History rhymes

Lithuania Tech Weekly #158

X and LinkedIn for fractional updates

Subscriptions are invite-only

Everyone has 1 invite for 2024:

Add a friend here - philomaths.tech

X and LinkedIn for fractional updates

Subscriptions are invite-only

Everyone has 1 invite for 2024:

Add a friend here - philomaths.tech

work in progress

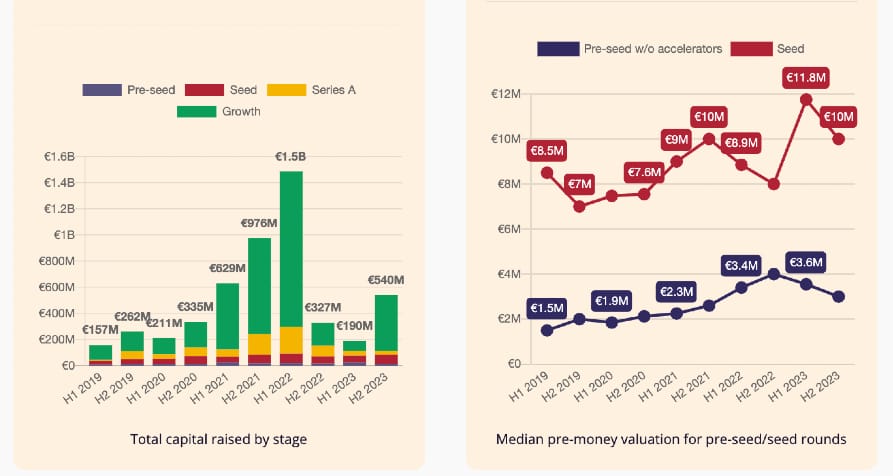

- Baltic funding trends, really good data from Change Ventures and FIRSTPICK. Growth rounds returning. Valuations are somewhat compressed but with huge disparity within. Series A needs to rebound!

- AI. Just a "Chat GPT wrapper" or venture-scale startup? For byFounders, Magnus wants to envision a sustained edge - how will this team continue building their moat? That often relies on the unique dataset, which your product enables to collect.

Have seen the "nerd party" meme? Famous photo was taken at the International Mathematical Olympiad held in Poland in 1997. Fast forward 27 years, Polish Ministry of Digital Affairs appoints AI advisory team, which will develop AI recommendations for the government. The initial group of AI experts (ex-Googlers, ex-SpaceX folks) decides to recreate the famous photo:

- Healthtech. Ivan started mowellio to promote active lifestyle. Benefiting from Kilo Co-found program, Pulsetto is making good progress, mostly selling in the US. A pilot open call for the use of health data was launched, started by EIT Health, Baltic Sandbox Ventures, LSMU and many other partners. Startups can apply to get access to anonymized data.

- Food. Modestas hiring engineers, and building a dietary plan platform with the help of AI. Billoka is something similar - a personal dietitian app. Better Market is a marketplace for sustainable food suppliers and buyers. Biohifas employs the power of mycelium and valorizes industrial side streams into the food. After exiting Rocketo, Arunas launches SOULEL – organic plant-based superfood smart blends (Adding Arunas to the highly popular repeat founders list).

- Mobility/climate. Micromobility is key for curbing emissions, thus seeing the current market bloodbath can be soul-crushing. Swedish CAKE entered insolvency. Vanmoof (NL) went under earlier. French Moonbikes, too. MATE bikes (DK), as well. In Estonia, Ampler got backing from the Comodule team, while Hagen Bikes filed, too..and this is nowhere close to the full list. But it's not all vanished - the likes of Gogoro, Cowboy, Lime, even Stark may survive this and return stronger. Rytis Jakubauskas decided to shut down Palmo, urban logistics network they've set out to build (ping him for something new). And looks like ADSCENSUS is just skipping the street completely - instead, building in "urban air mobility" space.

