw Aurimai, there are few people in Vilnius with big exits, too...).

- AI-quakes:

We're not too worried - given NordVPN was idea number 30-34, guys just please get back to that drawing board and have some fun.

Only couple of days left – meet and hear the Founder and former CEO of Trustpilot, Partner from Impellent Ventures and give your sales AI boost

- Retail. Traxlo is ready to scale with Tasku app, from MVP into a scalable and multilingual platform. Workofo brings AI to optimize staffing in retail. Pixevia has proved itself with REWE, and can do much better than Amazon:

Just Walk Out - after nearly a decade - still relied on 1,000 humans, actually Indians (aka AI), to review videos, check shopping carts and make sure receipts were correct.

- Scaling hardware. How things got started at Vargas, which is now likely #1 climate-focused industrial financier in Europe? Northvolt, H2 Steel, AIRA, Syre, this is an accelerator producing unicorn cleantech factories (every prime minister would love to have one). Europe and US, however, have had manufacturing potential declining for some time – we even fail to understand more nuanced developments in robotics and automation.

In the Baltics, which hardware plays have explosive potential? LABA7 is making fun solutions, don't see a scale yet but it might come around. 8devices have been growing really well. Elinta Motors and Elinta Charge are both on the right track. We might need to also look at lasers and defence, such as RSI Europe, Aktyvus Photics, Brolis Semiconductors, Litilit..

Need a playbook how to fail a consumer hardware brand, after raising $75m? Easier than it seems, here is CAKE analysis.

rounds and capital

- Blackswan Space secures EUR 760k round from ScaleWolf, Lemonade Stand, Baltic Sandbox Ventures, Linas Sargautis, Vladas Lašas. They have previously secured ESA contracts, too and hold a promise. Pleased to see Linas (co-founder of Nanoavionics) joining angels – we need some "space mafia" to emerge in the region.

- Akola Group makes a second investment into a drink startup – Brite. Functional drink startup has secured EUR 450k for further growth. Akola seems to be exploring paths towards vertical integration.

- (also, Akola has nothing to do with cola, it's Linas Agro... we read that new "name encapsulates the message "Authentic Knowledge Of the Land's Alphabet", who could have guessed that)

- SEB is putting aside EUR 20m for venture debt in the Baltics, high-growth startups with 500k ARR can go explore (above 10% interest, 4-year term)

- Agencies in Europe that help startups with grants and public funding. Suspiciously many in Germany... In adventurous Poland, some startups are requested to return these grants (after spending), bless them.

- Supersimple, an AI-native data analytics platform from Estonia raised €2 million in pre-seed funding - led by Tera Ventures, with Specialist VC, Tiny Ventures and a variety of angel investors.

sponsors

Privileged to receive support from a group of core sponsors, who decided to get onboard. All spots taken. They have some newsletter invites, too!

Cloudvisor [AWS partner dedicated to startups], Vinted [largest C2C European marketplace, always hiring], Tech Zity [tech hubs and campuses], Presto Ventures [investing in early-stage B2B startups and marketplaces], 15MIN Group [all the news you need to know], Wargaming [award-winning game developer, careers].

resources for supporters

- Startup lists for the Baltics - Drone startups, Marketplaces, Sportstech

- Repeat Lithuanian founders

three questions

Check our recent interviews with some of the smartest minds around. Might be able to help with an intro if you need, please reach out.

- Gabrielė Poteliūnaitė, Principal, HEARTFELT_

- Siim Teller, Managing Partner, Lemonade Stand

- Tomas Ramanauskas, co-founder, a Phone, a Friend

- Marius Jurgilas, Co-Founder and CEO, Axiology

- Tim Vaino and Akim Arhipov, founders, Fund Fellow Founders

- Viktorija Trimbel, Managing Director, Coinvest Capital

- Emmet King, Founding Partner, J12 Ventures

- Sten Tamkivi, Partner, Plural and Partner, Taavet+Sten

founder's guide

- How to optimize and for long-term, and endless learning: some great takes from Pijus Makarevicius, Furniture1 (neRutina podcast in LT)

- As a VP-to-be, put together a real, detailed First 60 Day Plans. As a founder – ask for one.

