Ethos

work in progress

- Fintechs for the better. Lightning, with Ignas as CTO, helps vulnerable in the UK access public funding. Similarly, Bronius started Inbestai to help calculate benefits (also UK). HeavyFinance already financed €50M in loans from 10k investors and will launch nature-based carbon credits in 2024 (also - partnering with softloans). kevin. is heading towards A2A payments with iOS update. Hive5 has achieved a major milestone of €10M in total invested amount. And Argyle offsite/onsite gathered distributed team into one picture.

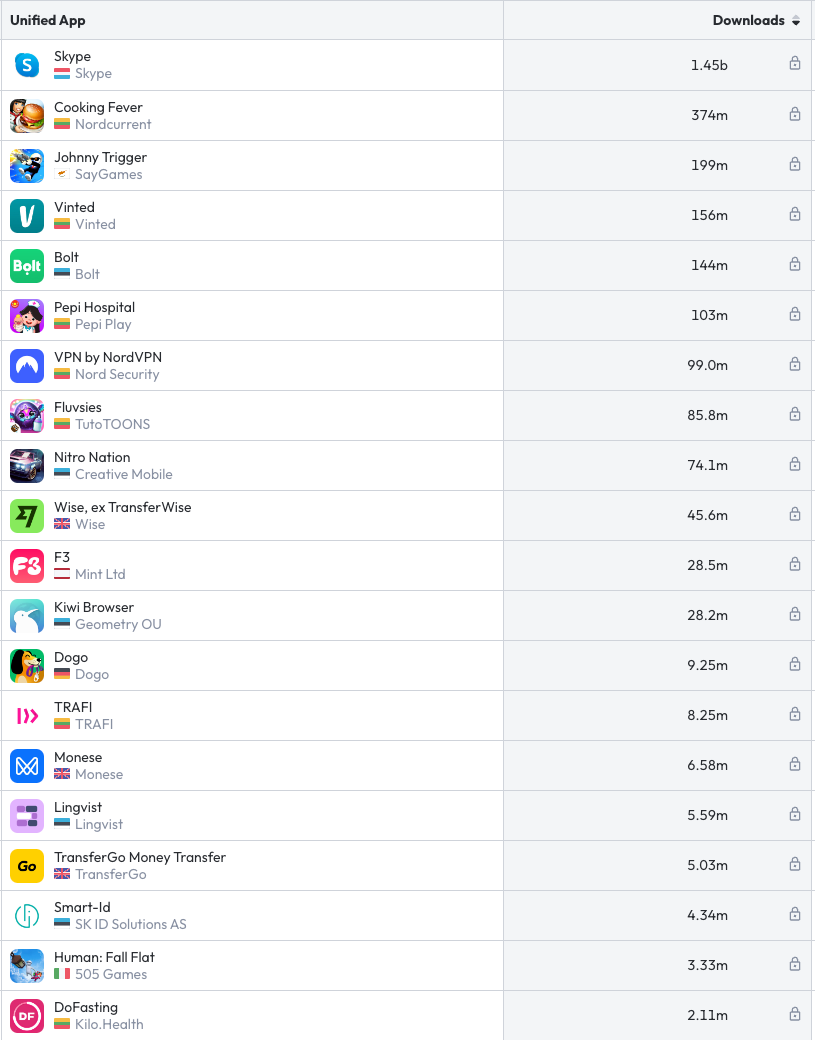

- Apps. "Prepared mind" is a common term among VCs now, it has long history - was the founding principle of Accel firm. Connecting this idea of theme investing, one famous story is from Sequoia, which was prepared to invest in the messaging space. Jim Goetz built a tracking system to see downloads globally (data was sparse then), and outperformed others to secure Whatsapp deal. That became an incredible $3 billion return for $60M invested.

Audrius has a prepared mind, too - he researched the most downloaded Apps from the Baltics. To avoid repetition, this is what we get when limiting the developer (company) to one app only. Lots to be proud of!

