Finding Angel Investors in Lithuania

Angel investment is typically the earliest outside investment a startup would receive. Here are some tips and resources on how to approach it.

Written in 2020 and calls for update. Thoughts what to add? Feel free to email.

How to think about angel investors

- They are more than providers of capital - in most cases, they like being close to the business and find ways to help. Angels come at the earliest phase of the startup (mostly).

- Angel investors are early believers. They invest in founders with billion-dollar ideas and expect for most to fail. It's counterintuitive. You can profitably lose 9 out of 10 bets if the winner returns 30x. It is very different from most other types of investment (into other businesses or assets).

- It is about betting on the founder and the team. Everything else (product, market, etc) is usually too early to judge.

- For founders, it's a matching game - you have to find the right ones, instead of convincing someone. If you believe in your idea and ability to make it happen, eventually you will find the angels you need.

What makes angel investors good for you?

I. Reasonable expectations and support mindset

- They should understand at least a little about startup valuations and have reasonable expectations. Something along these lines

- They should be ready for failure; in fact, they should expect failure, as statistically, it is the most realistic outcome

- When things go south (it will), will they be ready to support you, or will apply more pressure?

II. Experience

- They know something about the industry that you will benefit from

- You genuinely enjoy discussing with them and can learn a lot from your relationship

- They also have a good track record - meaning their partners and colleagues enjoyed working together

III. Network

- They have some useful connections for the future - other investors, VCs

- Connections in a relevant industry where your startup operates

Where to find one?

I. Your network

- Start with your closest network - friends and family friends, look for people with years of business experience, owners of businesses. The best is to meet ones, who have prior startup operating / investing experience

- Check with your connections in the startup world - entrepreneurs, investors. They might be able to introduce.

II. Active Angel investor lists

- Coinvest Capital (list of angels, interested in dealflow)

- LitBAN (2o0 angels, monthly pitching meetings)

Apply for funding at litban.lt (asks for your pitch deck + short description)

LitBAN investment committee reviews and selects who gets to pitch to angel members

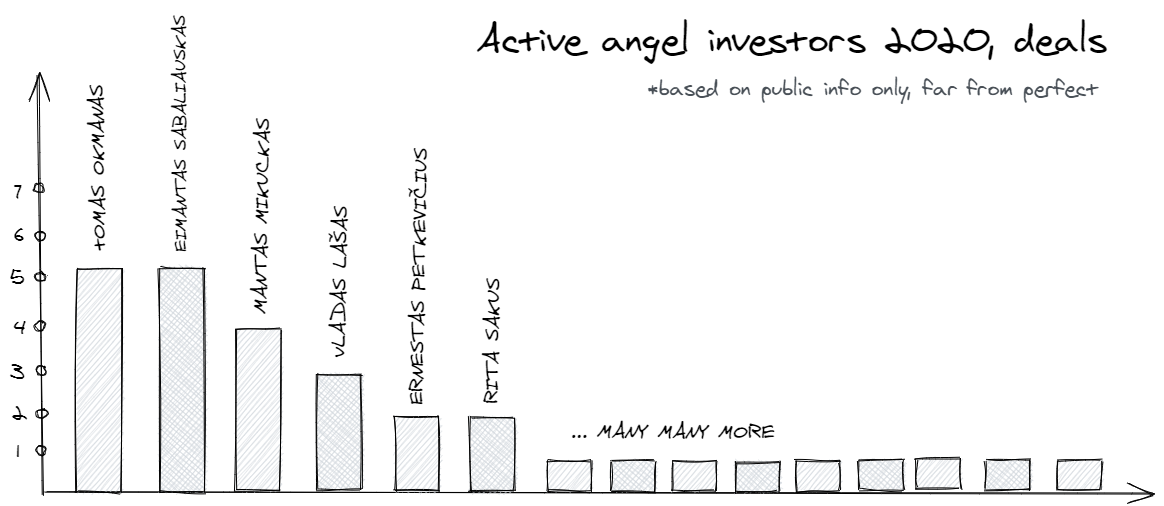

The rounds vary from 50k up to 1 M Eur (if VCs join the round), but most applications are pre-seed and on the lower end of the spectrum - Find other angels reviewing last 2-3 years of all Lithuanian investment deals here

EstBAN (150+ angels, monthly pitching meetings)

Applications via website into StartupIncluder

Connection would be helpful (EstBAN member recommendation is best, or at least check with the EstBAN staff) - Estonian most active angel investors and VC's of 2020 (78 names)

III. Venture Capital Funds

- Even if you consider being too early for a VC, they leverage large networks of angel investors. Just reach out (better get introduced). You will establish a relationship (good for the future), and hopefully, they can introduce you to some angels in your vertical

Member discussion