Scale at work

work in progress

- The promised land. Bolt posted 2023 revenue at EUR 1.7B (jumped 37.4%), EBIT loss of €94.2m (only). 87% of revenue is from Europe, and 81% is driving service (the rest being rentals and deliveries). What else to know? EUR 535m marketing spend. The largest shareholder – Markus Villig – owns 16.88% of the company.

On a similar scale, but little more profit: Revolut 2023. That is £1.8b of revenue (+95% YoY), £438m of pre-tax profit (vs £25m loss in 2022), 45m accounts (+36% YoY). Curious to see how Nik Storonsky's side hustle, AI-led and ‘truly systematic’ $200 million VC firm QuantumLight, will perform (in New Nordics, they have backed Danish Monta already).

Also, in the promised land, regulators are after you: Vinted will appeal the €2,3 m privacy fine it received from the Lithuanian data protection authority, making a case that they have been protecting users and has not violated GDPR. If the fine is refuted – it will be a sad case study of a regulator who shows no understanding of strategy, as Eimantas argues) - More on mobility, beyond Bolt. Woop Drive is getting launched, starting with petrol discount card and moving into car-sharing very soon. Now talking about gas, the tide has shifted, as you know – it will be almost all electric, because of these fundamental technology improvements. Inbalance grid is set to become major player in Poland – just made a deal with Stokrotka, to launch 270 charging spots across the market. Dancer, an electric bus maker, has made its way with public funding and private investment, but now struggling to survive.

- AI x BIO. Simona (Perfection42) changed industries, but she has Molecular Biology background, and mentions these teams to follow: Caszyme, Klinio (part of Kilo), Biomatter, AI Dermatologist: Skin Scanner. There are certainly more, for example, Justas Dauparas is a co-founder and Xaira Therapeutics, which recently came out of stealth with... $1B funding (ARCH Venture Partners and Foresite Labs, along with F-Prime, NEA, Sequoia Capital, Lux Capital, Lightspeed Venture Partners, Menlo Ventures, Two Sigma Ventures and SV Angel).

- People moves. Povilas Zinys joins Plug and Play Accelerator as Director for Lithuania. Laurynas Bogusevicius, the founder of Deals on Wheels, is leaving the business and selling his equity, to focus on Deals on Home, 15min reports. (Interestingly the largest shareholder for DoW is Pijus Makarevicius (Furniture1), with 49% stake). Tautvydas joins #walk15 as their new CTO. Martynas leaves Oxylabs / Nord Security to lead talent acquisition at Light Conversion.

- Breakfast with Iron Wolf - they have Karolis, product designer and OpenAI, as a guest (July 11th)

sponsors

Privileged to receive support from a group of core sponsors, who decided to get onboard. Reach out to them if you want to be a subscriber.

Cloudvisor [AWS partner dedicated to startups]

PayPal [Global integrated payments solution]

Vinted [largest C2C European marketplace, always hiring]

Tech Zity [tech hubs and campuses across Lithuania]

Presto Ventures [investing in early-stage B2B startups and marketplaces],

15MIN Group [all the news you need to know]

Wargaming [award-winning game developer, careers]

Join Tech Philomaths Community

- Invites to dinners

- Slack channel for members

- Exclusive content, such as

Repeat Lithuanian founders

Startup lists for the Baltics (drone tech, marketplaces, sports-tech)

Lean and Mean - small profitable tech firms (in works)

rounds and capital

- Lithuania-based FreeBnk secures $3M in funding to revolutionize crypto investment. Round led by Founderheads, with participation from several other key investors in the fintech space including ChaiTech Ventures, LVT Capital, and Lavender Capital.

- eAgronom (Iron Wolf portco) raises EUR 10m Series A2 round to boost sustainable farming practices. Swedbank AB is leading the round with a €4 million investment alongside Icos Capital, Soulmates Ventures, and SmartCap Green Fund.

- French startup altrove has closed a €3.5m round with investment by Contrarian Ventures, Emblem, and a number of high-profile business angels. Altrove is building better alternatives for materials, to achieve Net Zero.

- Estonian SmartCap announces EUR 5m investment in Antler Nordic Fund II, which sounds like a smart strategy from the network and insight perspective.

- Estonian MarkeDroid closed its seed round - EUR 500k from AS Giga. They are working on energy efficiency for battery owners.

- And something in Latvia, too - KALVE coffee is preparing for an IPO.

three questions

Vojta Roček, Partner, Presto Ventures

Help us understand Presto Tech Horizons: industry, stage, ticket size, geography?

- In short: Defense, Security, and Aerospace with a focus on dual-use.

