Community CTA

X and LinkedIn for fractional

Send ideas and tips anonymously here

Subscriptions are invite-only, add a friend at philomaths.tech

Finally - you can become a supporter via Contribee

Hey friends! It took 3 years to build your trust, approx 180 weekly letters.

I hope we are landing on the right spot.

- Content remains open for all (but invite-only, and everyone has 1 invite)

- Privileged to receive support from a group of core sponsors, who decided to get onboard. 6 slots booked, two are available.

- There will be more content, a Slack channel and in-person dinners happening.

- I need your support, too! Jump on Contribee and select what works for you. You will get to invite more people, join a Slack channel and take part at future events.

P.S. First 30 supporters (any tier) will get something great to wear, so hurry up.

P.S.2. Many don't know who is behind Tech Philomaths and seemingly want to know. I happy to send linkedin invite and calendly link for all supporters, and even more happy to jump on a call if you'd like. You can choose not to have a call :)

work in progress

- Edtech. Cluster grows faster when other startups pivot to edtech! Leya AI just secured 1m pre-seed for personal speaking AI English Tutor. They initially founded Oxus.ai to focus on speech recognition, but sometimes you need to take smart turns to meet demand. TLT is CEE winner for Super Connect For Good 2023; here Rasa reflects her journey and how rewarding this cause is. EditAI joined Digital Education Accelerator (interview with their experienced team). Three Cubes moved beyond Minecraft with their own game and not looking back.

STEAM Academy is expanding, making big leaps LT-> Ireland ->now Chicago. To announce something soon? (...in unrelated note, researchers looked at school infrasture investments in the US and figured that test scores improve when they fix HVAC instead of building new athletic facilities)

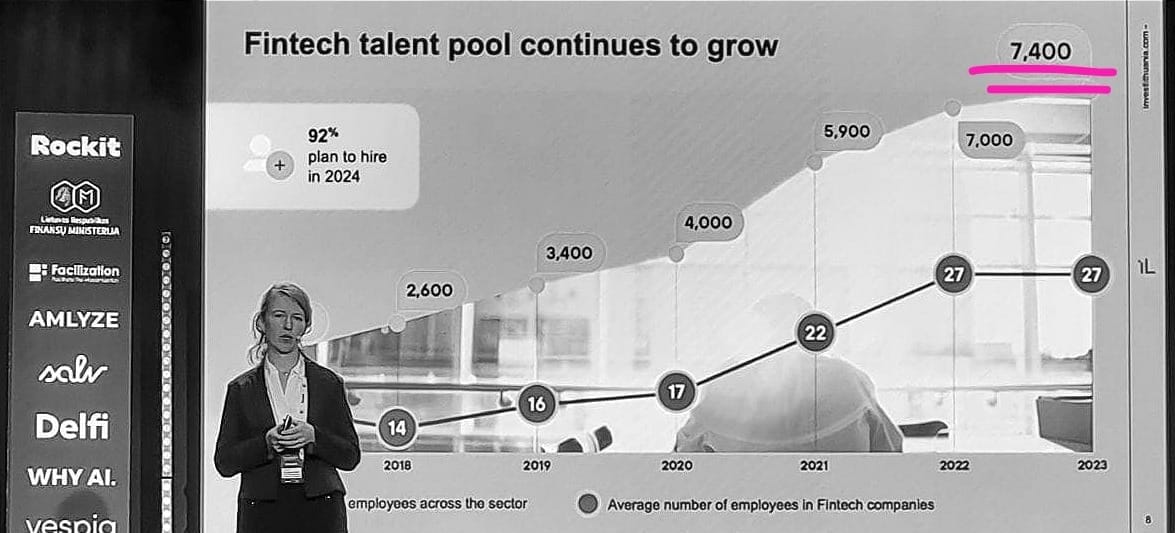

- Fintech (banktech?). There are under 600 Electronic Money Institutions (EMI) across Europe, including 250 in the UK and around 80 in Lithuania. Estonian Tuum, core banking software vendor, closed EUR 25M series B. TransferGo onboarding exprienced execs - CMO, CPO and CCO (guessing it wrong, it is marketing, people and compliance). There is plenty of talent in the industry, see graph (although flattening)

- There is more at play with finance infrastructure, and arguably even more exciting. Axiology emerges from SuperHow studio closing EUR 2m round to streamline securities trading with distributed ledger technology. Another one to watch (easy to notice, always take great pictures) is micapass, offering AML solution for DeFI protocols. Web3 security protocal Lossless has already recovered significant amounts.

rounds and capital

- Axiology, DLT infrastructure solution for securities, secured a EUR 2M investment in this round from Coinvest Capital, Baltic Sandbox Ventures, and accredited private co-investors. It is was co-founded and led by Marius Jurgilas, PhD, a former board member of the Bank of Lithuania - of course we had to ask couple questions (below).

- Leya AI closed EUR 1m pre-seed round as founders demonstrate how persistance works in life, and how "linear" is startup journey (not). Founders are on a mission to change education with personal real-time speaking AI coach. Investing: V-Sharp Venture Studio, Inventure, BADideas.fund, and LitBAN angels.