- Retail. It seems shoppers prefer outdoors much more than malls, at least in the US. Also, remote work effect - retail purchases grow as consumers spend less on transport and office adjacent services. Traxlo grew 10x last year with a flexible workforce concept. Workofo brings AI to help retailers build smart schedules. MELP won IKI as a customer, bringing 5000 consumers onto their benefits platform.

- Female leadership. Lina Zakarauskaite is building She Wolf community. Contrarian Ventures organized the second Female Climate Tech Investor Dinner in Berlin.

- Giving. Philanthropy is becoming a recurring team here. Bored Panda donated €100k to buy a new neonatal ambulance designed to help preterm babies. Pijus Makarevicius received St. Christopher Award for impactful leadership - they have recently supported a housing project for the seniors. And then Tadas Burgaila – in his style – reminds the top500 wealthiest that they have more options how to spend it.

- BY. Katalista Ventures is starting BYpassing Borders acceleration program to support 8 relocated Belarusian teams to integrate into the European startup ecosystem.

- Trajectory. Unicorns Lithuania highlights 12 startups set to grow - and there will be positive surprises, too. Subscribe to Unicorns' monthly newsletter here.

rounds and capital

- Plural raised €400M to keep the promise of GDP-level impact via technology. We talked with Sten about ecosystems earlier here.

- Open Circle Capital is working towards a second fund, and will focus on early-stage deep tech. Meri Helleranta has joined the team as a partner/ health expert from Courage Ventures. OCC has chosen the geography of New Nordics with partners - Will and Meri in Helsinki, Jens Damsgaard in Copenhagen, and Audrius Milukas in Vilnius (Baltics). The fund target size is €70M with a first close of €35M (in works)

- 2C Ventures launches a €50M fund to invest in early-stage cleantech companies in Estonia and the New Nordics.

- Speedinvest is backing FIRSTPICK as an emerging GP.

- Wayren, Estonian startup in the field of mission-critical communications won an investment offer from Baltic Sandbox Ventures of up to €125k - that's at sTARTUp Day.

- CHOOOSE, Contrarian portco, will partner with bp and receive strategic investment from them, too.

three questions

Tim Vaino and Akim Arhipov, founders, Fund Fellow Founders

The structure and latest dynamics - how would you compare Estonian and Lithuanian tech ecosystems?

We are the Baltics! Coming from the Estonian success, we really fell in love with the Lithuanian ecosystem, believing it has been rather overlooked in the past. It is clearly growing and pushing forward!

As for the recent dynamics, even though the local market has slowed down, we still believe that Lithuania has a lot of success stories. Those stories (Tesonet / Nord, Kilo Health, etc) are actively deploying capital, leading to the new, second-wave founders, investors and organizations - driving the whole industry forward.

Surprising to see you moving to Vilnius - what is your plan here?

Even though the post-Covid era is all about online, we felt like we would actually like to get to know the community, scene, and people here.

In Estonia, we have built a community of unique, top people from tech. The collectiveness that we have allows us to get access to deals that are normally out of reach for smaller investors (Bolt, Inbank, Salv). Nowadays, it's not only about tech deals; we are sourcing deals of various asset classes like Private Equity, Funds, Private Credit, Bonds, etc.

During our time in Lithuania, we would like to offer the benefits of fff.vc to the local top tech people and add even more collective power to this cross-border, Baltic community.

You rapidly built up Fund Fellow Founders and closed multiple investment deals. What's the latest at FFF and where are you taking it next?

Starting off as an angel community, we have matured a lot. I believe the key is to adapt to market conditions and listen to the members of the community. Once the market went down in 2022, we switched our focus to secondary deals - de-risking the approach. Secondaries are tricky as the tickets grow bigger and access becomes harder.

Through the quality of our members, we can get access and win allocations in high-end deals that are impossible to get.

