Warpigs*

Hello Friday!

Lithuania Tech Weekly #87

Subscribe at philomaths.tech, also LinkedIn

Important to share? Book to advertise here or send us an electronic mail!

Join TP Membership Circle with some great minds already there.

Lithuania Tech Weekly #87

Subscribe at philomaths.tech, also LinkedIn

Important to share? Book to advertise here or send us an electronic mail!

Join TP Membership Circle with some great minds already there.

work in progress

- Marketing collapse = when your campaign gets picked up by VTF.

- This week, startups challenged industrialists on milking subsidies (not without a reason, some executives really embarrassed themselves with Belarus ideas). We like that now we've got an alternative voice in public, and prioritizing education is 100% on target. We do expect these clashes to continue. All governments scramble with "chronic state of shortage of good jobs". As per Sandbiu's book, if you fail to provide average Joe with a meaningful job with raising income, he might decide that Trump is an awesome president, or that leaving EU could somehow help... Economic insecurity is a real political pain and will continue to be exploited by large firms. The challenge for every government of ours - finding effective interventions to convert wood processing jobs into new Teltonikas.

- Seed, and very early growth - these are bittersweet spots for the Lithuanian founders. Many are trying to bridge themselves into the next season. Your startup has early (possibly weak) signals of traction, so fundraising is still a lot about team and thesis (=hard). While pre-seed funds are starting to deploy, there is very little later-stage capital locally - founders end up chasing another follow-up call with Change or Presto Ventures. But there are some pulling through with brute force. They grow in explosive markets (Elinta Motors), find ways to solve productivity challenges (Track-POD), create massive movements across borders (walk15), or just movements at home (Octomoves).

- Will Figma be Adobe's Instagram? One of the largest software transactions ever, at $20B. Early investors getting 400x + return. Should we now expect more 50X ARR multiples? Frankly, no.

rounds and capital

- Eddy, the exit machine, completes another one with TripAdd acquiring Eddy Travels. Congrats to the team! TripAdd is New York-based travel product provider, a subsidiary of the Blue Ribbon Bags group. Announcement video

- Workshop of Photonics (Altechna) is getting EUR 0.5m loan from VIVA.

- Tomas Vaisvila acquires Skycop.

- Following Firstpick, Baltic Sandbox Ventures is revealing itself - a new early (pre-seed / seed) stage thesis-driven fund. It will exclusively focus on the Baltic Deep Tech and Life Science ecosystems.

- Podcast startup Podimo (Denmark) raises USD 58 m to continue rapid growth. Their Lithuanian team is trying to keep up hiring.

- Istanbul-based VC firm 500 Emerging Europe has raised more than EUR 50m for its second fund, targeting a close of EUR 70m. Will invest in CEE startups — from the Baltics to Turkey.

founder & operator guide

- Five indicators for product-market fit (PMF)

- How ConvertKit manages secondary sales to keep the team motivated - relevant for all our bootstrapped scale-ups.

- Common themes of successful VCs

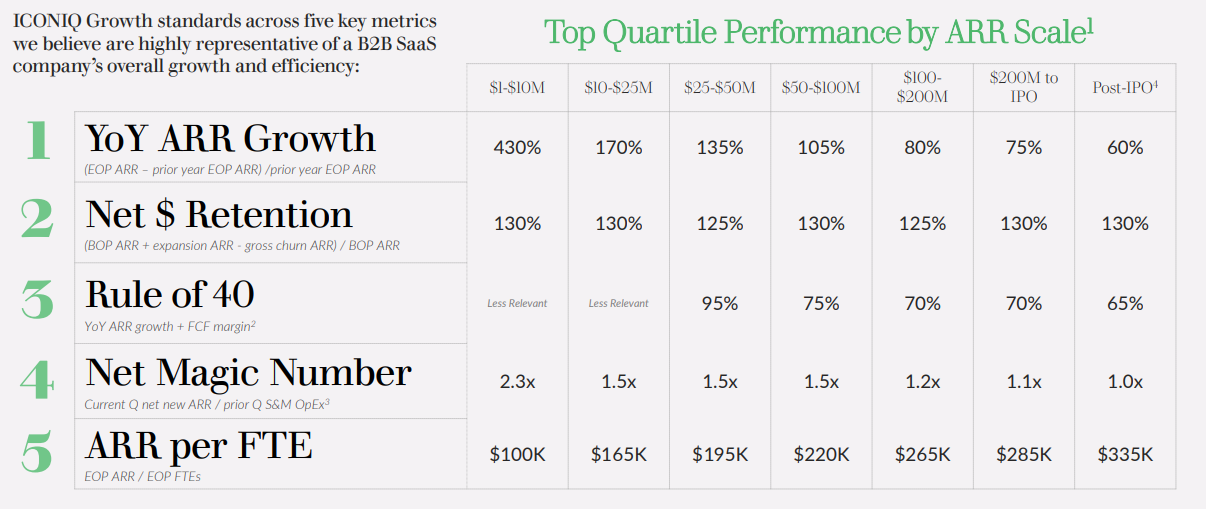

- Iconiq gathers data from their 92 B2B SaaS companies - see metrics report

roleplay

TripAdd -Product Manager

Sanobiotech - B2B Sales Manager

Eliq - Client Support Engineer

AISPECO - Embedded Electronics Engineer

Sanobiotech - B2B Sales Manager

Eliq - Client Support Engineer

AISPECO - Embedded Electronics Engineer

insights

- Why Is Elon Musk Having So Many Kids with So Many Women

- Portugal as a destination on the rise, but why stagnant in productivity for the last 35 years? Comparing to Poland.

what if it went right?