- Primarily post-revenue companies: Seed, Late Seed, early Series A.

- Tickets €500k to €5M.NATO countries and allied nations.

More key facts here. Media Kit incl. visual assets here.

What role do you expect Baltics to play for this Presto fund?

I expect the Baltics to play a crucial role. Poland, Czechia, and the Baltic states are at the forefront of Ukrainian support. Founders in these countries understand that if Ukraine falls, they might be the next in line. This brings a different kind of fierce motivation to build startups that can change the course of history.

With 8 Baltic startups invested from our previous fund, Presto has always been a staunch supporter of the region – under Presto Tech Horizons, this connection may only intensify.

Market fragmentation, broken procurement, and limited exits have muted dual-use tech in the past. What's your view on the future?

In terms of becoming safer and more secure, I don't see an easy path for Europe in the next few years. Correcting the current, unfortunate situation will require a lot of coordinated effort from all EU states and institutions. Deploying cutting-edge, locally developed and manufactured technologies or solutions is certainly one way to jump-start this process. It's a clear path forward, and everybody in the broader ecosystem can see that. I remain optimistic.

founder's guide

- The Rule of 40, popularized by Brad Feld, states that an SaaS company’s revenue growth rate plus profit margin should be equal to or exceed 40%. But Blossom Street is not seeing that working in data, thus the advice is

Continue to push hard for cash-efficient growth. That means generating ARR of at least $0.70 for every dollar of operating loss. Don’t destroy your growth just to get to profitability, or break something trying to get to the Rule of 40, which we don’t see anywhere in the data.

