Security comes first

work in progress

- AI. Palantir CEO Alex Karp trashes European AI potential - unfortunately, this does not sound very unfair. Despite opinions, teams keep building. Starting of with InfiniteReps, Tadas, Mantas and Algimantas joined Evergrowth (JB, Aivaras) as co-founders - to build AI sales platform for B2B. CAST AI brings CMO, CRO and CP(people)O leaders on board. David Mataciunas is building AI-powered virtual pharmacist for online pharmacies - AQ22. Alphanome AI CTO Elijas is Nr1 GitHub user in Lithuania (ex UBER) and they outline what type of investors they want to work with. Without a big buzz, Br1ck is now a team of five.

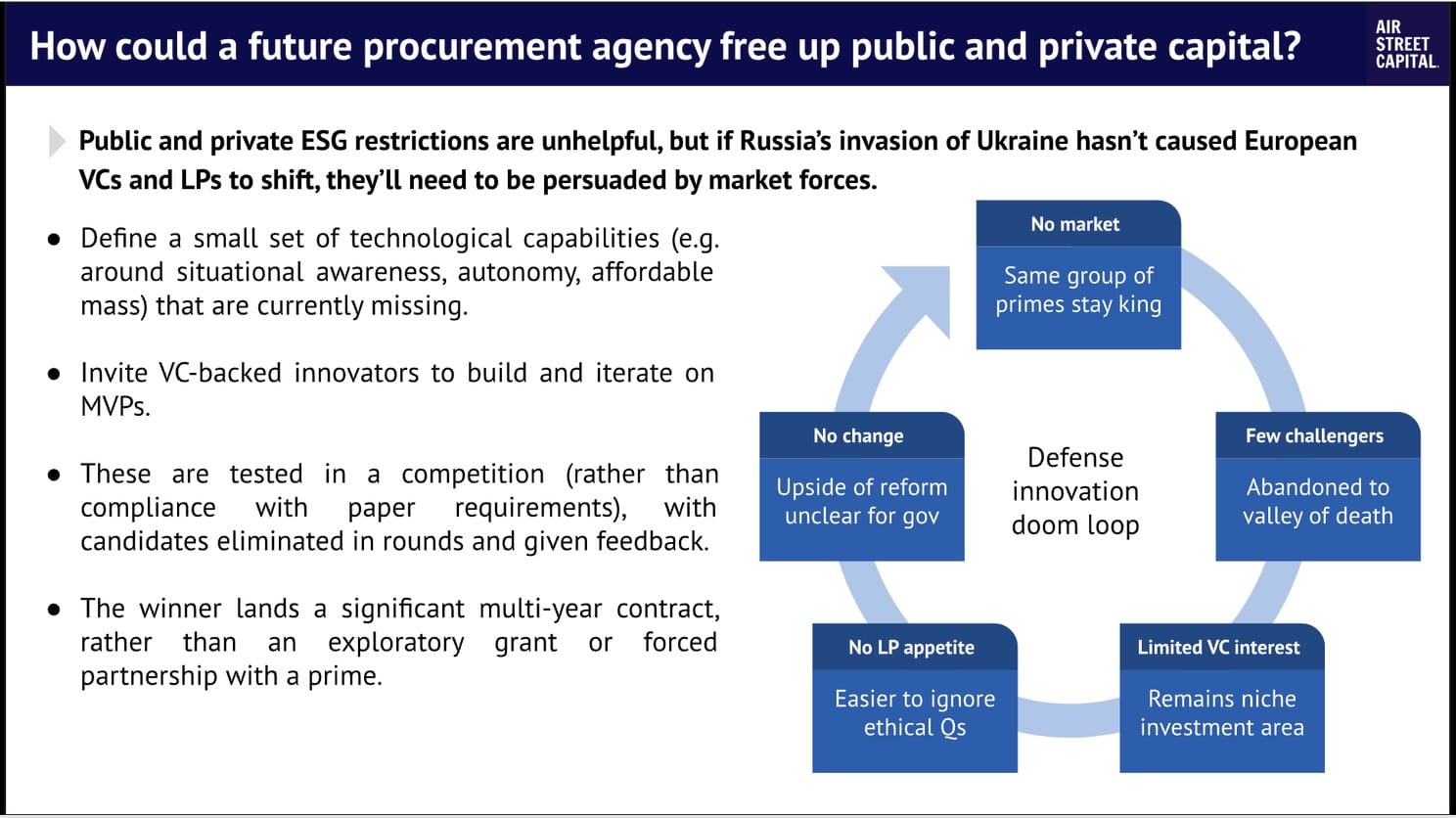

- Defence Tech is hot, both in talks and early-stage funding. For this reason, we are pleased to have Viktorija Trimbel helping us understand more - read short interview below. We also noticed Europe getting more ambitious (or more scared?), as Breton pithed EUR 100B EU fund to bolster defence capabilities. However - Nathan from Air Street claims more funding is just a band-aid - procurement is the big issue limiting returns from innovation in this space.

- Proptech. Good time to invest into Speiz, the commercial space marketplace, accelerating. ViaCorex has built procurement and asset management software for construction and manufacturing. Observue simplifies facility management.

- Profits. Latvian scale-up Printify reached profitability in 2023, two years after series A. Across the pond, profit-sharing excites the industry as a plan B of sorts.

- Accelerate. Health Tech Accelerator is now open. Cassini accelerator for space startups.

- Peoples. Aegir is among startups-to-watch in Denmark (wind energy intelligent), and is now led by Darius Snieckus. Gabriele is now Head of Ventures at XTX Markets. Laura is now a partner at Illuminati Capital, web3 investment firm, and going to Davos, too. Laimonas (ex iDenfy, Biomapas, Nexentria) is available as CTO-as-a-service. Similarly after a gig with Speiz, former CGTrader CTO Vilius is now fractional CTO and tech advisor.

rounds and capital

- Three Cubes launched on online voxel-based sandbox platform (a game in short) on Kickstarter - and already reached their initial goal. You should back them here

- Contrarian Ventures and Headline led EUR 6.3m seed round for Barcelona-based Delfos. They have developed a virtual engineer for the renewable energy industry, which uses AI and big data to automate performance, workflow and ensure reliability.

- Avallone.io – 70V portfolio company – closed seed at EUR 3.7m to further expand their KYC software business.

- Milda Mitkute talks about her story, managing finances, and mentions new investment into edtech team - which one? Already backed Teachers Lead Tech.