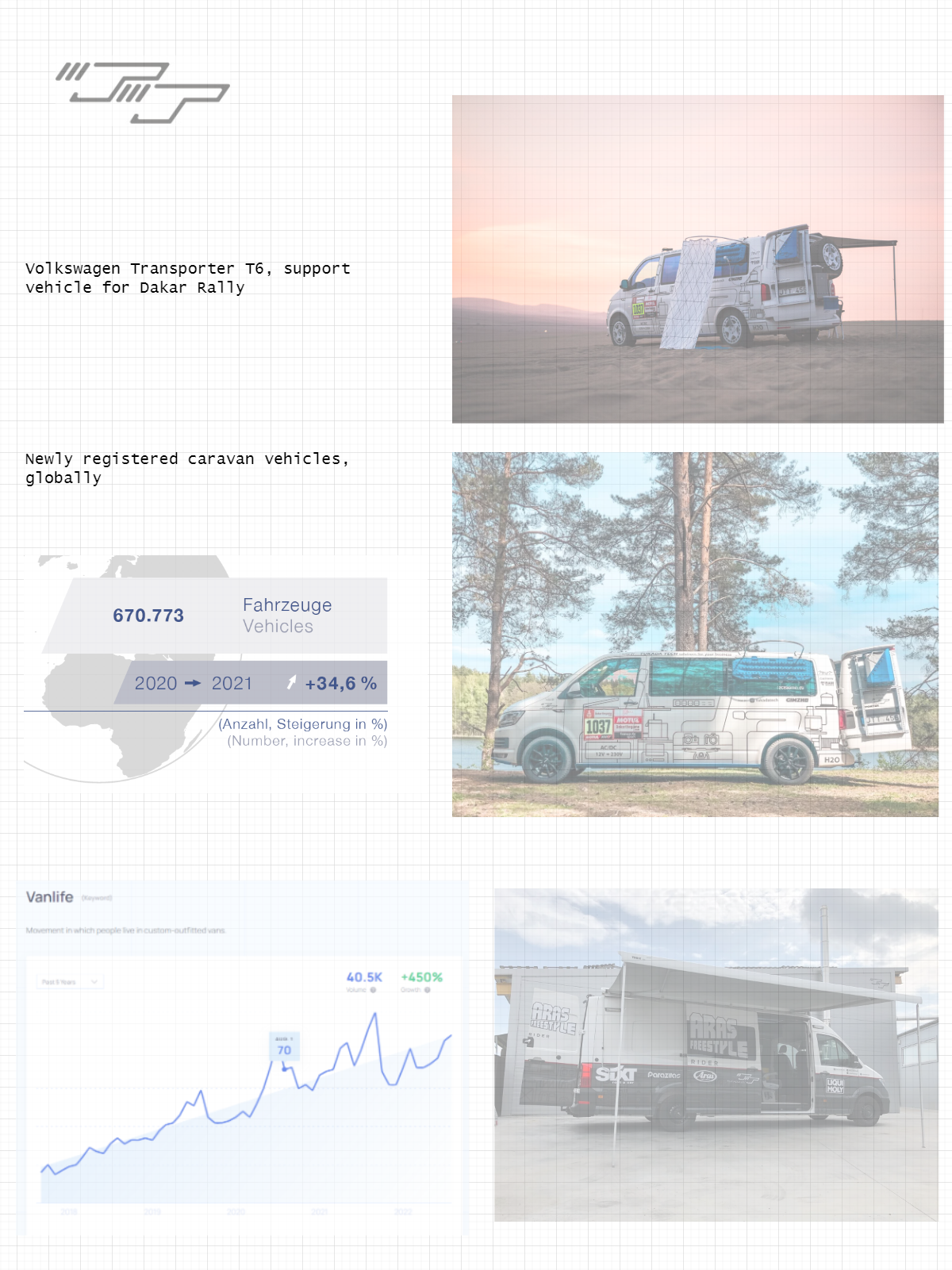

Tukada Tech is one of the leading commercial transport customization companies locally. Just happens that their revenue shot last year. Could there be a bigger story? What if it is serial production of standardized, custom-built, PHEV van for travels? Intersection of several trends.

- RV/Motorhome market expanded 34% last year globally, 13% in Europe, and continues to grow.

- Electrification - rapid BEV and PHEV share growth, especially in the EU. Very few options in van / commercial segments, just starting.

- #Vanlife (movement in which people live in custom-outfitted vans) zeitgeist continues, grew 450% in the last 5 years.

Member discussion