Efficient Frontier

X and LinkedIn for fractional updates

Send tips and tricks here, if want to stay anonymous

Subscriptions are invite-only

Everyone has 1 invite for 2024:

Add a friend here - philomaths.tech

work in progress

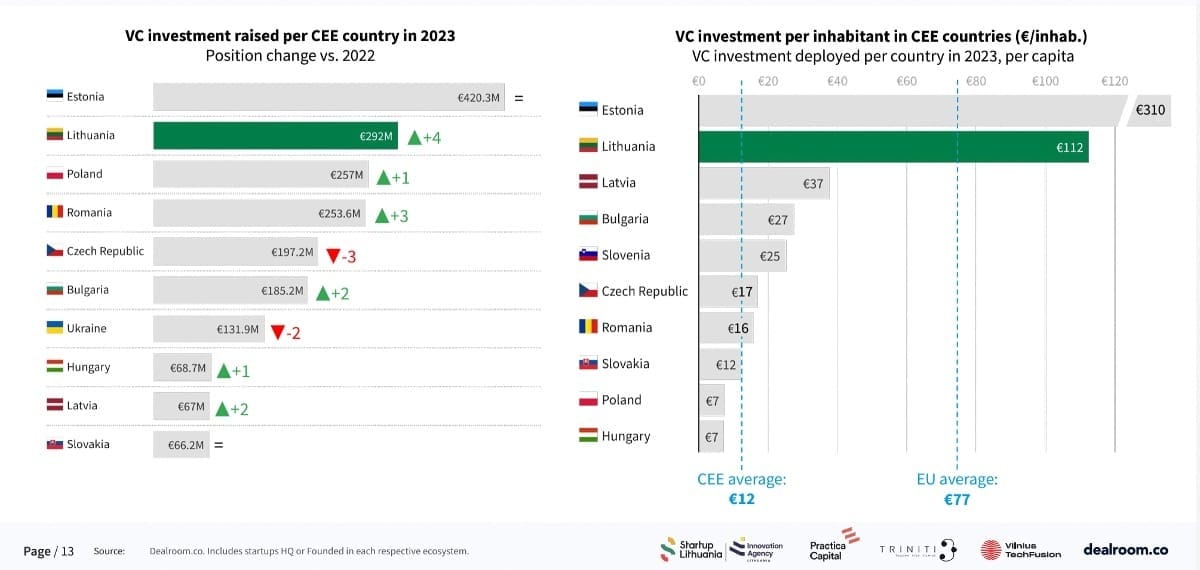

- How did the Baltics perform in raising capital in 2023? Very well, tops CEE list with Estonia, so pretty dynamic despite the slowdown. This Dealroom report relies on good data, finding EUR 293m total invested. However, we are also very reliant on growth rounds as shown here (Nord Security, PVcase and CAST AI) - would be interesting to look at the region with early-stage data isolated. How to Web released a similar CEE report but it seems to suffer from inaccurate data - some figures are off.

- Defence tech having a moment - Estonians, too, gathered tech people for an event. Importantly, the industry gets a closer look overall (AirStreet finds there is no incentive to innovate, small R&D spending and prioritizing shareholder payback). Hopefully, bottom-up tech funding will also bring needed reform in government contracting. Otherwise, limited exits and no scaleable business to grow for founders.