- EU LPs have liquidity problem we are all aware of.

three questions

Viktorija Trimbel, Managing Director, Coinvest Capital.

What brings CoInvest Capital into Defence and what is there available for startups in the field?

Coinvest Capital was the first VC in Lithuania, fully authorized to invest in defense since March 21, 2023. Being a sovereign VC arm of the national development agency INVEGA, we contribute to enabling and delivering innovation priorities of Lithuania, including by investing in deterance & defense startups. Our mandate definition is rather broad for this sector – all activities, except retail trade in arms, but we look for startups that are able to scale and grow fast. I.e. some of the projects, brought to our attention, are better suited for defense loans or other traditional instruments. We invest under two models and we always co-invest with partners:

- Pari-pasu (equal terms with co-investors) – under this model our share in the investment round should be within 30-50% range of the round

- Investment profit sharing model – we have the best offer in the world for coinvesting accredited private investors, primarily business angels, but also other corporate VCs, VC funds and alike, subject to them not having public money in their capital and passing our accreditation process. How it works – private investors co-invest with us directly in the startup company, and in case of investment success, we only keep 6% annual return, transferring all excess profits to them. Real life example – Interactio investment and exit, whereat our participation increased returns from 9 to 34 times. Why such a lucrative scheme – because it is a strategic interest to build and strengthen business angel community. Under this model our share vs. accredited co-investors is up to 80%, in addition, there can be other co-investing partners in the round with any amounts. For local partners we offer risk diversification and extra cash to fund startup runway, for foreign partners we also offer local market know-how and better insights in the due diligence process.

These terms are universal for defense, dual-use or any other startups, as we are generalists. Another important feature of the fund is being evergreen – we do not have time pressure to deploy capital and/or to exit within certain dates, so we have patient capital and are better positioned to invest in R&D intensive startups at earlier stages. We are also actively engaged in building defense innovation and VC investment ecosystem, engaging in dialogue and promoting necessary changes in the investment climate, taxation, legislation, know-how building & sharing with all relevant stakeholders and building international partnerships & alliances.