- Orion Ventures investined into Estonian Vectiopep, which develops cancer immunotherapy with unique mRNA delivery technology.

- Sygnity, part of the Total Specific Solutions group, in their first deal in the Baltics acquired Edrana Baltic, a leading developer of ERP finance, HR, and payroll systems.

- Skycop, which helps access compensation for flight delays, starting agressive acquisition strategy to become Nr2 in Europe.

- Early-stage venture funds, deploying in the Baltics. We looked at who got into new deals since July 2023. List of 46 funds is not complete as new funds get going all the time.

core sponsors

three questions

Marius Jurgilas, Co-Founder and CEO, Axiology

What's the biggest risk for Axiology going forward - market, product, team, regulation? What are you prioritizing to de-risk now?

I would say market. As we are venturing into new segment of the capital market. Using analogy its open banking moment for capital market and we expect at least some pushback. But we are excited that in this instance it is the regulation that is going ahead of the market in hope of better financial services for retail investors.

What have you learned about fundraising with a complex product in a heavily regulated space?

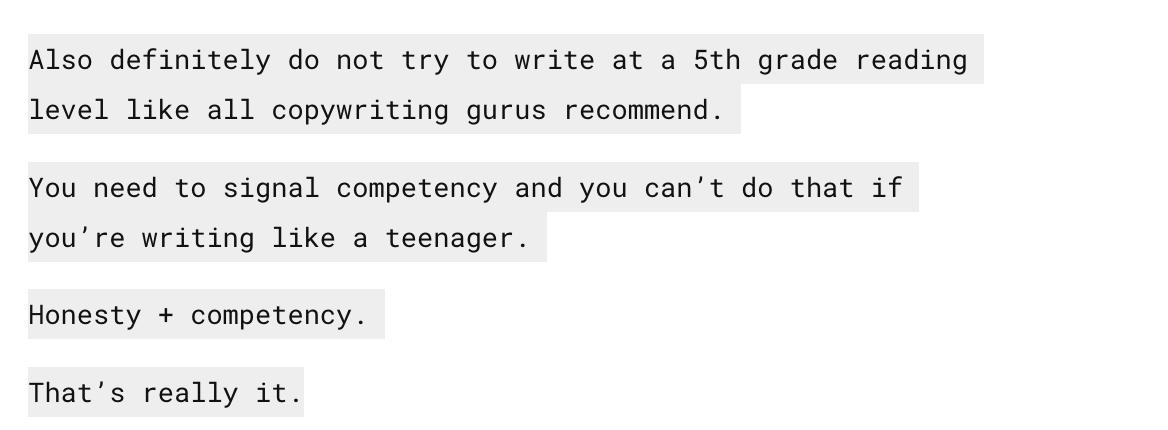

Simplify the message as not everyone is so deep into the subject. But in the other hand you want investors to take informed decision on what they are getting into. It’s a fine balance.

You spearheaded the Fintech initiative in LT, using regulatory arbitrage to grow the market and attract investment. Estonian e-residency is another example of regulation / public policy for a competitive edge. What other ideas come to mind - what Baltics should look into?

I do not agree on regulatory arbitrage statement. It has more to do with regulatory transparency and embracing innovations per se. Any new business model is unknown unknown and can be assigned a bigger “risk weight” making it less competitive compared to incumbants. But if the objective is to push for “creative distruction” then you have to lean over and provide guidance and regulatory comfort exactly in the grey zone of regulation.

Some markets are in more need of competition some have too much.

founder + operator

- When fundraising: never overstimate short-term results, you will regret it.

- How to Have Meetings That Don't Suck

- B2B Sales is Different:

- Podcast: How do you use ChatGPT? Very hands-on, talks to Tyler Cowen, David Perrell and others.

- Extreme brainstorming questions to trigger new, better ideas

- How to interact with potential customers to get true insight

- (Sorry to remind you this, happy Friday...)

Here's the thing we're all re-learning in 2024:

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) February 7, 2024

To be VC-backed, you truly have to grow at insane rates

At least, Triple Triple Double Double (3x 3x 2x 2x)

Ideally, Triple Triple Triple Double Double

If that's not you, don't raise. Or stop raising. Or at least, be realistic.

- Vojta from Presto Ventures has a goldmine for founders - articles and resources on most operational challenges building a startup.

further insights

- Trends I am seeing:

- New Nordic venture landscape will mesh up more closely by investing across boarders (Superangel first deal in Norway)

- VCs venture more into deeptech, and defencetech (SensusQ secures investment from Specialist VC)

ecosystem

- One big reason why Hubs (SF, London) continue to dominate venture-backed startups: density of investors that allow you to build competitive VC funnel

When you quickly do the math, you realize that in order to get two term sheets, you probably need to pitch at least 15 to 20 VC firms that can lead a round in order to guarantee that the Term Sheet Funnel will work.

roleplay

Leya AI - Product Manager and Backend Engineer

Evergrowth - Customer Success Manager (got to qualify as force of nature)

Jeff App - CMO

Bored Panda: Head of Business Unit (e-commerce articles)

Finbee - CFO

Novastar - CEO

Burga - Head of Video

Horizontal Media - Digital Business Development Manager

Member discussion