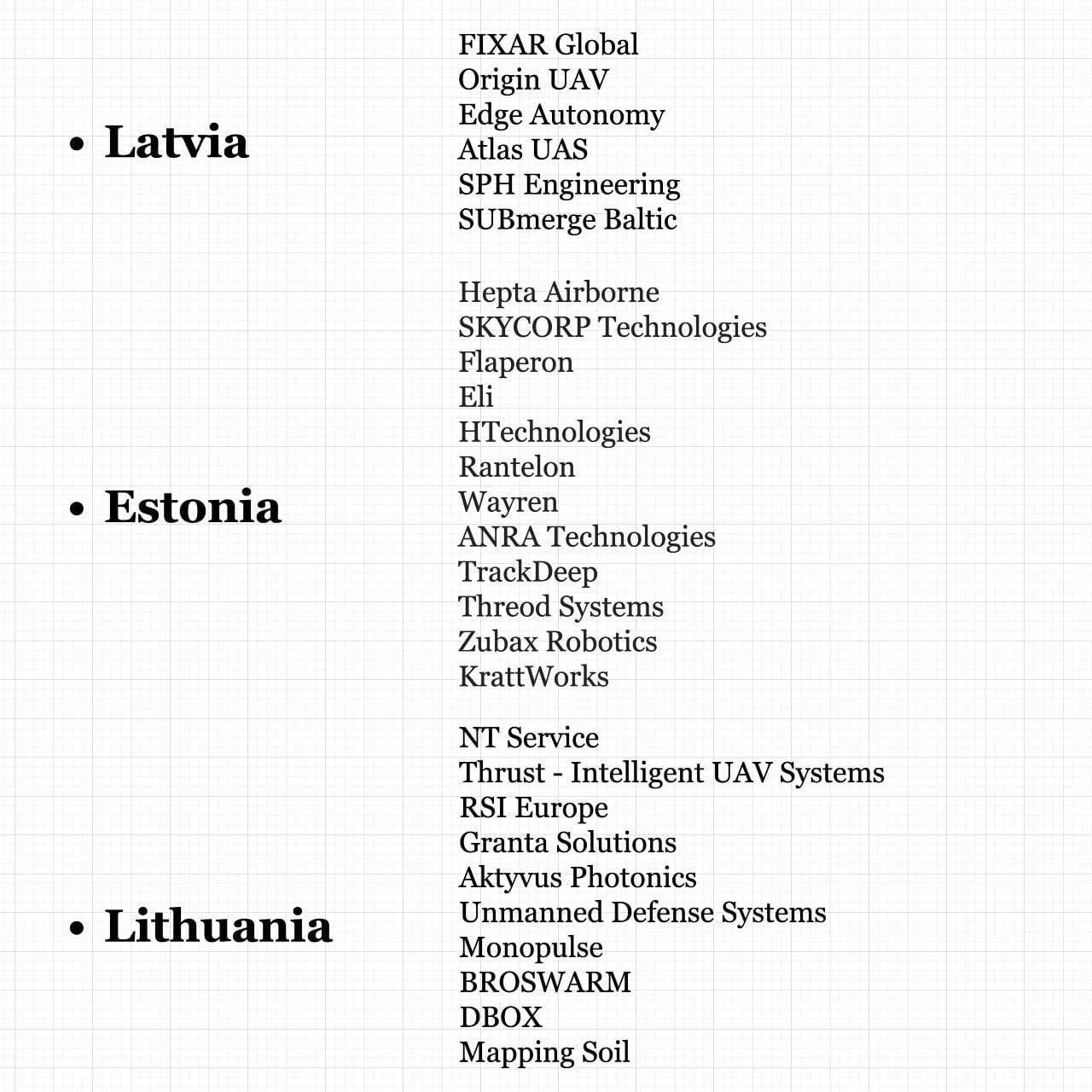

Narrowing down on drones, they suddenly became a defining capability in modern warfare – demand is not exactly an issue (LT is putting aside EUR 30m) for startups building in this space, although nuanced and can be complicated. Economist trying to grasp all industry shifts, potential and risks. Founded by Justas in Denmark, Monopulse built a drone without critical components from China, and with abilities to operate when reception is lost or jammed. Marduk is an Estonian firm with a new UAV detection/tracking system. Origin UAV (Latvia) is bringing a man-portable ISR drone with precision bomb-drop capability. And former Google CEO Eric Schmidt is starting new drone company - White Stork - in Estonia, too. So this is pretty much the drone landscape in the Baltics:

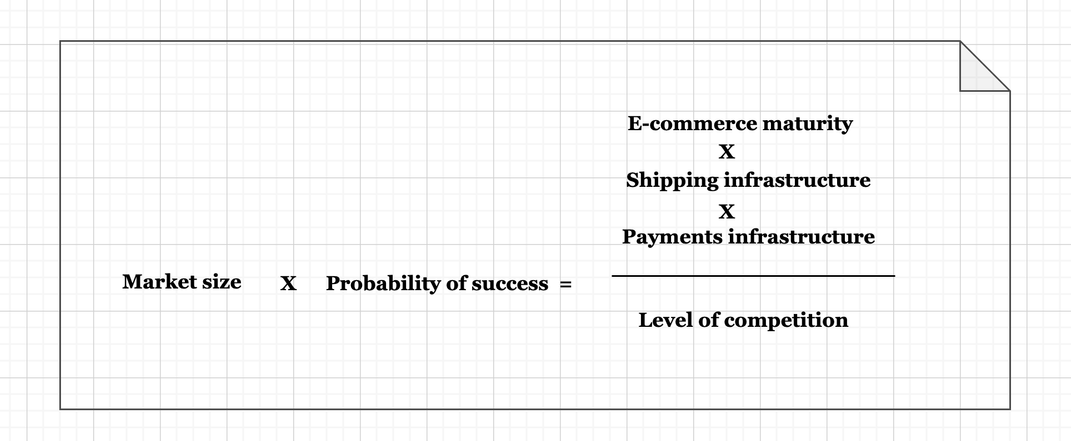

- It's worth checking Adevinta's report on marketplaces: they are increasingly blurred with SaaS and fintech, vertical ones dominate, overall investment is decreasing, and B2B is rising. See also EV / Revenue multiples, too. But what I absolutely loved to listen - was Harry Stebbings finally talking to Thomas Plantenga, CEO if Vinted (and Alex Taussig, LSVP investor). It is a marketplace masterclass, from understanding underlying value prop (why VintedGo logistics is critical) to dealing with multiple variables and risks, putting cashflow into the best use (efficient frontier?) and much more. Here is how Vinted prioritizes markets to expand:

Also, Milda's interviews keep popping up across media - here she tells more about 2 a.m. Vinted idea and the very first years.