The maximum amount of our cash contribution depends on several factors, like innovativeness of the startup, its age, registration location and alike. Currently we have almost EUR 14m dry powder, i.e. risk capital, available to be co-invested. We are proactively building our pipeline in the field and negotiating terms of additional capital injection, aiming to facilitate acceleration of dual-use and defense startup ecosystem.

With regards to DefenceTech, LT now has early-stage capital and acceleration service as key building blocs. There is also now DIANA in Estonia. What is still missing if we take a regional view?

Investing in DefenseTech carries extra risks, compared to standard VC risks and even VC investments in sectors with state agencies being the main procurement agents. Here we have military as the primary end buyer and user with inherent secrecy, traditionally very close ecosystem and even longer procurement cycles. Europe as such, has been lagging behind USA with fragmented decision making as well as national interests to support local manufacturers, at the same time focus of military purchases on well established and proven products and solutions. I am confident that current geopolitical threats will force everyone to rethink their processes and we will “invent this bicycle as we ride”. The sooner the better, so that we would invest in deterrence before defense. There are many news announced these recent weeks on European level as well as Lithuania, and we look forward to be an active players in this field.

How should early-stage founders take into account ESG and export controls?

This is very important, and if you want to sell to NATO and allied countries, one should be very careful to ensure proper chain of supply and selecting the right partners. We perform a thorough due diligence on the target startups, co-investing partners and have a three-layer mechanism in the investment contracts to ensure that we have tools to address third-party risks, if and when they materialize. The sector is heavily regulated for a reason, compliance costs are high. At the same time, I believe, there should not be a question even asked, if investing in defense is socially responsible. If anyone still has any doubts, just look at horrific slaughter in Bucha or Israel kibbutzes. If we are not able to defend ourselves, no other investments will matter. If we are not able to identify real threats and enemy, if we are fooled by hybrid attacks and discuss “green little men” with serious faces, civilization is doomed. Democracies can not afford to become extinct by inability to take important decisions swiftly. I maintain the trust in ability of societies to unite in face of a threat, like we did during covid-19 pandemic supporting medical system and now supporting Ukrainian defense, but I do wish to see such unity ahead, so that no one dears to cross red lines. It think it is more socially responsible to ensure deterrence and defense, so that there are no victims, than merely focus on solving consequences. As in every field, pick your KPIs wisely. Moreover, many innovations, currently used in the civil life, originally were created for the military needs. Let's seek synergies for the benefit of all and the greater good.

Thank you! Viktorija also writes a newsletter on Substack, here

founder's guide

- Ultimate guide to delegation - as well as overall time management, granular

- Many people were checking the productivity tools listed recently. We all get obsessed with personal productivity, but in building businesses it's all about teams:

Teams don’t follow a normal distribution with most teams a little worse or better. In 70% of cases it is a power law: the top 20% or so of teams are much better

