Copy Paste

Lithuania Tech Weekly #132

Short version - Work in Progress - landing on LinkedIn,

The full newsletter is email as always - subscribe philomaths.tech

Book a slot for your sponsored post here

Some more "likes" at last week's letter - check it out of you were in Juodkrante again. We've got Atomico's partner Andreas, also discovered some "stealth" startups (ok Enrikas is working on web3 security, which one may argue is not the biggest web3 problem at the moment), but still have not figured out what UBER guys are building (send us tips here). Also - stay alive and get ready to "really crush" this fall after reading an inspiring book.

work in progress

- Health. AI use in breast cancer screening as good as two radiologists - so we expect Oxipit to make some brave progress soon.

- Venture but in kind of studio. We received a few inbox ideas after Fractal model collapsed - their startups ended up being blacklisted by VC funds (130 uninvestable startups!). They were bringing founders for vetted ideas, $1m investment, and decent salaries, but taking a big chunk of initial equity.

Is it similar to Kilo Health or Tesonet portfolio? They did a big push last couple of years to the local ecosystem with early-stage investments. In some instances, we heard it could be similar, but likely different stories within their portfolio. Tesonet, for example, has ventured into very different businesses, and across stages. Founders tell they understood these two paths (venture capital VS taking strategic investment) are distinct, and both have certain advantages. Working with large players can bring in expertise, talent, infrastructure, customer acquisition, etc - and effectively de-risk a startup sooner. However, when it is pre-PMF, that may be of little help, as early-stage startups fail fast no matter what financing. Quite an important note (and Fractal lesson) is that it is a one-way street when a large equity package is locked by investors early. The founding team will be relying on this investor to deploy more. Cap table issues are one of the favourite VC topics to write about, and they run away quickly. Anyhow - it is early to tell on the overall pattern, and we have too few decisive success stories on both sides to make a strong argument. Here's an interesting pod on the venture studio model, share if you have a strong/interesting opinion on the topic, including an anonymous way.

- Products and their launches. Laimonas is now building AskToSell - an autonomous sales agent for small deal sizes. Surfshark launches Alternative ID, two years after we needed it! Tadas launched Prodevtivity, a tool to track developer productivity in real time. OXSICO, built AI-powered solution that can recognize text generated by... AI.

- Event(s). Some good speakers at Digital Brilliance (below), Startup Fair speaker line-up is here, and why and how media companies turn to events.

- Acceleration. The last batch of the Tech Hub acceleration program - apply. Katalista Ventures'Impact Valley residents across the #greentech, #edtech, and #healthtech tracks.

- What is persona-led growth? Something Scott Belsky recently wrote about. Also common topic on Media Empires podcast, as some creators taking it further, apply the PE model - boosting growth of brands they can speak off. Thinking of examples locally.. is that when a legal firm brings on Jekaterina Govina and secures a ton of fintech cashflow?

rounds and capital

- Animoca Brands has invested $30 million in hi - a startup from Singapore originally, but since they have Virtual Currency Service Provider (VCSP) license from Bank of LT, they come around as a Lithuanian startup in the media. hi is working on enhancing the utility of fungible tokens and NFTs in the Web3.

- Draugiem Capital, in partnership with Private Equity fund BaltCap, has finalized an agreement to acquire a majority stake in the kids soft play toy brand, IGLU, and its owner and manufacturing company PEPI RER.

- Riga-based finance company Eleving sold its subsidiary car subscription platform Renti Plus to SIXT.

- Local Ocean closes down, thank you all for your efforts.

roleplay

Elinta Charge - Sales Manager

Vinted - Engineering Manager, Network

Eneba - Product Manager

#Walk15 - B2B Sales

founder's guide

- Aurimas' sharing his struggles and learning as healthtech founder - appreciate this is a true battle! But it seems there are some dangerous dynamics. Grants can come in handy, yes, but they also major risk to focus on customers and products. Competitions.. some sure, but many? Experience VCs say they "never invest in teams that has won more awards than have customers".

- VC Fund Stack

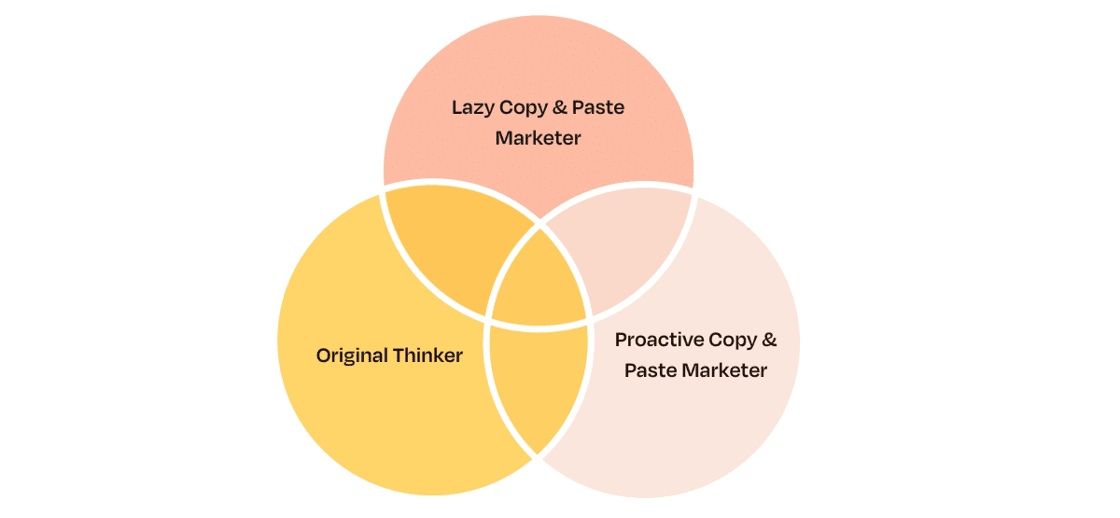

- Which marketers will survive AI? From Kieran Flanagan newsletter.

1. Lazy copy and paste marketers get replaced by AI (currently 60%)

2. Proactive copy and paste marketers need to move faster and add more value. AI will unfairly reward fast followers; laggards get crushed.

3. Original thinkers become even more valuable

- Latvia + Bad Ideas Fund = Fundraising School

further insights

- Higher Funding Doesn't Mean Faster Hiring in Startups

- Where the smartest and most talented people are focused right now (but very incomplete list, it's actually so much talent moving to climate actually)

weekly question

(will share to share next week)

Member discussion