- AI. NfX comes with another banger essay on AI, saying tech is no more a differentiator or moat for most AI startups.

For most founders right now, you have to build an entirely new point of view around what differentiation means to you. You are going to need a clear and aggressive perspective on how you’re going to win.

Think distribution. (But incumbents will eat your lunch here too, so the old rules don’t apply.) Think brand. Messaging. Marketing. GTM. Pricing. Customer service. You can’t graft all this on at the end anymore. You’ll need to develop a key insight about how you will be creating value for your end users in a way that no one else can. You’ll need to focus on the heartbeat and emotion of the people you’re building for.

Two events in Vilnius you should not miss —

Engineering Summit: ML/AI sessions - March 14, 2024

- New this year – a startup train in April to Techchill in Riga.

- Early-stage startups to watch in 2024 as endorsed by BAD.ideas team and their friends.

- Sportstech. Tesonet founders talk about Zalgiris engagement - what has been done and what might be coming. We've previously made a list of Baltic startups in the sports field, perhaps something to get inspired by.

rounds and capital

- CoInvest Capital and a large group of angels (NGL) added another EUR 1m investment into #Walk15, a wellness app. This adds to the 500k it had secured a few months ago at a EUR 15m valuation. Now expanding to Germany is top priority. Love the concept and such a passionate team, would be fantastic to see them bring high-calibre operators with stock options, accelerate in a new market and have a much larger round to fuel growth. It's been a great run so far but likely team is spending too much time fundraising (gathered approx EUR 2.4m total via 4-5 funding events) - they need more bandwidth to focus on product/distribution.

- CyberUpgrade raised EUR 650k pre-seed from NGL 23 angel syndicate, FIRSTPICK, and other angels. Serial entrepreneurs, clear value proposition, market changes due to new regulation - hopes are high!

- On a side note - it's already the third investment by CoInvest Capital this year, a solid start. Also, in all 5 rounds have angel participation – sometimes very significant – which also paints the local picture.

Join Tech Philomaths in a better way

We've a premium package if you are ready to support. Here is how it works.

- Content remains open for all (but invite-only, and everyone has 1 invite)

- There will be more content, a Slack channel and in-person dinners happening.

- Jump on Contribee and select "friends". You will be able to invite more people, join a Slack channel and take part in future events (dinners)

- P.S. First 30 supporters (any tier) will get something great to wear, so hurry up.

- P.S.2. Many don't know who is behind Tech Philomaths and seemingly want to know. I happy to send linkedin invite and calendly link for all supporters, and even more happy to jump on a call if you'd like. You can choose not to have a call :)

Privileged to receive support from a group of core sponsors, who decided to get onboard. 6 slots booked, two are available.

founder's guide

- In B2B and starting sales? Listen to this talk with Jason Lemkin and take notes, very good tips. And when hiring, consider chatting with Edvin for advice.

- 350+ female VC partners in Europe (Sifted paywall)

- Education (degree) helps when fundraising, but hardly translates into different startup outcomes.

- Agreed: "I believe the most important trait of exceptional startups is intensity"

further insights

- Only around 8% of European VC firms are headed by former founders or operators. Do VCs need to be former operators, or specific age – or anything else?

Success in venture - if predictable at all - seems correlated somewhat to experience and apprenticeship within venture itself, somewhat to humility and fear of failure, and greatly to self-awareness and human empathy with others. (Do you know yourself and can you read a boardroom?)

- It may help, however, if the fund manager has industry understanding.

- There’s a live map of radio-tagged sharks maintained by a marine conservation nonprofit, so you can track specific sharks on their journey around the world’s oceans.

- Another map visualizes Earth's orbit - see all satellites live, many more than sharks tracked!

- East and West Germany still very much exist.

roleplay

Mentum AI - Sales Manager

Burga - Head of Product Development

Plug and Play - Accelerator Director

Hello100 - Junior Affiliate Manager

Tesonet - Creative Copywriter

Dogo - Senior Performance Marketing Manager (Berlin)

Go Vilnius - Head of Business and Investment

Repsense - Backend Engineer

Printify - Head of Platform (Remote within EMEA)

Member discussion