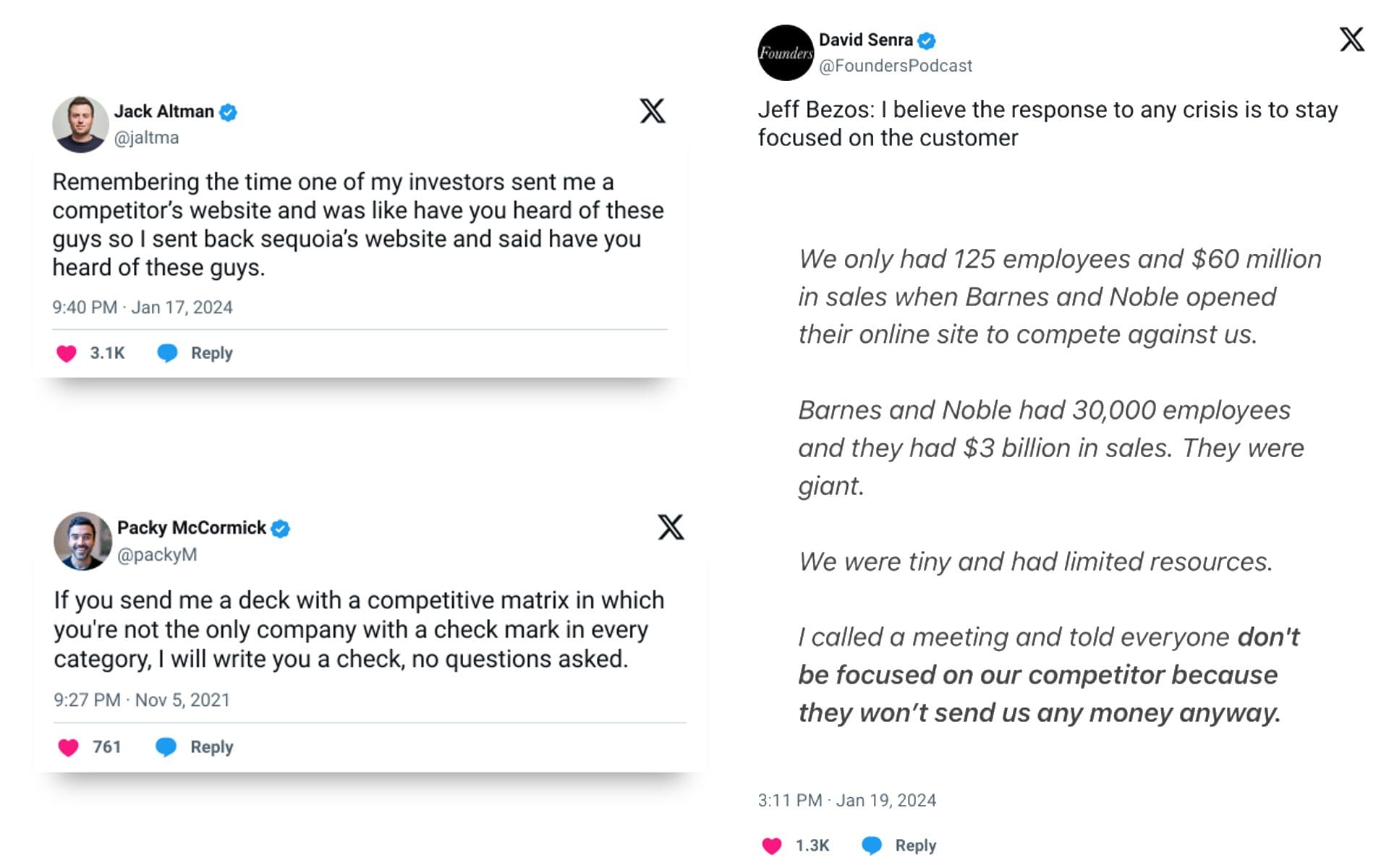

- How to think about competition, few takes (simply don't)

- Sequoia scouts in Europe - easy to find, list themselves on LinkedIn

further insights

- Something to work on in 2024 - write slower: When I have a slower publishing cadence my blog grows faster

- Creator economy predictions 2024 - includes slow down of short-form video and youtube embracing podcasts.

- Easy Money - how macro shaped investing behaviour for years

- Why dancers are better workers, according to research

- Mindaugas, CTO at Vinted, writes personal reflection on 2023.

- London vibes no more?

my biggest issue with living in London is that i need to live in a place where most people are excited about the future

— Rod (@rod_mallo) January 9, 2024

this doesn’t feel like that place anymore

ecosystem

- Chris Arnade compares US cities to other countries. It is such an important reminder that trust is the profound building bloc for successful societies - once it erodes, no policy or regulation can compensate.

Regulations themselves aren’t the problem, though. Germany, like much of northern Europe, is a high-regulation society, but it’s also high-trust, compared to the US. Here, nice and fully functional things are built without fear of misuse. For Americans, who have both a high-regulation and low-trust society, this is all rather depressing; it’s the combination that means we can’t have nice things.

- Mike Sapiton started a new newsletter on New Nordics from Estonia. This geography resonates well.

roleplay

Finbee - CFO

Nortal - Head of Sales Ops

Whatagraph - Senior Content Marketing Manager

Breezit - Video Content Creator (Instagram, Tiktok, Youtube)

Omnisend - Product Manager, Integrations

Woola - Marketing Manager (French speaking)

Evergrowth - UI/UX Designer

Talent

Vytautas Butkus - Product Director (Argyle, Toptal, CGTrader)

Vytis Sibonis - iOS, Developer Productivity (Shopify, Zalando)

Member discussion