- Simple, powerful way to build a community/interest before product

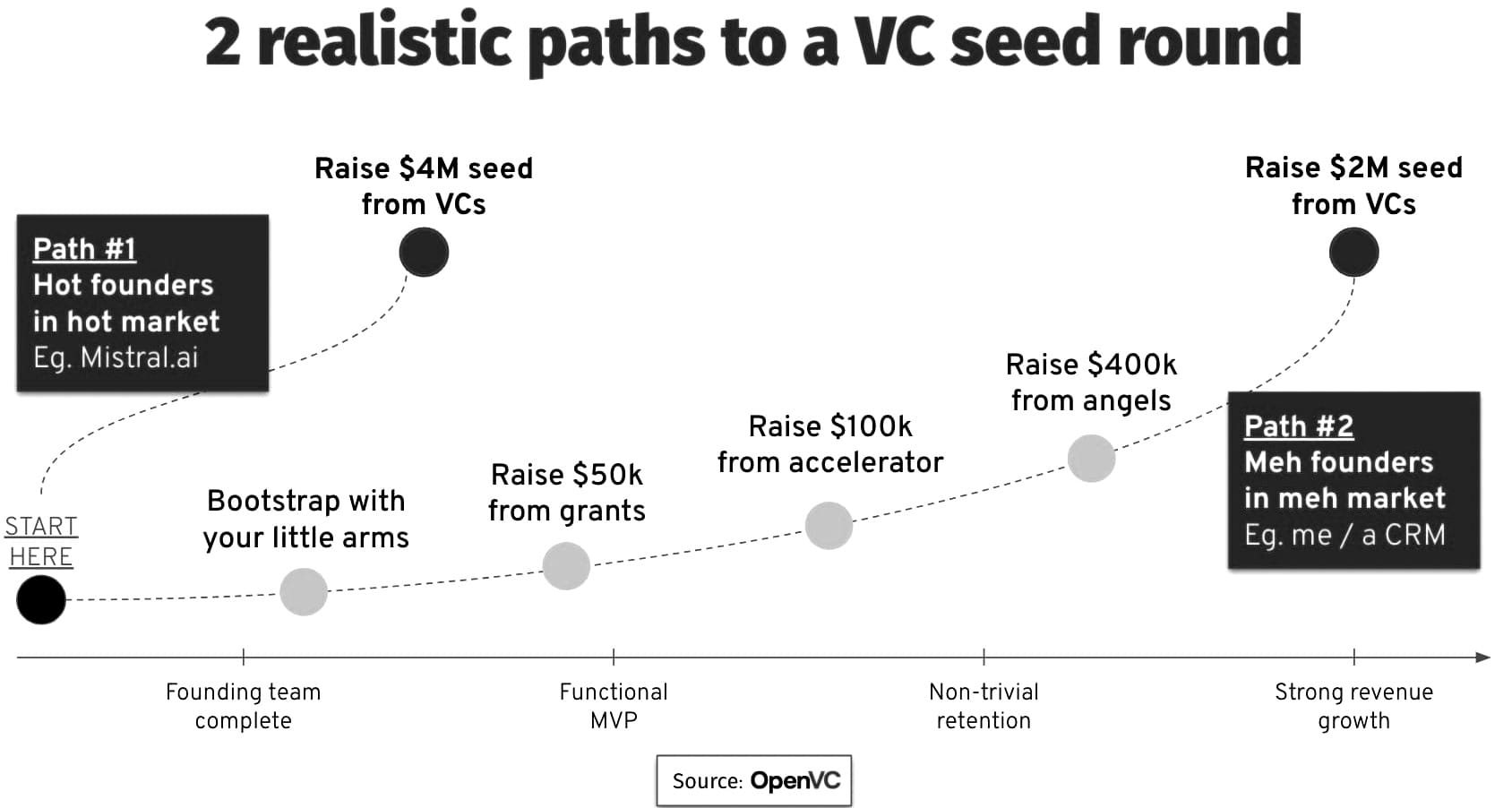

- Why fundraising can drive crazy (need to be hot)

