The best market

Follow on X and LinkedIn

Job board - early-stage Baltic startups - here (updated with Spike Technologies, Evergrowth, CyberUpgrade, Kernolab hiring)

Newsletter is invitation-only (1 invite for 2024)

Many invites for subscribers and sponsors

philomaths.tech

work in progress

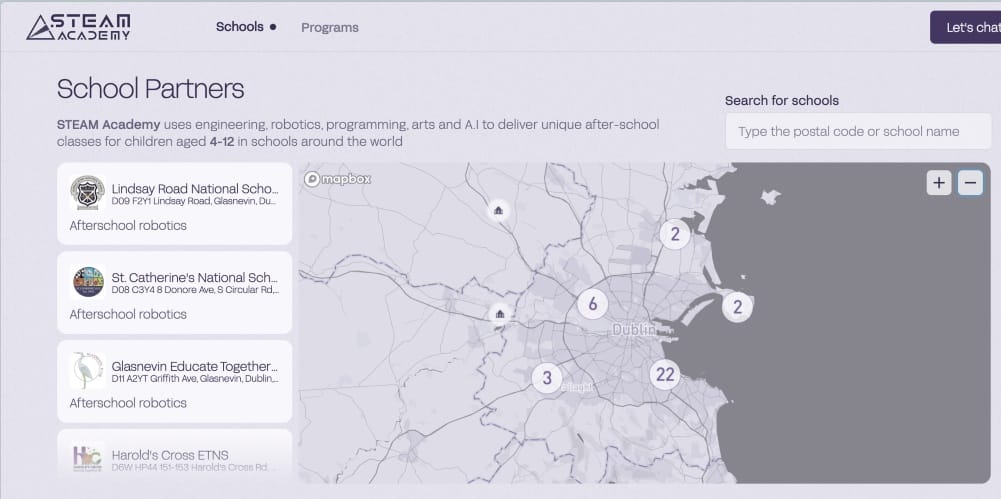

- Expansions are high-impact decisions for startups. It has to prove a scalable growth model, involves spending on operations, sales and marketing – and poses a significant risk of failure. Entering Poland: Mark ID, which follows where their customers export, and beesure_, perhaps due to partnership with AXA Partners. STEAM Academy started humbly with Robotikos Akademija, proven a repeatable model in Ireland (38 locations) and now growing in the US (11 schools in Chicago).

The famous Uber step-by-step global expansion guide. Increasingly, VCs position themselves to help bring Europeans across the Atlantic – like Frontline or Hoxton Ventures (good pod). Index has a whole book to offer – "Destination USA". Back to the market selection in the early days, David links it well to the original insight:

<>It has made me consider if Danish startups should ditch Denmark and just launch in the US. For Goods it has been the right choice. But that is because they got their Original Insight with US fashion brands. So to me, there is no "best" market. The best market is the one you understand better than your competition.

- New thesis taking shape: AI-first Service Business. It's built on the premise that while AI tools are superpowerful, it takes much longer to mature AI solutions from 80% to 100%, compared to rapid 0 to 80%. Edge cases are difficult to sort, just like autonomous cars were available many years ago, but taking a decade to bring them to the market. AI-first business is about having service interface, but your offering is heavily productized/automated in the backend. Therefore your revenue is at the service level ("companies spend 10x-100x more on accountant than accounting software"), and it can be a lucrative business. Who might consider taking this route? Robolabs for sure. "Perhaps" list – Algori, CTO2B (watch them), Evergrowth, Ask to Sell, Avokaado, Fyma, Repsense, Inveniam, Amlyze, Royalty Range, and many more. Is Palantir a good case-in-point? Laughed early as limited "consulting biz", now $50B valuation.

- A pillow, a frying pan, a knife (1m sold), a power scrubber – see this video interview with Orbio World showing their products. Performance marketing, full-gas, EUR 156m revenue.