Now, as the market and our members are looking more into optimization, rebalancing, and alternatives when it comes to investments, we are delivering deals from different asset classes, markets, and models. Today, we are transitioning to somewhat of a next-gen Family Office for tech professionals.

founder's guide

- The job of the CEO comes with clear responsibilities, let’s call them ‘the Big 8’, Yannick Oswald writes.

- Always make sure there is enough cash in the bank

- Set and communicate the vision and strategy of the company

- Hire and retain the best possible talent

- Go out and be connected in the domain your startup is active in

- Run great board meetings

- Design and adapt the organisation

- Tackle urgent matters in due time

- Be a leader...

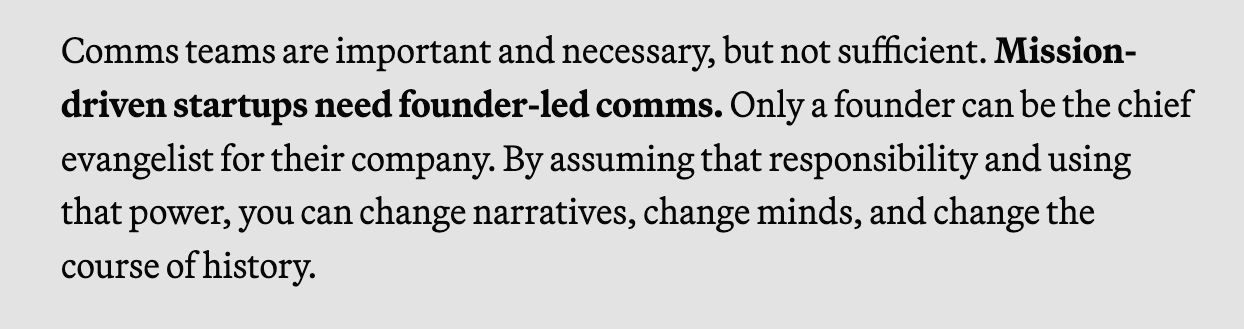

- Inside Anduril's Comms Strategy - 10 Rules for Mission-Driven Founders (good stuff only)

- Most likely, VC isn't for you. We need to talk more about alternatives.

- Fundraising 101 - outreach template

- RatePunk's Justinas wrote 100 lessons learned building stuff all the time

roleplay

Poklet - Co-founder

Dogo - Performance Marketing Manager

NordVPN - Pricing Manager

Sixteen Media - Senior Paid Media Manager

Contrarian Ventures - Head of Community Platform

Toggl - Head of Brand & Content Marketing (remote)

Robolabs - Accountant and SDR

further insights

- The Knowledge Economy Is Over. Welcome to the Allocation Economy

- UK recruiting astronauts:

- Speak Russian

- Masters in a competitive field

- 1,000 hrs experience flying a fighter jet

- US dual citizenship

- ...£40k a year starting salary

- I like LocalGlobe, they have interesting takes and deliberate strategy - not shallow. Here is a recent podcast with George Henry about intersections

If you think about the three areas that govern our life/society, I would say today it’s tech, culture and politics. Culture is upstream of politics and tech is upstream of culture. I spend most of my time thinking about the intersection between technology and culture. Culture shapes the present and so it helps to understand which technology/product could be/get adopted. Politics is then there to regulate.

It's encouraging - and we can already see the influence tech has in the Baltics, and across the societies. Hope they will drive transformation further, we still need to make the leap forward to post-material values, when people assign themselves to higher ideals and major challenges. That is exactly what was absent in much shared Ieva's text using New Nordic reference - it's so limited to material wealth, to an extent that it refutes the title.

ecosystem

Hot takes: food for the innovation frontier.

People discover the secret sauce behind ETH Zurich 43 spinoffs per year - it's the canteen (affordable, open for dinner, and table placements). Similarly, Nathan is promising Air Street Cafe to boost innovation output in the UK.

Member discussion