further insights

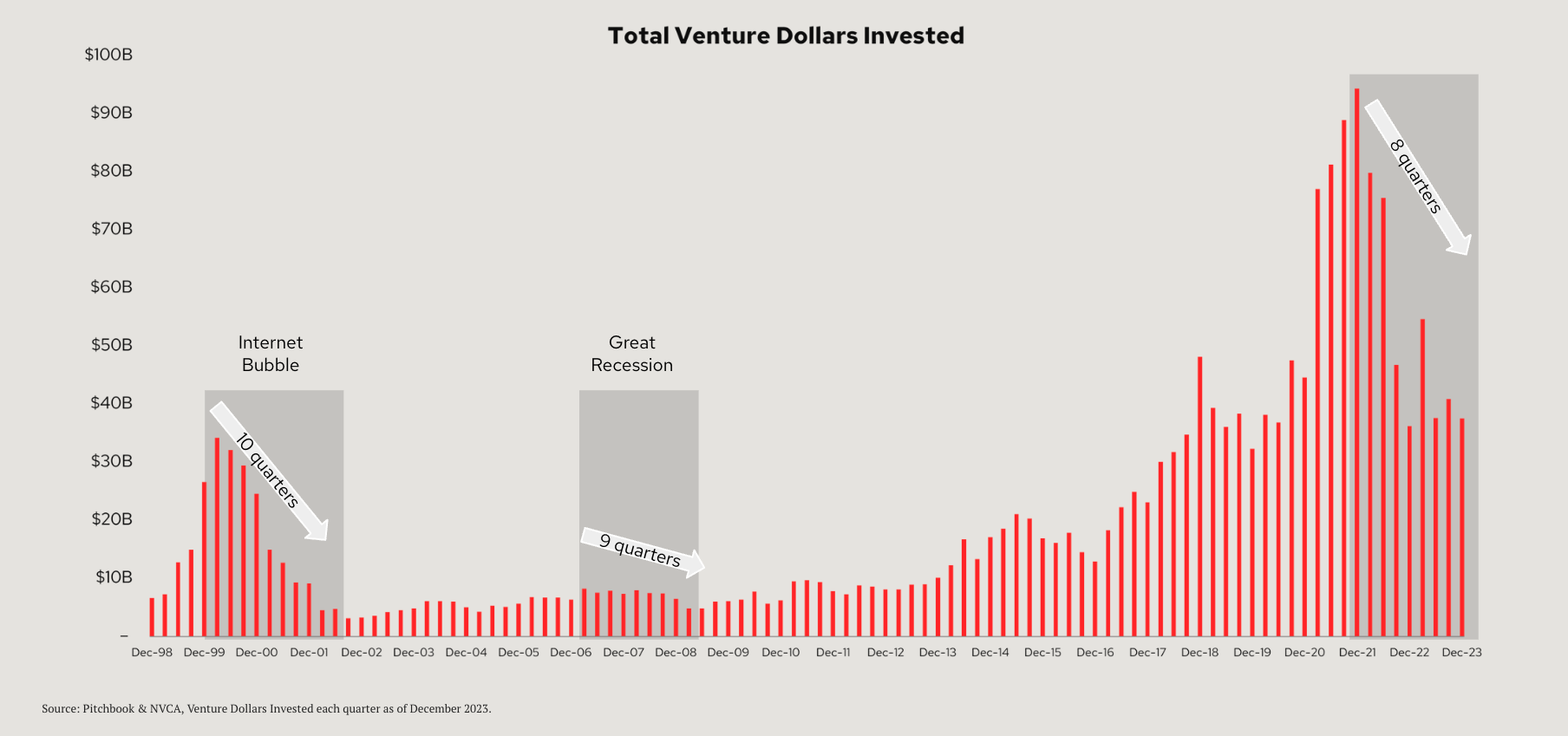

- Annual Venture Overview from Redpoint

- Best performing VC strategies (did you make the right choice?)

- Small VCs win

- Emerging Managers win

- Specialist VCs win

- Larger, more diversified portfolios reduce risk dramatically → higher risk adjusted returns

- Are you, actually, a technology company? Will writes about ways to define it.

If a company is a technology company in a “good” vertical, then the valuation might be 7-10x revenue. If it’s not a technology company, the valuation might be 2-5x revenue. The rationale behind this difference is that a technology company should be able to push its gross margin to 70+% as it matures, which will drive significantly higher cash flow, and most valuations are anchored in discounted future cash flow.

