Summer postcards

Our supporters and sponsors received this earlier

We also had our first community dinner last week

Join our community via Contribee here

work in progress

- Cross that border. This thread got started during Tech Philomaths' dinner, when Robolabs acquisition was mentioned. How scalable is this model? Accounting is notoriously complex following local taxation laws. Indeed in Europe many things aren't scalable – but at this point, that's precisely the opportunity. Businesses that are immediately scalable (think e-commerce) also have little moat against competition. But if you can unlock services that used to be "local" – the advantage will be game-changing. This is part of big story behind Vinted's ongoing success (breaking out of flea markets and local listings), or the skyrocketing of Deel, a $12B monster (before, companies needed a local entity to hire in each country). Ovoko brought Vinted's playbook for used car parts, at speed and scale, making the marketplace much more fluid. Anyone who has moved (even within EU) have experienced European fragmentation – your new doctors won't have health data, you'll have no credit history, it will be tricky with education, and a few more headaches. No surprise simple solution as eTools won the public choice award at the Plug & Play pitch battle in Vilnius – there is room for many more.

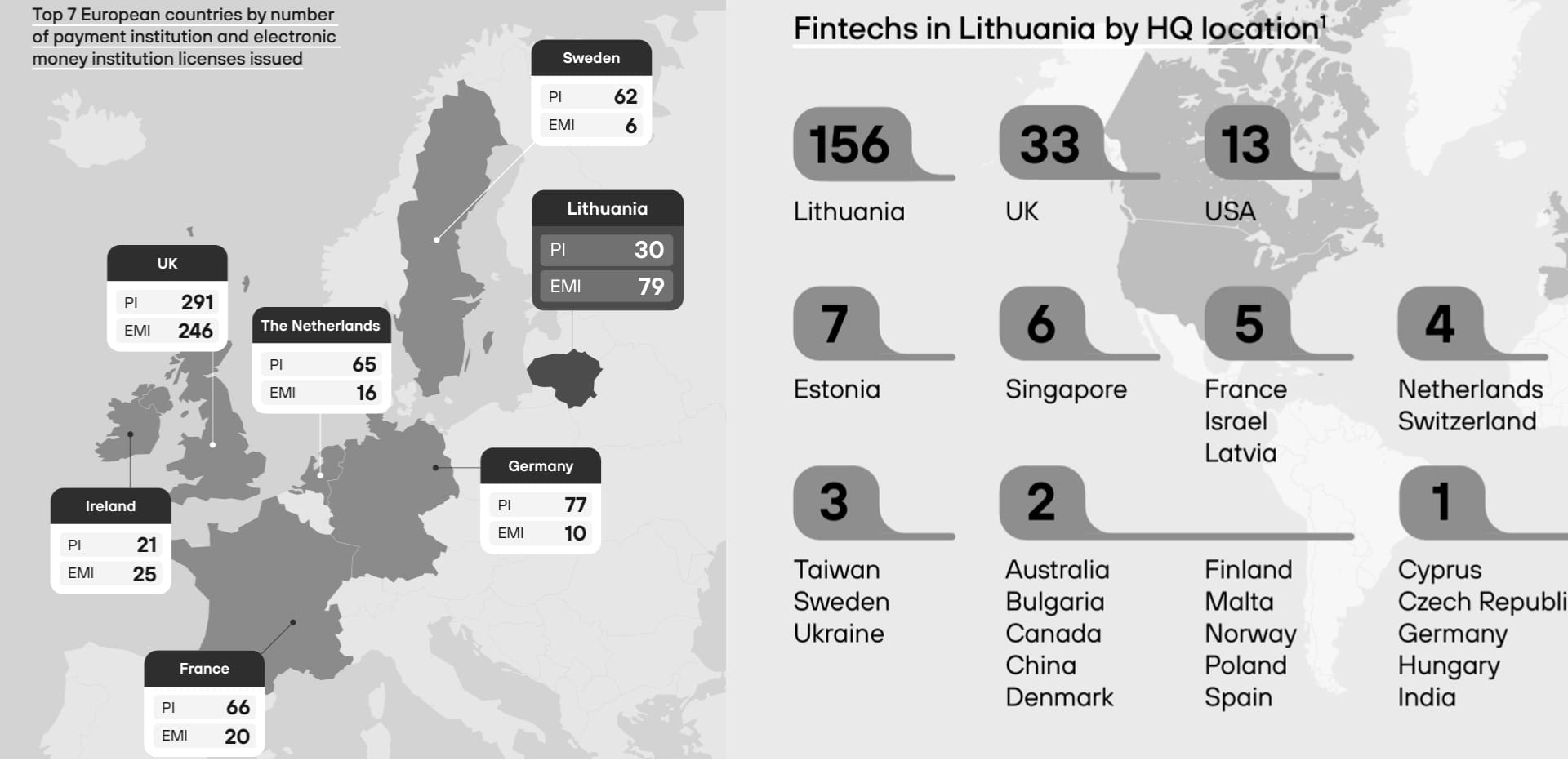

- Fintech has been toxic in the media lately, due to that weird Foxpay political scandal. Let's move beyond that. Lithuania's fintech story is an obvious success story, just look at EUR 340m exports from almost nothing just 5 years ago. ByMyBond doing well, raising EUR 3m in a day (not equity, financing projects). ConnectPay launched European Fintech Index, and it clearly puts New Nordics at the very top. Paysera closed 2023 with EUR 7m profit, and heading to physical retail locations with a new acquisition (virtuali kasa). Greet was awarded as the winner of the JCDecaux Nurture Startup Challenge. Max is building wCard – a supercard for superfans, hiring. He is also keen to connect more with fellow entrepreneurs - DM him for a founder meetup.