- While many bootstrapping champions started with PPC just like Orbio, other products can be more sticky than e-commerce – like consumer subscriptions (SaaS) or marketplaces. There, with scale, you enter a beautiful world of built-in distribution, open for complimentary products. Now Nord Security launches Saily, eSim for travellers (Revolut rolled out eSim, too). Eneba is turning its marketplace towards game distribution, as publishers struggle with GTM. Does your product have built-in distribution? If so, it's better than sliced bread.

- LitBAN awards 2024 – big congrats to:

Partner of the Year 2024 - Swedbank Private Banking

LitBAN Hero of 2024 - Apolinaras Sinkevicius

LitBAN Community Builder 2024 - Alex Gibb

Angel of the year 2024 - Man - Sarunas Rackauskas

Angel of the Year 2024 - Woman - Erin Gainer

- Lessons. Justinas shares Whatagraph learnings and tips for new founders, such as "commit to your idea for 2 years at least". Jone from FIRSTPICK has another pod episode, worth checking for other Baltic VCs on positioning, access and dealflow sharing (looks like some scarcity mindset is still around in the region?).

- Net salaries for programmers in Lithuania 2023 (in LT, and found this via Unicorns Lithuania newsletter). Wages were stagnant last year.

rounds and capital

- Inven Capital, 2150 and AENU led a $14M investment for Scottish company Ember (Contrarian Ventures portco). Ember runs electric buses.

- Rendin (Iron Wolf portco) raised nearly two million euros, led by Tera Ventures and also including clients via SWG fund.

- Good luck fundraising: Superangel built a table with all 135 VCs investing in the Baltics.

three questions

Gabrielė Poteliūnaitė, Principal, HEARTFELT_

Looking at HEARTFELT_ as a fund – what (besides a cool name) makes it special? What edge are you building?

It took us some time getting used to the name haha.

Ex-APX, re-branded and launched Heartfelt_ in May 2023. We're backed by Axel Springer, Porsche and numerous founders. Investing out of 40M+ fund as a first cheque investor across Europe, aiming to invest in one company every week. We believe venture success can come from any geo and any background; some of our best-performing companies were built by first-time founders.

We are contrarian

- We can invest when our fellow early-stage VC friends said no (every startup knows the “too early” rejection reason).

- Usually this reason deciphers in “not convincing enough execution abilities, GTM, or market size/ momentum”. We still dare to believe that, GTM can be worked on, market momentum and sizing can change, and team abilities in the very-early-stages are not just assessable through an existing product traction or Linkedin track record

- We don't wait for others to believe in the founders/care if they have been rejected by the rest, we can deploy the first cheque as soon as we ourselves build conviction on the founders on several dimensions. Hence, we focus our sessions trying to answer: why them? and why now?

- And we have proven with companies such as Colossyan (Lakestar, Launchhub, Day One), Trucksters (Kibo, Continental, tbc), Chargetrip (Blue Bear Capital, HSBC), Getquin (Portage, New Horizon, tbc), Bluedot (YC, Revo, TechNexus, tbc), CYCLE (LocalGlobe, Visionaries Club, Scania), Nuvo (La Famiglia/ General Catalyst, Atlantic Labs) etc. that our seed-/ growth stage VC colleagues can course-correct and still decide to join the journey later on.

- The market in the first-cheque/first-round stages is usually very uninformed. Assessments of teams, product visions, GTMs, and market forecasts are often wrong. We decided to build a strategy that accepts this reality and plays according to this reality: Find the most driven and resilient founders that truly want to win in their categories and spend time building conviction on the team.

We emphasize the power of network and community effects leveraging our large and diverse portfolio not just for fund diversification, but also to create meaningful connections and support networks for our founders. With approximately 200 investments made since 2018, our portfolio founders serve as invaluable resources, offering mentorship, partnerships, and introductions to top funds in Europe and the US.

Recognizing the challenges faced by early-stage founders, we prioritize speed and decisiveness in our investments - we are comfortable with the risk. We understand that uncertainty around product validation, go-to-market strategies, and funding needs can slow progress. Therefore, we encourage founders to move quickly, maintain momentum, and focus on building impactful businesses.

What are the most common, painful mistakes you observe founders making in the early stages?

