Summer and IPOs coming

Follow on X and LinkedIn

Job board - early-stage Baltic startups - here (new openings added every week, don't miss out)

Newsletter is invitation-only (1 invite for 2024)

Many invites for subscribers and sponsors

philomaths.tech

work in progress

- IPO readiness spotlight this week, by two incredible marketplaces - Vinted and Bolt. Vinted shows profitability while growing revenue to almost EUR 600m, from EUR 370m last year – please keep this Usain Bolt's pace. Several tailwinds for Vinted, from sustainability as consumer preference, to their own "C2C pipes", pan-European affordable shipment under VintedGo. In Europe, Vinted is clearly in a category of one, Peter Thiel would approve. Bolt added EUR 220m credit facility from JP Morgan, Citi, and Goldman Sachs, team is working towards IPO. In 2022 they posted EUR 1.26 billion revenue and only 72m losses. Following liquidity, we should see more stories like this: founders of Trace.Space got going by selling early stock options at Localise, a Latvian scale-up.

- Cybersecurity. Repsense and partners will run an anti-disinformation conference/hackathon on 10th of May. CUBE3 is celebrating its second birthday. Nord Security launches another product - NordStellar, a threat exposure management solution to secure employee and consumer accounts. Nord is shipping these days, and that's how you discover new oceans.

- Starting with something useful. Erikas is doing 6-digit MRR with Shopify App. Now to get there, you start with a skill set that can take you places:

... and then you are off to building tools people would benefit from using. It could be just an automatic note-taking, like Bertrand built by Simonas, or something more elaborate, such as WYSIWYG Editor for Docusaurus, just launched by Valdemaras Repsys.

- Defence. Hugely important discussion – how to allocate increasing defence investment – is actually not happening, yet. Viktoras has spot-on list of capabilities we should be building if we ever got serious about geopolitics. Estonia is launching EUR 50m fund for defence-tech and dual-use technologies. Wishing Scalewolf had 100 teams working on drone pilots like this, today. Astrolight is on a path to demonstrate unjammable high bandwidth laser communication for NATO.

- Many users. Bored Panda’s original show Fire Spike receives Silver Play Button for hitting 100,000 subscribers. CGTrader is celebrating one million buyers.

- Climate scene is busy, take a look at these rounds - Stargate Hydrogen in Estonia bags EUR 42m and calls it a seed (equity investment by UG Investments and grant financing from IPCEI, also others). Business model diversity is endless in climate – from lightweight SaaS to giga factories and FOAK (first-of-a-kind) pilots. To help founders, Contrarian Ventures partnered with EQT to show all possible pathways via The Climate Brick.

rounds and capital

- Plug and Play accelerator is open for the second batch

- VC/PE funds in Finland still deliver strong returns, especially mature ones. Detailed study here

sponsors

Privileged to receive support from a group of core sponsors, who decided to get onboard. They have newsletter invites, too!

Cloudvisor [AWS partner dedicated to startups]

PayPal [Global integrated payments solution]

Vinted [largest C2C European marketplace, always hiring]

Tech Zity [tech hubs and campuses across Lithuania]

Presto Ventures [investing in early-stage B2B startups and marketplaces],

15MIN Group [all the news you need to know]

Wargaming [award-winning game developer, careers]

Our friends Cloudvisor are running a survey on tech use in startups. It takes 15 minutes and you can win EUR 500 Amazon gift card - share your views here, thanks!

founder's guide

- Shut down? How to decide if you should shut down your startup or keep going? Also, if things are stuck, perhaps meet the man who sells VC orphans from CEE to US tech giants.

- Expanding into B2B from the initial B2C freewheel - NordVPN learnings by Rytis Meskauskas, CRO.