- Marketplaces should be a recurring topic here – many attempts. Boop (pet owners and caregivers) is making steady progress, and won pitch battle at Plug & Play Expo Day. We are tracking Eany.io as they are assembling an experienced team for the B2B marketplace. Commody is a new collectable car marketplace, with Savy+HFinance founders joining the venture.

- AI. Aleph Alpha is reported to be in trouble – more voices telling the company will not survive (despite having a founder of Lithuanian origin). There is suspicion that the product is not delivering well, and the last round was inflated in numbers. Others argue Europeans don't offer enough capital to sustain this as a standalone business. In the meantime, Hostinger has a lot to show in how to deploy AI chatbots, they got 103k convos resolved by AI in the last 12-months.

- Always making. Our repeat founder list keeps expanding, love to see. Here is one project that kept Ignas Survila busy lately – Memstagram, a socialfi dApp designed to help memers monetize their creativity. Justas Albertynas (RatePunk and other travel ventures) also launched new - Glimpsefy is AI-powered product encyclopedia, which leverages user comments on the web to help you choose the best product.

- New breeds. Top 20 Lithuanian scale-ups, all EUR 25m in revenue and more (much more). Missed anyone?

rounds and capital

- Presto is launching its third fun – Presto Tech Horizons – in a close partnership with CSG (Czechoslovak Group), a global industrial and technology group with Czech roots. With target size of EUR 150 million, Presto Tech Horizons is positioned to become one of the largest funds with this sector's expertise and experience. They plan to do B2B and B2G, 500k-5m tickets. We can certainly see them spending more time in the Baltics now – many defence tech ventures scaling up.

- Mavenoid, a provider of AI-powered automated CS, raised $6 million in debt from HSBC. Swedish scale-up is led by CEO and co-founder Gintautas Miliauskas. They plan to raise a Series C in mid-2025.

- Civitta & xEdu (Finland) have been chosen to run an international EdTech accelerator, powered by Startup Lithuania. They will do 3 batches with 10-15 startups each in the next two years.

- Peninsula Corporate and Game BCN (Spain) has been awarded to run game accelerator (are they good, does anyone know?).

- Estonian Specialist VC, Trind Ventures, and some business angels invested $3,5M in telemedicine company DrHouse. It was founded in NewYork in 2021 by Estonian entrepreneurs Sten Tarro and Ergo Sooru.

- Stebby (Estonia) controlling stake was acquired by the French rewards and benefit leader Up Coop. Livonia's first exit in Fund II.

Join Tech Philomaths Community

- Invites to dinners

- Slack channel for members

- Exclusive content, such as

Repeat Lithuanian founders

Startup lists for the Baltics (drone tech, marketplaces, sportstech)

Lean and Mean - small profitable tech firms (in works)

Cloudvisor teamed up with PwC to research startup trends – some findings are truly surprising. 68% of startups use AI (well, we expected that), why HubSpot commands a 78% market share among CRMs, and why over 80% of startups depend on Zendesk for customer service.

founder's guide

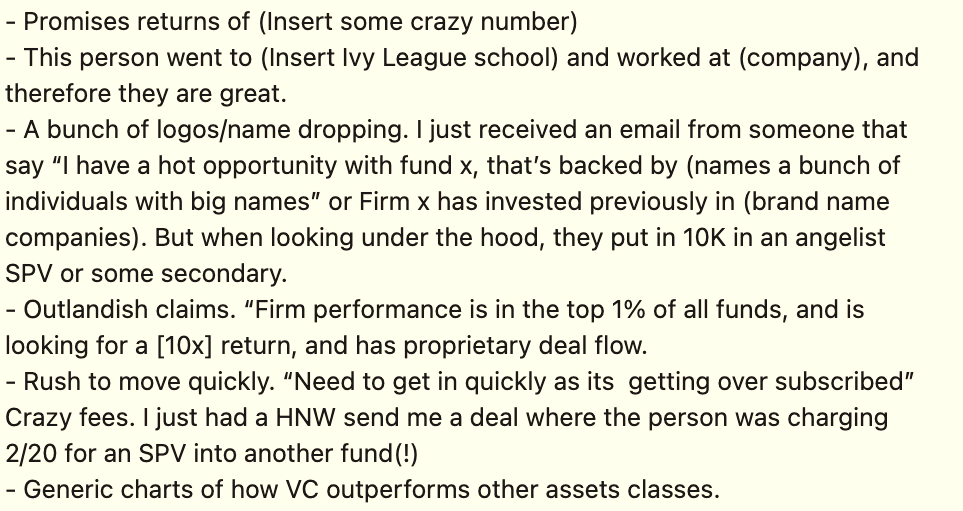

- How to raise a venture fund - run a drip campaign (you can build similar strategy for a startup, too).