- Aspiring entrepreneur? In the meantime, Paul Graham says -

stay in school and have fun

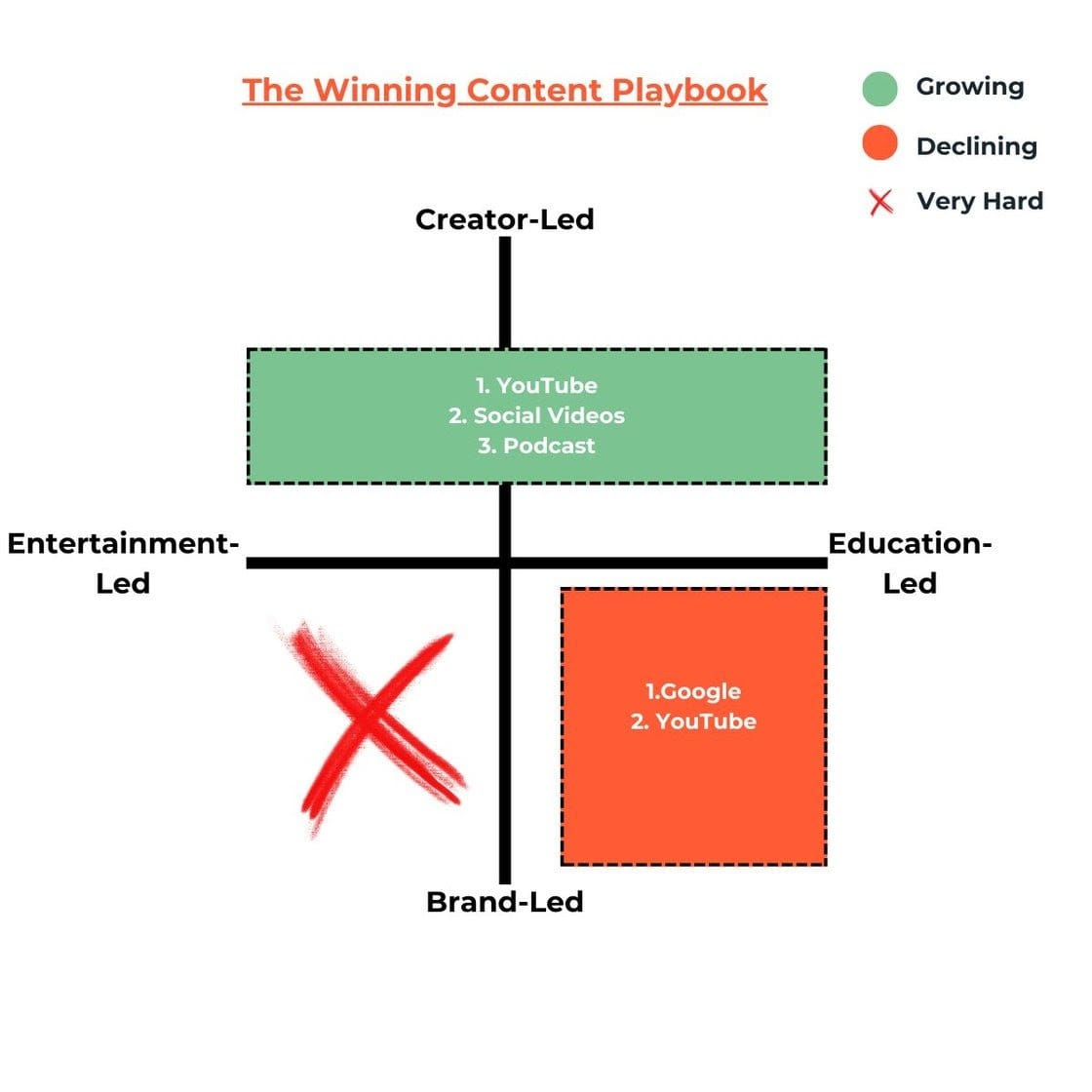

- State of content marketing today, by Kieran Flanagan (his newsletter). (Yes he is saying these company-published content pieces are not making the cut anymore).

further insights

- AI’s $600B Question – that's the revenue that should come to life to justify AI infrastructure build-out.