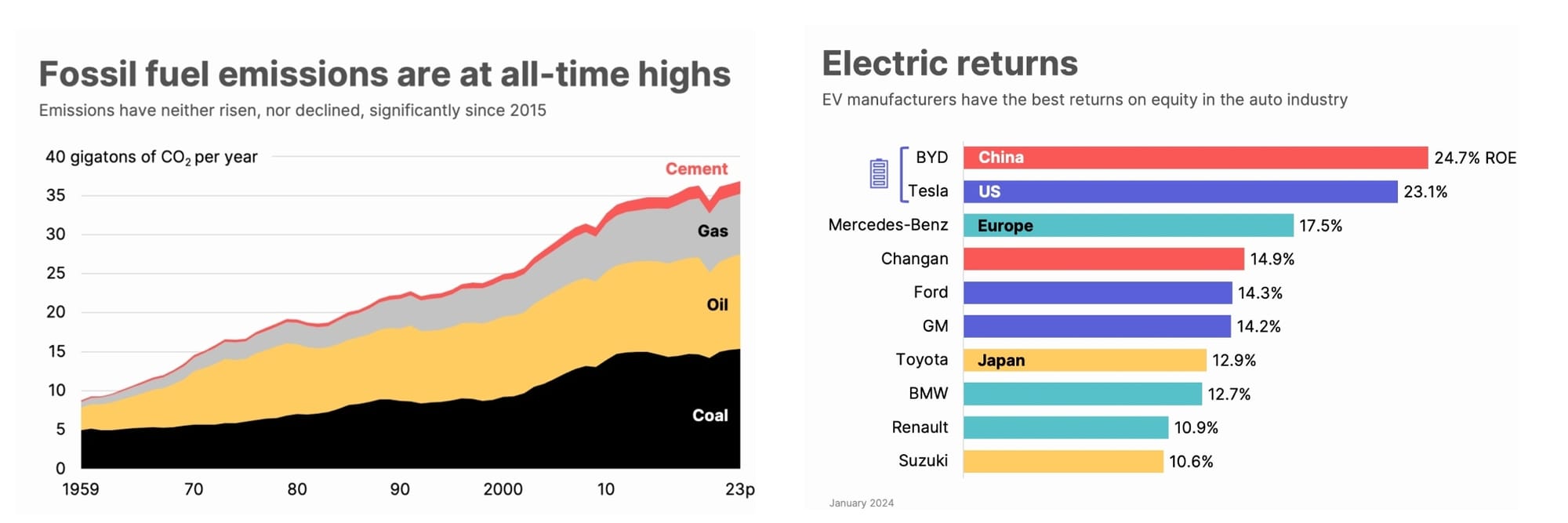

Anyhow, are you in climate at all if not yet memorized all these Nat Bullard slides? Really good pack, only 200 slides, for example:

- Calendar. Fintech Day - Feb 8. ScaleWolf second program applications close Feb 15. LitBAN Angel School starts end of Feb.

rounds and capital

- Practica Capital receives broad backing from institutional investors and announces EUR 80m Seed fund - largest in the Baltics. It's the third fund for Practica which started as a venture pioneer in Lithuania – they are now well-positioned to take the lead in the Baltics. With regards to the second fund, the seed to series A graduation cohort is approaching 40%, and the fund is currently at 0.7x DPI.

- Presto Ventures has their "showroom" - providing access to their portfolio startups currently raising. Check the progress Okredo and Spenfi is making.

- Polish Smok Ventures closed $25M to invest in 25-35 startups from the CEE region and diaspora - still need the first Lithuanian one!

- Another side of venture. What options for founders who raised plenty, now under 5m ARR, and recognizing this is not venture scale business? Incentives are all messed up and a lot depends on where your investors are at.

roleplay

PodBase - Head of Growth

mowellio - co-founder and CTO

TransferGo - Director of Product Marketing

IPRoyal - HR/Recruiter

Mindletic - Head of Operations

Blackswan Space - Unity 3D Developer

mowellio - co-founder and CTO

TransferGo - Director of Product Marketing

IPRoyal - HR/Recruiter

Mindletic - Head of Operations

Blackswan Space - Unity 3D Developer

founder's guide

- Many takes on how to build startups in a new funding environment. Jason Lemkin suggests "raise, but only one round". Gil Dibner believes that

critical unlock must be reframed as a new question: can this be a business? The point is not to always get to breakeven or always assume no capital is ever available. The point is to develop the conviction that the company you are building can be an actual profitable business at some predictable point in the future.

And this is what VCs think when you reply "not raising right now".

- Creator businesses: The rate and frequency of member connections is the best predictor of the success of a course or community business

- 21 things founders should know about getting acquired (noting this is a very Google-centric view)

- Decoding the DNA of a Product Manager: What It Takes to Excel - by Tadas from Superproduktas

- What's the "clock speed" at your startup?

further insights

- Dynamism, but opposite. The richest five families in Florence, Italy from 1427 are... still the richest today

- Ark Big Ideas report 2024. Digging into all big trends, AI, bitcoin, EVs, etc.