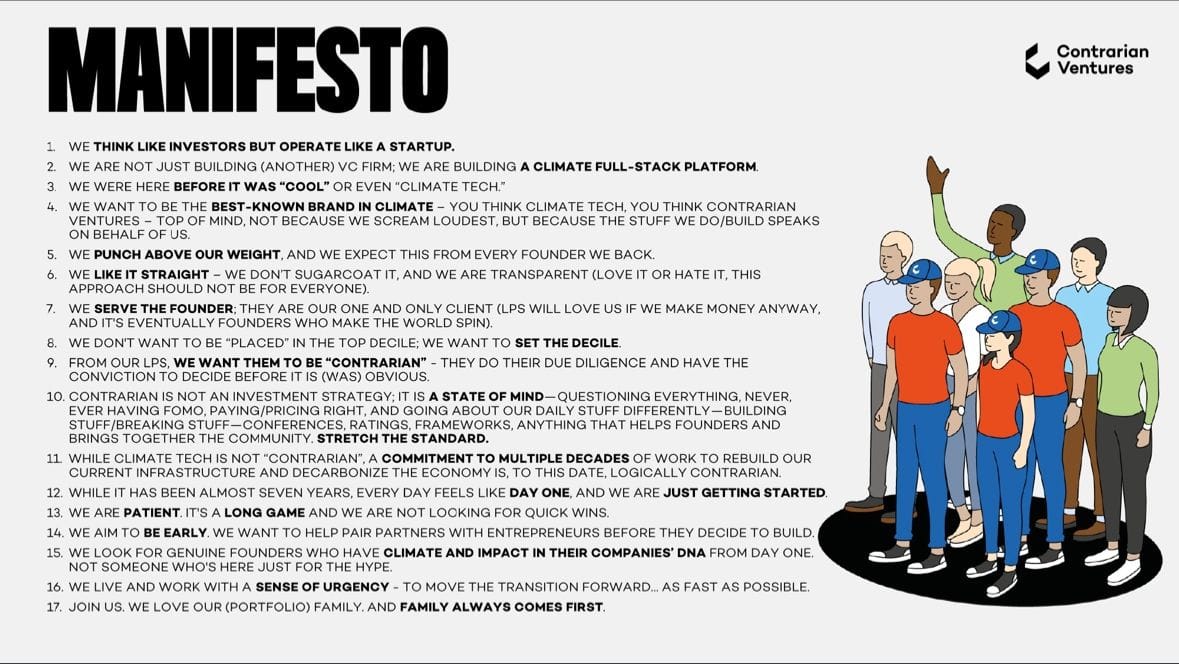

- VC positioning. How to position and build a brand for your firm? We are looking at Contrarian Venture's manifesto, and write-up for the Daybreak fund by Rex Woodbury.

- VC automate. The workflows and automation to run an efficient fund

- Vinod Koshla. Who earns the right to advise an entrepreneur? We do need to raise that bar in the Baltics. (Although, it's more nuanced; a tech investor can actually be very helpful if he/she is a true student of the craft and have enough experience. On the other side, some "fellow entrepreneur" advice can be completely off if that person comes from other industries or very different times).

three questions

Klaudija Budreikaitė, Principal, Open Circle Capital

What are your biggest learnings with 70V from an investor perspective? It was rather a unique model.

70V was an example of how Acceleration works when VC actually puts some skin in the game not only in terms of money. Despite contractual terms of Acceleration program being 14 weeks, in fact our team worked closely with portco until a scalable B2B sales playbook (that can be replicated without our input) has been achieved. Respectively, 5 years in since our first investment out of 55 portfolio companies to this day 38 are active and 32 still growing. That is not the statistics that typical Pre-seed VC can brag about.

But that's on the model side. From investor perspective main take aways for me were:

- Adaptability of the founding team is one of the soft skills that is most difficult to assess early on yet it is crucial to spot that before the investment decision is made. Business model that works today can become completely outdated in no time and no amount of technical experience will save the startup if the founders are not willing to adapt.

- Stalling VC can become a burdain for upcoming 10 years on both startup and co-investing VC side. I see no value in excessive terms and conditions on early stage deals. I think as investors expect startups to move fast they should deliver the same expectation on their end as well. Cases where stalled negotiations harm startup's ability to grow just prove that such VCs are not oriented towards doing everything in their power to make the startup succeed.

- Might come as an unpopular opinion, especially for Pre-seed, but the strategy to trust the "crazy ones" founders as they posses the drive required to move the mountains did not justify in reality. Yes, drive is a necessary quality for the founding team, but ability to apply rational behaviour in stressful situations has proved to win in the long run.

- I think I will always remain B2B school :) Predictable business models are what shaped my way of assessing the startup and I remain loyal to that. Nothing against B2C just it tends to be more difficult to assess predictability in such models - always open to be proved wrong!

However, it is necessary to note that such conclusions are mainly gathered from Pre-seed dynamics, as companies mature - different angles need to be taken into account when making investment decision.

Came out as quite a paragraph, but it's been a while since I was asked about 70V. It truly was a great team to kickstart my journey in VC world.

Where is Open Circle Capital with the new fund?

First of all, I'd like to emphasise that OCC II is a completely different fund compared to OCC I. After fully investing OCC I the market has shifted and the team felt like there is no need for another generalist fund. Also Pre-seed in Lithuania and Baltics is rather well covered, but late Seed - Series A gap is underserved.

Investment thesis has changed in essence, stage-wise OCC II will invest into late Seed - Series A stages, geography wise 50% of the fund will be dedicated to Baltics with main focus on Lithuania and 50% will be dedicated to Nordics with main focus on Finland. We spent some time identifying growing trends and structuring how the new strategy could look like and one of the findings was that Health-tech is on the rise both globally and taking leading European markets separately, yet in the Baltics we do not yet have enough VCs with such focus. Respectively, Meri Helleranta has joined the team as a partner and will be responsible for Health-tech vertical. The primary verticals of OCC II will be Health-tech, Industrial Automation and Enterprise Software.

The target Fund size is EUR 70M with a first close of EUR 35M. Currently we have secured around EUR 30M from Institutional Investors, Corporates, Family Offices and High Net Worth Individuals and we target to launch the Fund and start investing in Q4 2024. If interested to hear more detailed investment strategy - ping me! We are actively talking to potential LPs to close the missing EUR 5M and start investing sooner rather than later.