- Teams are indecisive/ not moving fast enough.

As we focus on first-cheque/first-round investments, founders often still lack deep validation on dimensions such as product, GTM, or even the right first round setup (funding need and investor composition). Sometimes all these challenges and questions are paralyzing founders or at least slowing them down. - Resilience vs. ability to pivot

It’s not easy to navigate through tough times. Understanding when to hold the ground and when to switch angles or pivot more substantially can be tough at times. It helps to have an outside perspective and to get informed by design partners, clients and early investors - however, the decision-making competency is on the founders' side. - Learning to deploy capital in the most effective ways

It's definitely not easy and painful to learn. Especially as a first-time founder in the early-stages. Team needs to learn to translate money into operational resources. - Being out in your market early and fast

Product obsession is good generally. But dare to be out there to co-build the product in a real-world environment fast. We have seen lots of ventures failing to do this efficiently, having raised millions in pre-seed funding. - Trust your partners in order to reduce the risk of spotting blindspots too late

Often investors are treated as clients, which makes sense if you have substantial investments still to get from an investor. But next to the capital, you should keep in mind that your investors are your experienced business partners. You can ask for support, introductions, and (hopefully) meet them on eye-level and have a human interaction. Especially in the very-early-stages of your company, this is an important resource to have and benefit from. - CAP table issues

Some teams tend to dilute too fast too early. Dead equity is often a dealbreaker for future funding and leaves the operating team little room for solid incentives. Non-operating founder/ advisor/organisation/venture builder or even an early VC fund holding crazy amounts paralyse the founders going forward. Early Investors getting too greedy early on is something founders should be wary of, as the CAP table issue will always come up sooner or later.

What are European investors overlooking or misinterpreting about the Baltic tech scene?

Overlooking the Baltics at the earliest stages. I would say later stages are very well covered by international investors who can trust local investors have vetted the founders over the years, but early stages are still very much dominated by the local players and founders don’t have that much to choose from. And that’s where we come in;)

founder's guide

- Think about your startup as an experiment –

Instead, it’s my experience that the best founders aren’t necessarily those who grind the longest, but those who are the most “greedy” with their time. Said another way, I’m constantly inspired by founders who, with limited information, quickly make the call on whether something is working or not, and then either double-down or move on.

- Raising capital: each stage should be derisking your venture

- 8 Types of Partnerships for Go-to-market

- Bootstrapping lessons from GitHub founder, starting with

To bootstrap a business, it's important to think about TTFD (my own acronym, not his) - Time To First Dollar. You need to be focused on both value creation AND value capture.

- What is closest to Canva for video?

sponsors

Privileged to receive support from a group of core sponsors, who decided to get onboard. They have some newsletter invites, too!

Cloudvisor [AWS partner dedicated to startups], Vinted [largest C2C European marketplace, always hiring], Tech Zity [tech hubs and campuses], Presto Ventures [investing in early-stage B2B startups and marketplaces], 15MIN Group [all the news you need to know], Wargaming [award-winning game developer, careers].

resources for supporters

- Startup lists for the Baltics - Drone startups, Marketplaces, Sportstech

- Repeat Lithuanian founders

further insights

- Seven Principles of Venture Research by Brett Bivens

- European Clean Tech tracker – see how fast countries are deploying heat pumps and whatever else. Also, Baltics seem to have plenty of renewable potential.

- AI is there to help governments, too - a Romanian agency employs UiPath for tedious tasks like searching in databases for land registry and judicial records (saving years' of wasted time)

ecosystem

- Think big. Tel Aviv has produced 83 unicorns in the last five years, behind only the Bay Area and New York, and it leads London in EMEA.

- City. One major homework for Vilnius that nobody cares about – road safety has to be improved by bringing speed down.

Join the leadership team before Series A

(Submit your opening for free)

Traxlo - B2B Sales Manager

HeavyFinance - Investor Community Manager

Trafi - Product Owner

Payswix - Chief Risk Officer

Oxylabs - SEO & Growth Marketing Lead

Member discussion