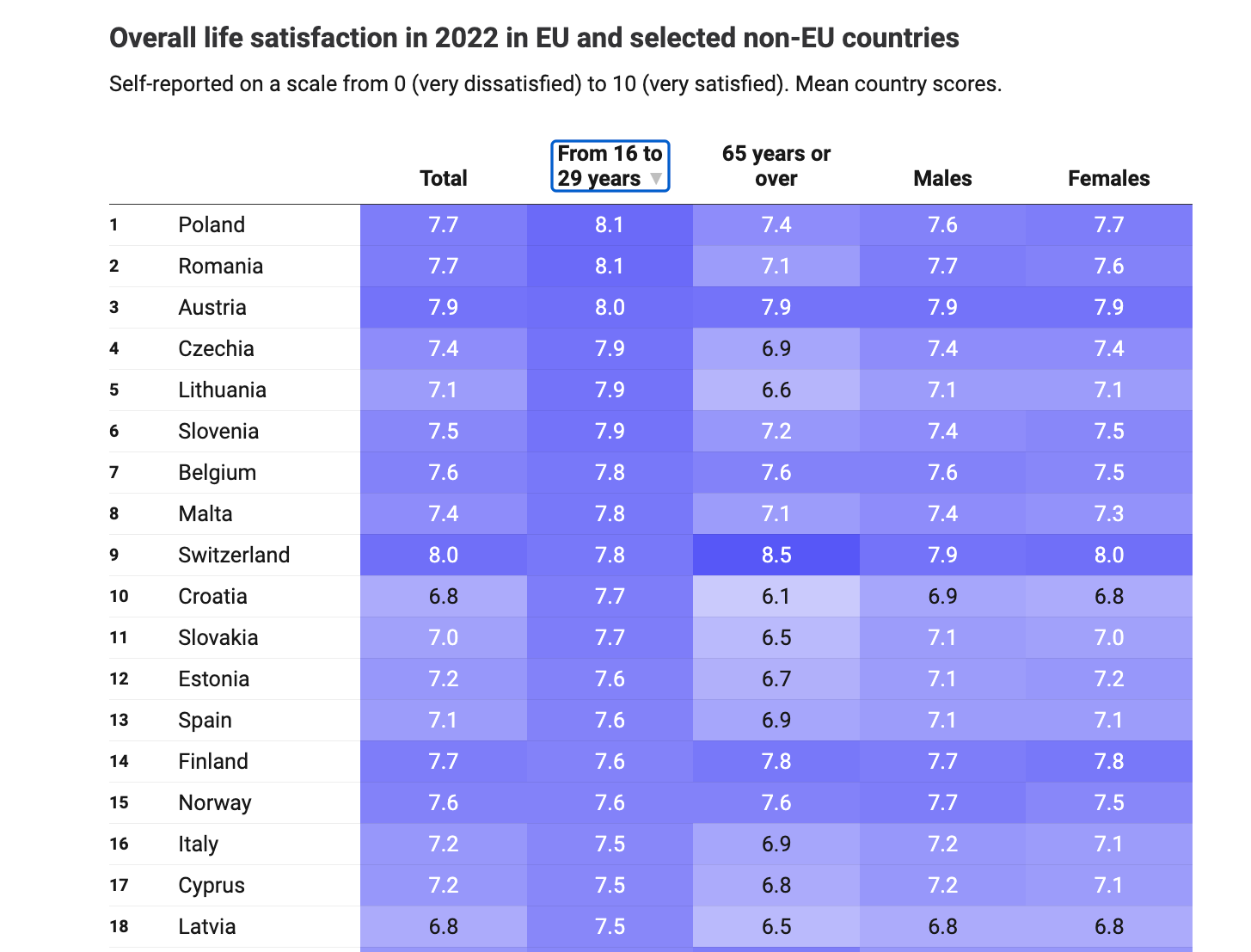

- Young people in Emerging Europe are pretty happy, why? Couple of decades of visible and tangible progress? Got to cheer up seniors, too.

- Good thread on the topic - what happens when many industries suddenly become global. Normal outcome distribution disappears:

A networked economy cannot produce a middle class.

— Dror Poleg (@drorpoleg) December 9, 2022

ecosystem

- Lithuania has joined Nordic Innovation House in Silicon Valley and now LT companies can have some connections and perhaps a workspace.. will keep you posted. Talent and network density make a huge difference - even Entrepreneur First now suggests relocating after you secure funding in one of their global sites.

Member discussion