And a message to the startups - despite not being able to deploy the money just yet, we want to meet you! If you fall within the above described thesis (can be earlier stage as well) let's start getting to know each other and build the trust early on.

Your views on diversity - will we have more female investors and founders?

In general, I am not a fan of where this diversity question has evolved to. While some action has been taken, speaking in real terms during past few years I notice an underlying trend of VCs just superficially delivering diversity quota and then using new hires more for PR purposes than actually investing in their journey of becoming members of upper management team/ investment committee. However, superficial or not - once in the game strong personalities will push their way through so I think we should start seeing more balanced decision making structures on management level within few years, but we are not there yet.

On founders part I actually believe that more women would be willing to begin their startup journey knowing that they will face more diverse investment committee when pitching. So if we expect to see more female-led startups we need to create an environment for that to take place. I think we are on the right path just bumpy road :)

further insights

- Making fun of startup competition may not age well, more so when not taking Musk seriously:

"SpaceX primarily seems to be selling a dream. $50M launch is a dream. Reusability is a dream. How do you respond to a dream? You let people wake up on their own. They (SpaceX) are not supermen. What they can do, we can do". - Arianespace executive, 2013 (video)

If Elon “can show me that the car will be profitable at that price, I will copy the formula, add the Italian design flair, and get it to the market within 12 months.” - Sergio Marchionne (CEO, Fiat Chrysler), April 2016

- How AI apps make money (very similar to other apps - subs per user)

- Economy. Ramp data shows US firms are increasing ad spending quite a bit.

- Who is selling you a course? Beware.

ecosystem

Our conclusions are that European efforts, while laudable, are insufficient, in both quantity and quality. EU industry invests less than its peers in R&D, it lags way behind in software and artificial intelligence, and its pharmaceutical component is at risk. For over 20 years the same companies, mostly from the automotive sector, have dominated EU innovation activity. We call this the middle technology trap.

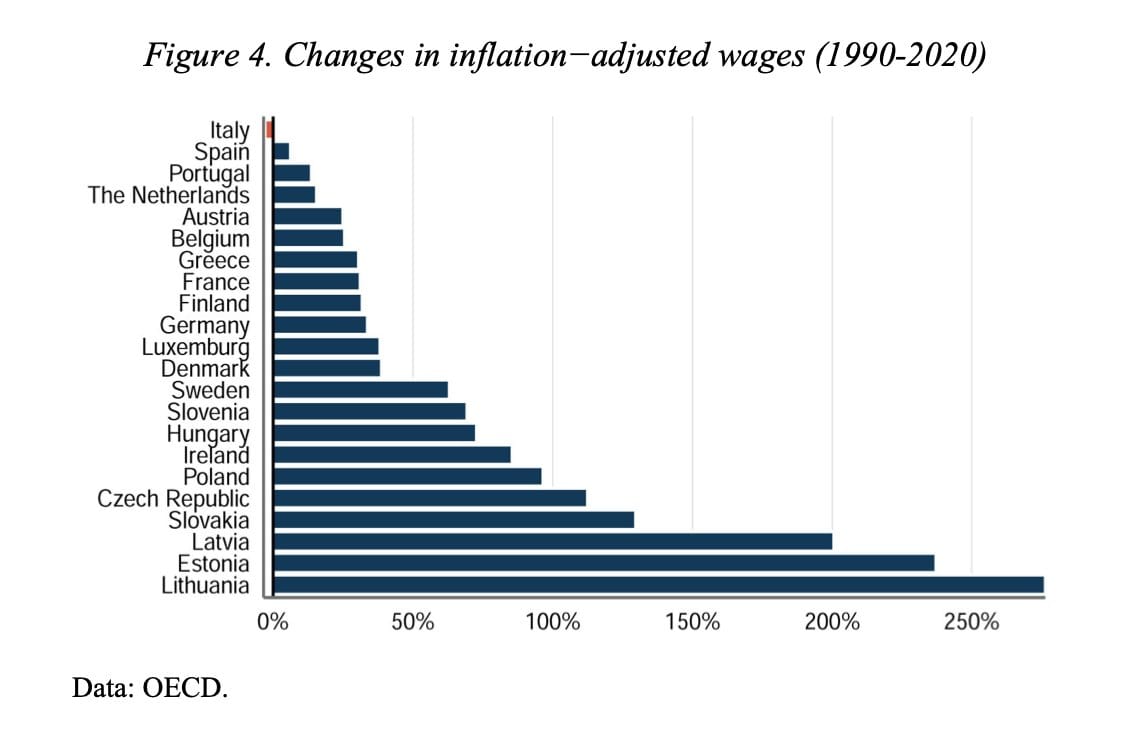

- One of those graphs that point to why young people in Lithuania are so optimistic?

roleplay

Join the leadership team before Series A

(Submit your opening for free)

Surfshark - Head of Product

Telesoftas - CMO

FinoMark - Sales Project Manager

devtodev - Product Marketing Manager

Stealth startup - Founding Engineer

Ovoko - Head of Product

Member discussion