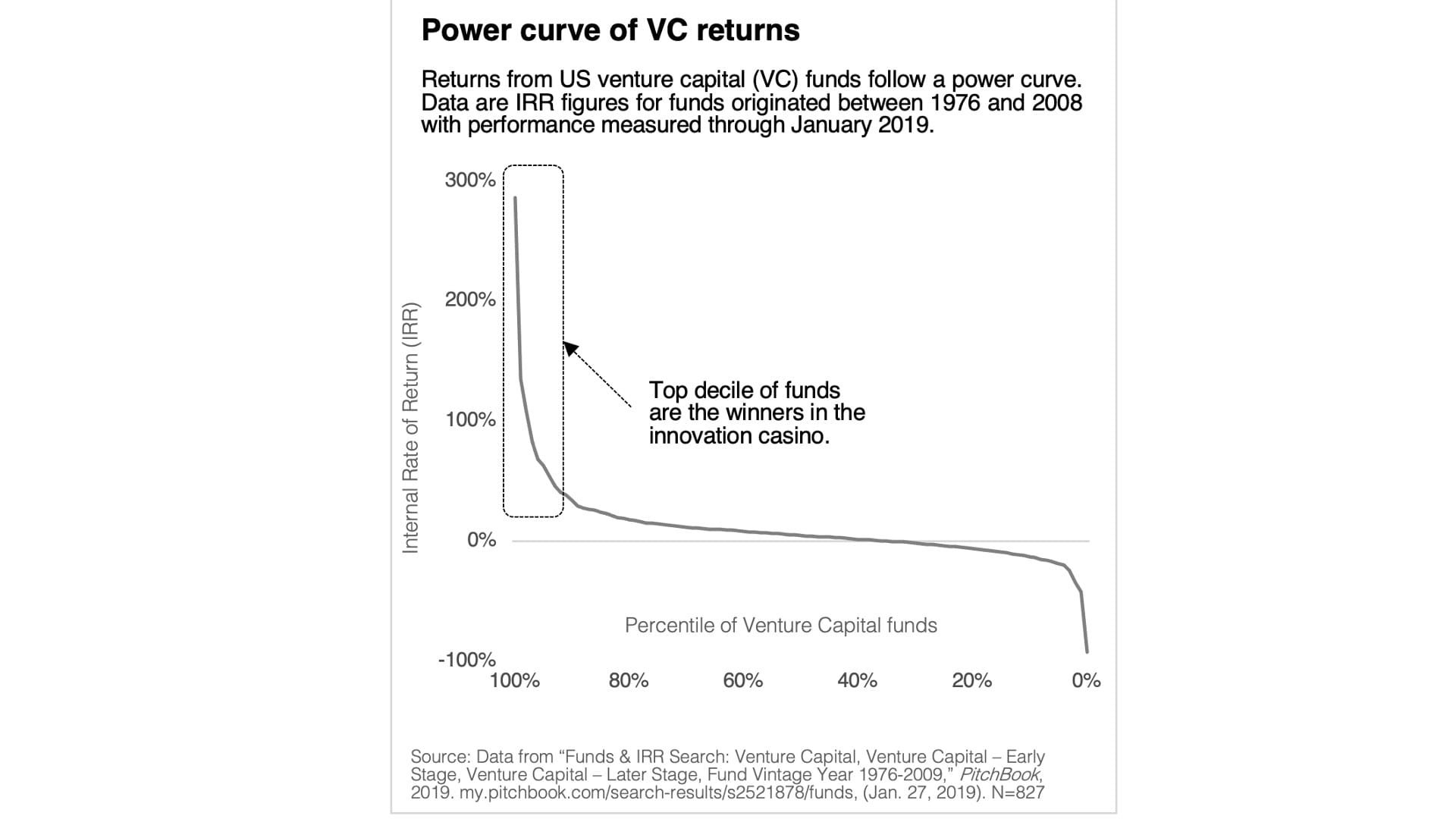

- Venture Capital is a MEAN business

- Let's have a definition as we keep using the term "strategic" all over

any decision a company makes that is not a normal-course-of-business choice, that has a present cost most comparable companies are empirically unwilling to pay, but that the decisionmaker thinks will pay off well long-term. McDonald's opening another McDonald's isn't strategy; McDonald's taking a majority stake in Chipotle as a hedge against shifting dining habits (and a bet on a good concept) was. Fixing a software bug isn't strategic; open-sourcing an internal tool is.

ecosystem

- Rita Sakus explains for Finnish media why young Lithuanians are so happy

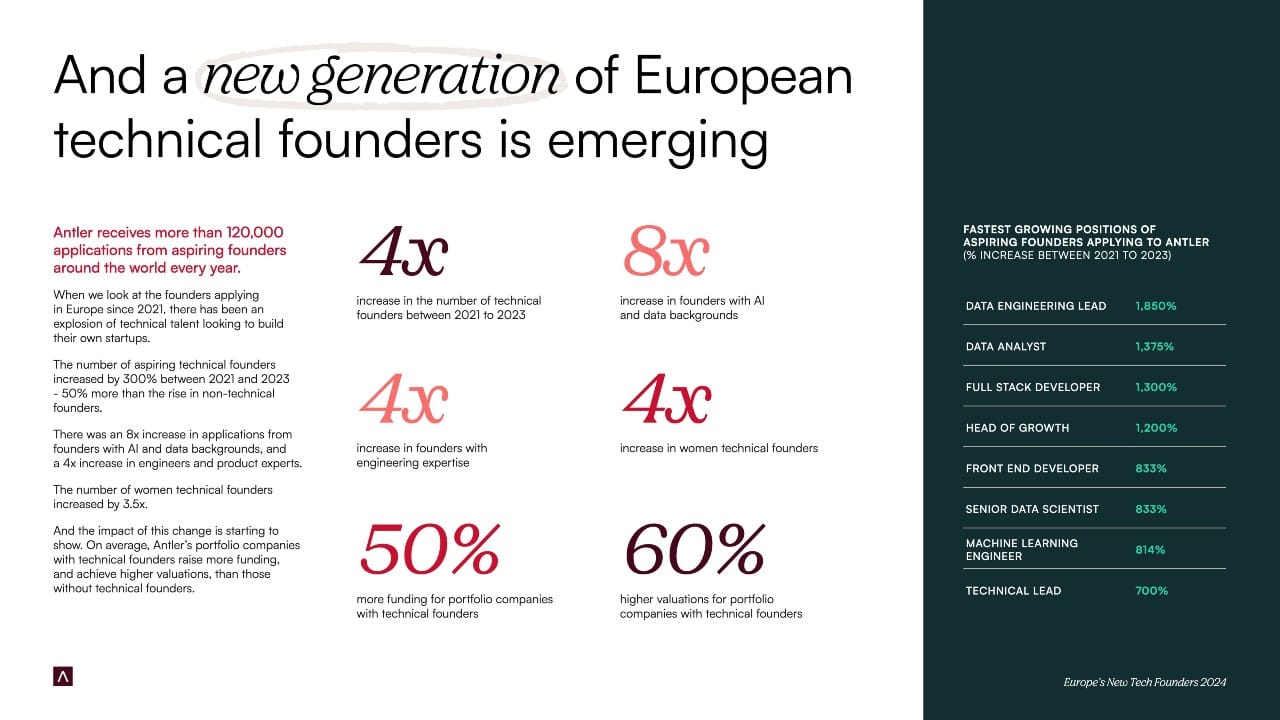

- Antler released an interesting report on the rise of technical founders – this can drive broad impact across Europe

- Just as we would be suggesting English as an administrative language, Aki points to something just more basic – why aren't all public service websites translated already? That's super low cost in this day and age.

roleplay

Join the leadership team before Series A

(Submit your opening for free)

Coinvest Capital - Investment Analyst

Tech Zity - Financial Analyst (to grow towards CFO)

15min - Head of Subscription Product

RSI Europe - Head of Quality Management

Surfshark - Research and Insights Team Lead

Willgrow - Investment Manager

Bored Panda - Head of Marketing

INVL - Investment Strategist

GovTech Lab - Innovation Expert

Member discussion