- Family Offices and HNW individuals – here are red flags when you are being forwarded a deal:

- If (or when) truly scaling, this resource from Index is very handy (especially on things like hiring, structure, and operations)

- Design a life you don't need to escape from (wishing best of luck).

- How much revenue does a company need to generate to go for IPO? The median now is $189m.

- What does it take to be top-performing Saas?

- Top decile startups produce ~ $150k-200k/employees across different funding and growth stages. (This means hitting $5M ARR with 25-33 people in the team)

- The top 10% show 3-4x more revenues per employee than the median

sponsors

Privileged to receive support from a group of core sponsors, who decided to get onboard. They have some newsletter invites, too!

Cloudvisor [AWS partner dedicated to startups]

PayPal [Global integrated payments solution]

Vinted [largest C2C European marketplace, always hiring]

Tech Zity [tech hubs and campuses across Lithuania]

Presto Ventures [investing in early-stage B2B startups and marketplaces],

Wargaming [award-winning game developer, careers]

15MIN Group – congrats our friends on the announced expected acquisition, taking over M-1 group. M-1 (radio and more) has been demonstrating sound financial performance.

further insights

- The type of alarm upgrade some of us need, desperately.

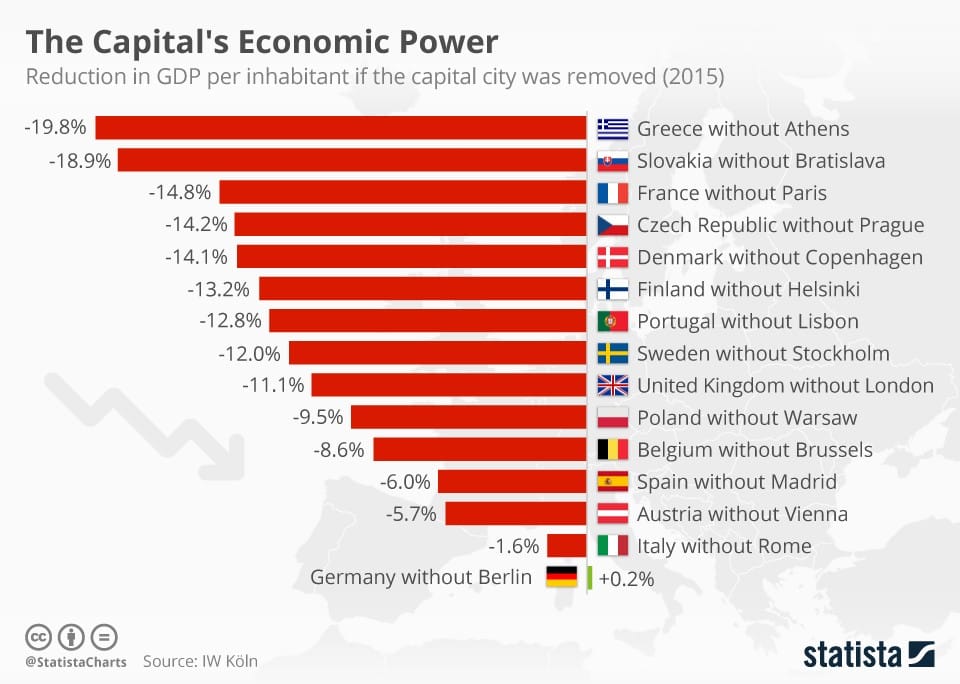

- Most countries: "everything (companies, capital, talent) is so concentrated in the capital city". Germany: "Kein Problem".

Startups with shorter names are significantly more likely to raise funding than those with long, multi-word names. Seed-stage businesses with 15+ letter names were almost half as likely to convert to Series-A as those with <6 letter names.

ecosystem

- Philanthropy. Lithuanian-Canadian dentists and philanthropists Angelė and Sigitas Kazlauskas bequeathed CAD 7 million (about EUR 4.7 million) to the philanthropic Vilnius University (VU) Endowment Fund. The value of the fund will be doubled to EUR 9 million as a result of the new contribution. New professionals, including Rokas from Contrarian Ventures, are joining the Board.

Devbridge acquisition by Cognizant has been one of the largest (likely the largest in tech) in the last decade, still hoping this shall spark more fresh capital+expertise into Lithuanian ecosystem. A new US-based fund (Moose Ventures) took part in Softloans funding, but founders also established a foundation (with EUR 8m capital) – it just announced to illuminate Kaunas St. Michael the Archangel Church. - Talent magnet (?). There are 11,500 international students in Lithuania, studying for a full program (not exchange). On average, only 8% stay to work!

roleplay

Join the leadership team before Series A

ConnectPay - CCO

Vinted - Content Strategist

Bored Panda - Animation Product Owner (BD Focus)

Member discussion