In simplistic terms, Ben Thomson has defined software businesses as having zero marginal costs – effectively new customer is generating almost negligible costs. But looking broader, one can define this via R&D impact:

If you’re trying to determine whether you’re in this ex-technology striation, the question I’d encourage you to ask yourself is whether R&D at your company can significantly change your company’s financial profile over the next three years. If the answer is yes, then I don’t think you’re a member.

ecosystem

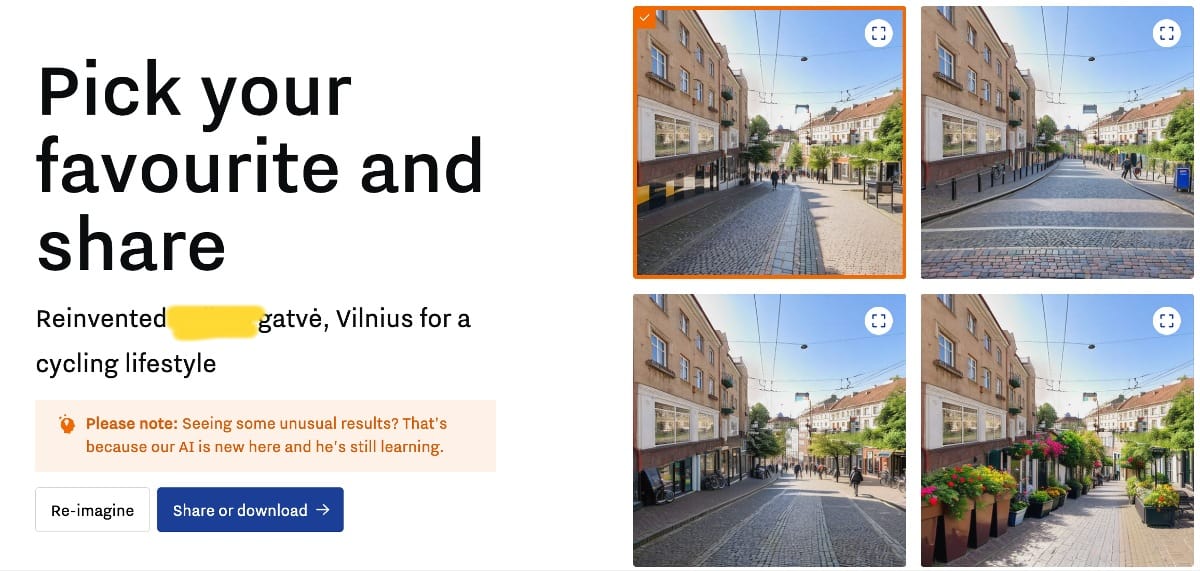

Dutch are getting good promoting cycling lifestyle, you can play around with any street - which one is here?

Following sound PISA scores, Guardian explores Estonian schools and education policy... being famous for public schools is a serious flex in Europe these days.

4%. Just sign up for this. It's an investment, also insurance, absolutely fundamental for a nation in our region. But also the second point. Investing in defence for Baltic countries means lower costs elsewhere: lower cost of capital, easier to borrow (both for economy and business), easier to build partnerships, secure investments, more tourism flows, and more. We have to be confident when risks are around, otherwise, we are paying "Putin's tax" as Arnas (Hostinger) explains.

Tech entrepreneurs and other business leaders expected that politicians will pick this up with pleasure (did not happen). But we all know it's the right thing to do. It's not an easy one, but we can find a way. Is this the kind of speech we are still waiting to hear?

Now if we find some courage to invest much more into defence (only EUR 2B more is required), some smart minds have to work on "productive capacity" thinking. It is military "spending" that gave United States DARPA, which resulted in... internet! Not to mention all other advancements in GPS, UAV tech, robotics... It's also defence budgets that contribute to a record number of unicorns in Israel, a true powerhouse in cybersecurity and other deep technologies. Investing into military-related R&D crowds in private investment, research has shown:

A related point is that these large budgets are pointless if political leaders don't have goals to achieve. Percentage is not a goal, it is a tool. Without ambitious goals, we won't be able to bring top talent to the defence. What if instead, we would aim to build a "world-class military institute for cybersecurity" or perhaps finance "drone-powered air-superiority" research program. These mission-driven budgets could turn military "spending" into productive investing, attract talented leaders to take charge, and teach young people skills they can benefit from later.

roleplay

75% of a successful career in tech is... choosing the right team. So here are some great startups to consider, depending on your taste of risk and ambiguity.

Join the leadership team before Series A

(Submit your opening for free)

Hostinger - Head of Product Innovation

Bikeep - B2B Enterprise Sales Executive

Planner 5D - Product Manager

kevin. - Head of AML Operations

NFQ - Head of Business Unit

ZENOO is looking for growth marketing/hacking advice/mentoring

Member discussion